No Liberation from Uncertainty in our IFRS 9 and CECL scenarios

The implementation of the US “Liberation Day” tariff hikes will have significant impacts on individual sectors and firms, even in their latest, scaled back, coverage. Although our initial assessment suggests a global recession will likely be avoided, assessing the implications on downside risks around the baseline forecast has become increasingly important.

Following President Trump’s announcement, there was a sharp deterioration in sentiment, with our latest global risk survey highlighting that businesses have shifted their main concern from broader geopolitical tensions to trade-related uncertainty. This uncertainty is likely to persist, as governments enter negotiations on individual reciprocal tariffs. Questions also remain around how the US might respond to retaliation and whether talks may drag on over contentious issues such as non-tariff barriers.

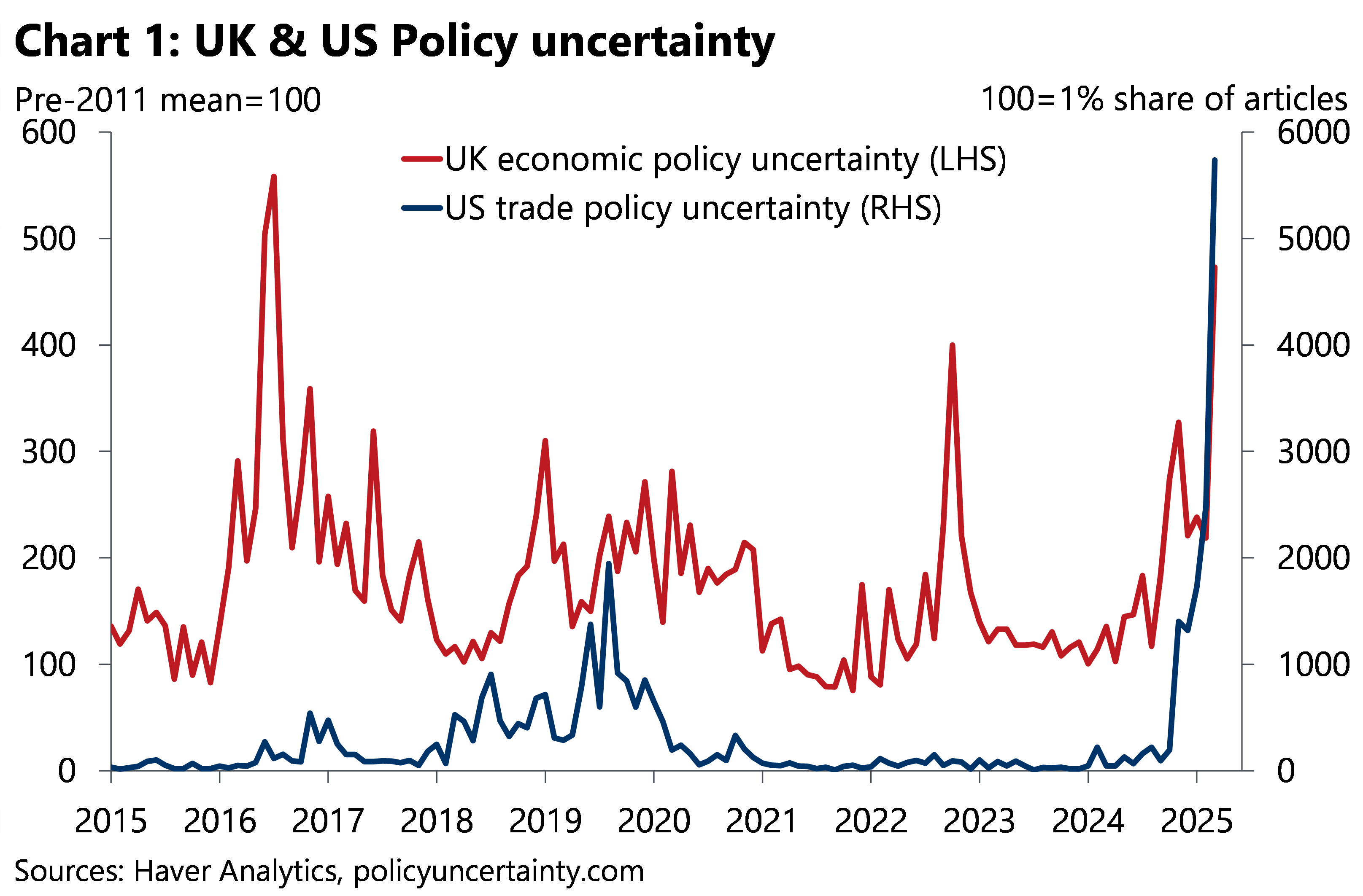

Chart 1 shows the surge in uncertainty in the lead up to the US “Liberation Day”. With trade-related uncertainty set to remain elevated, its impact on global growth prospects will be harmful, particularly for business investment.

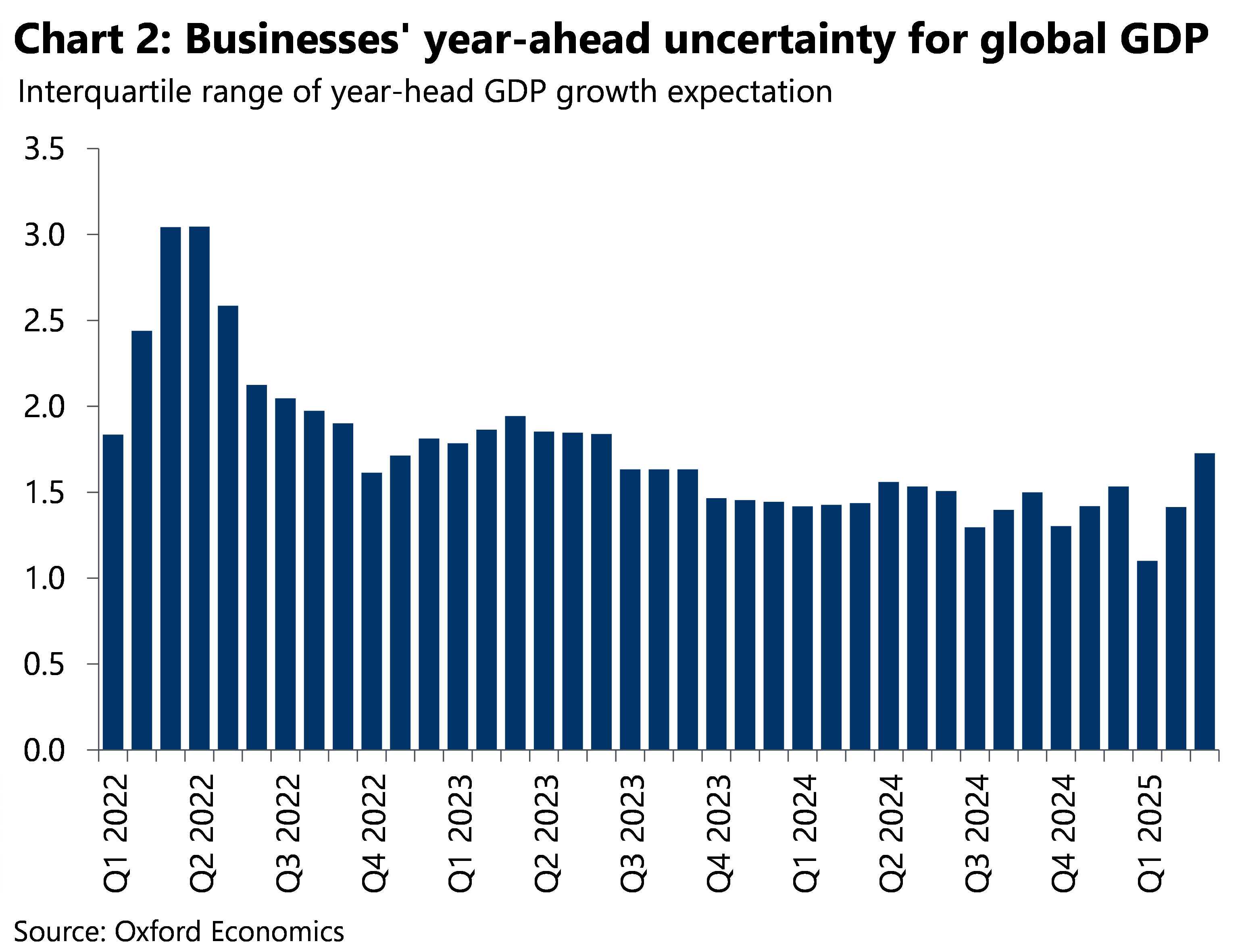

Despite escalating trade tensions, broader economic uncertainty remains relatively contained by historical standards across two key metrics we track. The first is based on our Global Business Sentiment Index, which captures the average year-ahead world GDP expectations from over 150 businesses completing our survey each month. We calculate the interquartile range of these responses to gauge how uncertain businesses are about future growth. As shown in Chart 2, intensifying trade tensions have driven a renewed uptick in uncertainty in February and March. Although levels remain within historical norms for now, recent developments suggest a further rise is likely in the months ahead.

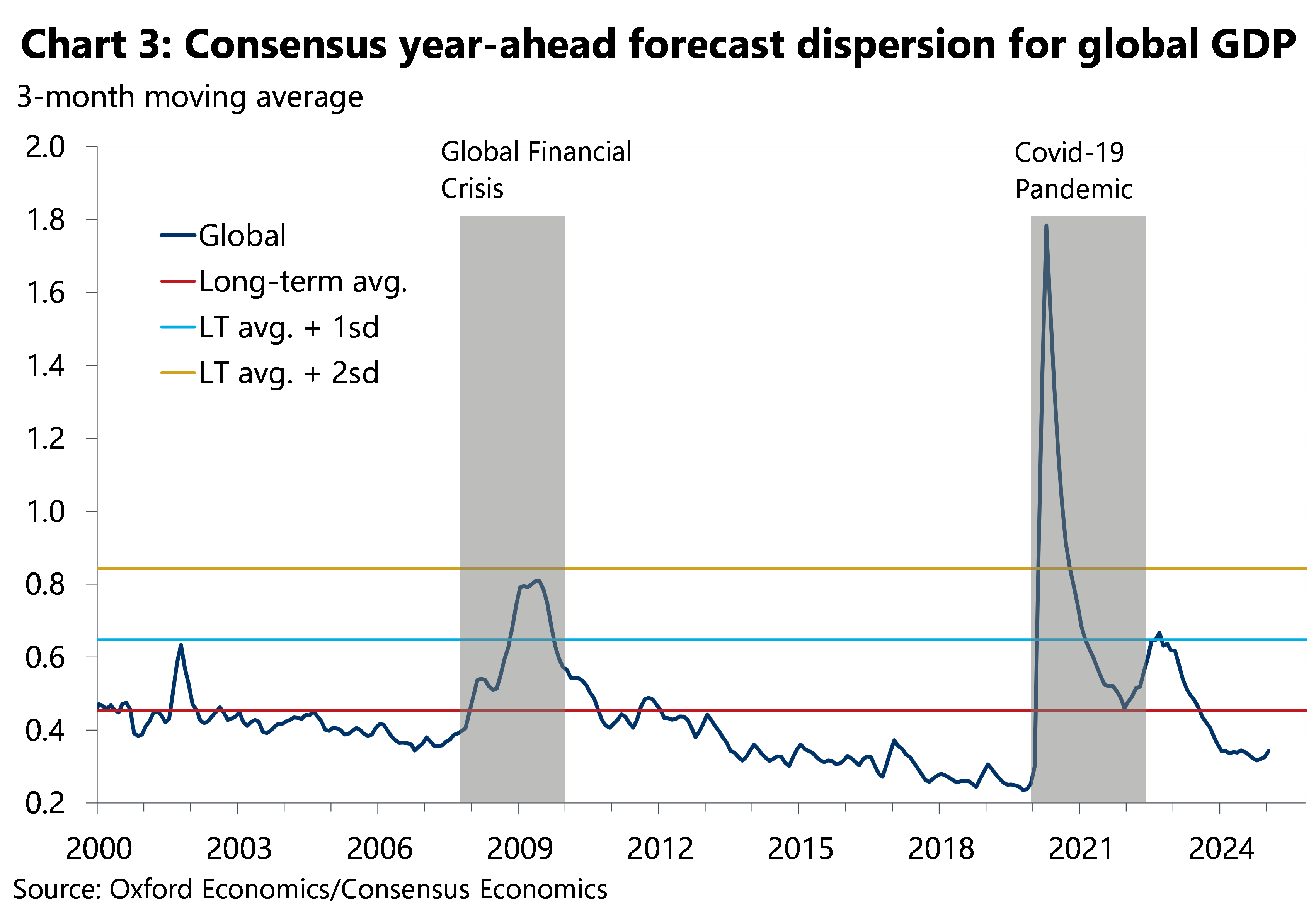

Our second metric draws on Consensus Economics’ monthly reports, which provides a measure for the dispersion of respondents’ year-ahead GDP growth forecasts. As shown in Chart 3, the forecast dispersion for implied global GDP growth ticked up in March but remained well below its long-term average. Recent US policy announcements are likely to trigger a renewed widening in forecast dispersion as economists diverge on their assumptions about the global growth outlook following the breakdown of a predictable trading system. We now expect global demand to be much weaker than our March baseline, by around 0.3ppts this year and 0.4ppts in 2026, with risk around the base case skewed to the downside.

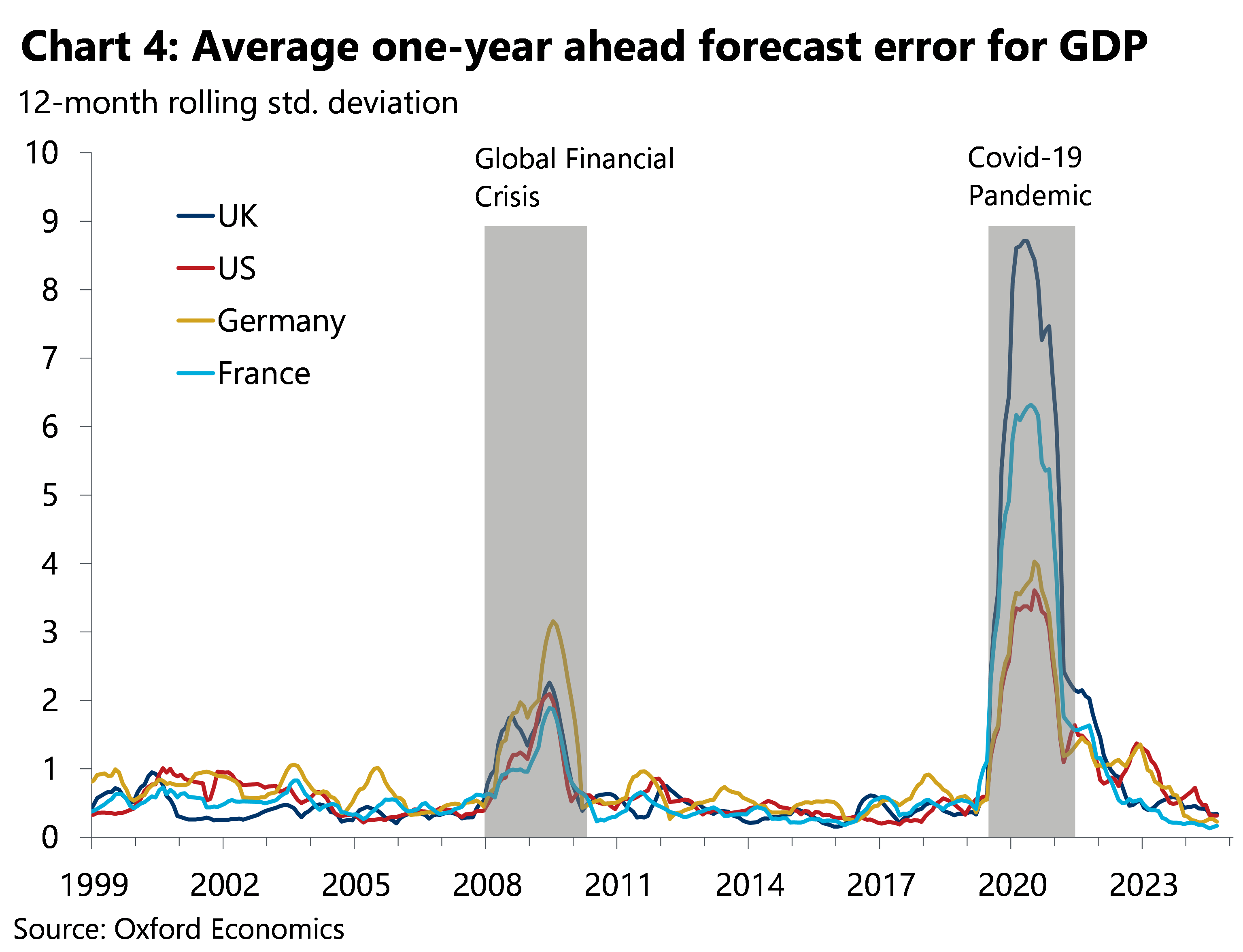

These high-frequency measures of uncertainty correlate well with our own forecast errors. Chart 4 plots the average one-year-ahead forecast error for GDP growth across key economies, highlighting that forecast errors typically increase during periods of elevated forecast dispersion (e.g., during the Global Financial Crisis and the Covid-19 pandemic), resulting in higher standard deviations. This pattern reinforces the idea that shifts in the distribution of expectations are informative at times when economic conditions are shifting markedly.

Combined, these measures therefore provide useful benchmarks to assess the wider ramifications from trade disruption, volatility in prices, and a new policy mix over the coming years. Should economic uncertainty exceed historical thresholds again we would be able to reflect that in our IFRS 9 and CECL scenarios by incorporating a heightened near-term dispersion in the scenarios. This is similar to the approach taken during the Covid-19 pandemic when we incorporated an overlay into our forecast-error distributions to capture the extreme macroeconomic uncertainty. As a result, our methodology remains well-suited during times of volatility, which allows us to help clients appropriately reflect risks in their expected credit loss (ECL) calculations.

Click here if you want to learn more about our IFRS 9 service and here for our CECL service.

Upcoming Webinars

Asia reacts to US tariffs

We draw the implications of tariffs for Asian economies, in particular how the movement in financial markets may affect real economic outcomes.

Find Out More

トランプ関税下の世界経済:経済モデルを用いたシナリオ分析

今次ウェビナーの前半では、トランプ関税下、最新の世界および日本経済見通しを説明します。当社では、一連の関税の発表を受け、米国の2025年の成長率見通しを従来の2.0%から1.2%へと大幅に下方修正、日本経済についても、今後、2026年前半までゼロ成長を強いられるという見通しに変更しました。内外経済・物価の先行き不透明感が増すなか、日銀は利上げサイクルを一時停止し、次回の利上げは2027年にずれ込むと予想します。 後半では、各国の関税政策をめぐる不確実性の高さを踏まえ、当社マクロ経済モデルを用いたシナリオ分析を紹介します。実際にモデル上の「関税レバー」を操作し、「相互関税」の復活や、グローバルな関税の応酬激化を想定した場合の世界経済・金融市場・コモディティ市場への影響を、波及経路を確認しながら検討します。

Find Out More

Trump 2.0: Global Trade, Tariffs & Economic Shifts

In part two, of our Trump 2.0 webinar series, we explore the international consequences of President Trump’s return to power. With initial tariffs far exceeding expectations, we will discuss renewed tariff tensions, shifting alliances, supply chain disruptions and global market uncertainty. We will examine how the first 100 days have shaped the global economic landscape — and what the ripple effects may be in the months to come. We’ll focus on cross-border trade, sector-level impact, climate and the evolving role of the US to its neighbours and globally.

Find Out More

Trump 2.0: US Economy & Policy Shifts

In the first session of our Trump 2.0 series, we turn our attention to the domestic landscape. We unpack how Trump’s early policy actions — from fiscal shifts and labour market interventions to immigration and industry-specific changes — are affecting the U.S. economy, and how tariff policies will impact local markets. We assess the immediate and longer-term consequences for states, cities, sectors, and tourism, and consider what lies ahead as the administration’s agenda takes shape.

Find Out MoreTags: