Australia’s housing policy looks to fix symptom, not cause

Housing will be a key battleground in May’s Federal Election, with both the incumbent Labor Government (ALP) and the Coalition (LNP) firming their stances in recent days.

The ALP revealed plans to build up to 100,000 new homes for first home buyers (FHBs). Exactly how, where, and when these homes will be delivered is unknown. They also flagged expanded eligibility for the Home Guarantee Scheme, adding to changes earmarked in March’s Federal Budget for the Help to Buy Scheme.

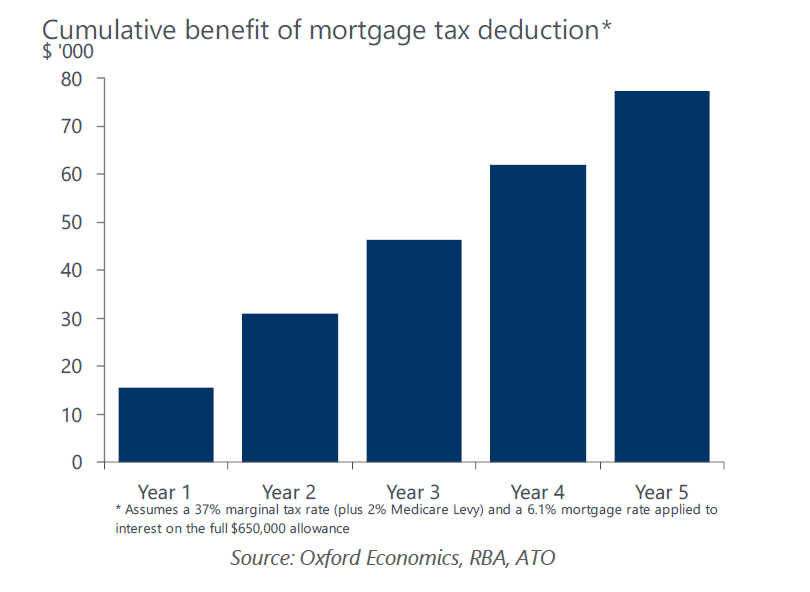

The LNP announced the First Home Buyer Mortgage Deductibility Scheme for FHBs purchasing a newly built home. The mooted tax deduction is regressive, with the benefit increasing as incomes and mortgage sizes rise. Assuming the maximum marginal tax rate possible under the income threshold of 37%, and interest on the full $650,000 at 6.1%, the annual deduction comes to $15,460.

We have previously flagged further movement on demand side policy, and this is it. While the thrust of policy is unfortunate, it may be smart politics during an election cycle (the majority of households are owner-occupiers, and a sizeable proportion of renters are aspirational buyers).

The bulk of these policies represent a shift to more structural demand side support, sprawling beyond the counter-cyclical FHB boosts seen in the past. They add to the ratcheting up of Federal Government spending on housing, which will be hard to walk back despite outcomes becoming increasingly perverse.

The First Home Buyer Mortgage Deductibility Scheme could be worth north of $75,000

.