Blog | 04 Apr 2022

A second shot for African hydrocarbons?

As Western Europe accelerates a structural shift away from Russian energy dependence, Africa could play a salient role in filling the void. The longer-term transition towards renewable energy and a shorter-term reduction on Russian hydrocarbon dependence will increase demand for African renewable and non-renewable resources.

Acknowledging this heavy reliance on Russia for mineral resources, the European Commission on March 8 proposed a plan to make Europe independent from Russian fossil fuels well before 2030. The plan outlines the following measures to be taken:

- Diversifying gas supplies, via higher Liquefied Natural Gas (LNG) and pipeline imports from non-Russian suppliers

- Increasing volumes of biomethane and renewable hydrogen production and imports

- Increasing renewables

Some African countries such as the DRC, Gabon, South Africa, and Guinea are in a position to benefit from the longer-term green transition due to their mineral resources, but the medium-term gap in gas supplies will need bridging. Underinvestment in African reserves suggests these projects could look a lot more attractive now.

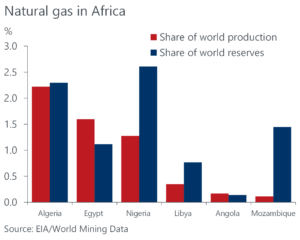

Algeria’s state energy firm, Sonatrach, has said it is ready to ramp up gas supply to Europe from its surplus via the Transmed pipeline; Italy is already in talks with Algeria to increase quantities of Algerian gas. In turn, Egypt aims to position itself as a key regional destination for the processing and re-exportation of natural gas – Israel recently approved a new route for gas exports to Egypt via Jordan. Notably, though, authorities in both Algeria and Egypt have said domestic demand will be prioritised before gas is made available for export.

In countries like Nigeria and Mozambique, which contain a large share of the continent’s natural gas reserves, the situation is a bit more complex. Mozambique has 100 trillion cubic feet of proven gas reserves, which could potentially place the country in the top tier of LNG producers in the world. But most of the gas is located off the shores of the northern Cabo Delgado province, where insurgent groups operate. Nigeria has around 180 trillion cubic feet of proven gas reserves, but several oil and gas majors are opting to exit the market as increasing security challenges and vandalism impact production. While the investment equation has changed, Nigerian and Mozambican hydrocarbons will remain unattractive for risk-averse investors.

The outlook is more positive in countries such as Senegal and Tanzania. Grand Tortue Ahmeyim (GTA), a gas field straddling the border between Senegal and Mauritania, is estimated to hold 15 trillion cubic feet of gas. Senegalese authorities are confident GTA’s Phase I production target date of late-2023 will be met, while a final investment decision on Phase II is expected by end 2022 or early 2023. In addition to GTA, the Yakaar-Teranga gas field is estimated to hold 15 trillion to 20 trillion cubic feet of gas, with an investment decision by British energy giant BP expected this year. Gas finds such as those in Senegal – given the size of the fields and proximity to Europe – are likely to be increasingly attractive investment opportunities.

Tanzania reignited interest in its gas resources when, in November, it began negotiations with foreign energy companies regarding a $30bn LNG project. Discussions surrounding the country’s LNG sector had come to a deadlock under late President John Magufuli, whose administration adopted a very combative tone with large foreign investors.

While overlooked in the past, Africa’s hydrocarbons sector could see quick uptake in development if these governments position themselves as attractive alternatives to Russian oil and gas. This will require them to placate fears that property rights will not be respected over the long-term investment horizons, and the provision of accommodative operational environments. Another factor counting in Africa’s favour is the fact that domestic demand for hydrocarbons is likely to remain strong well after many advanced economies have transitioned to renewable sources of energy, which supports the long-term investment case.

Tags:

You may be interested in

Post

Africa’s energy conundrum: What we can learn from a small mountainous enclave

A small mountainous kingdom at the southern tip of Africa has demonstrated how the world’s most energy-starved region can develop while not contributing its ‘fair share’ to climate change.

Find Out More

Post

Africa: Who will ride the oil price tailwinds?

The impact of a “limited” incursion by Russia into Ukraine would deal an unwelcome blow to the European economy via higher inflation squeezing real incomes, but it would be far from a knockout.

Find Out More