News | 03 May 2022

Anchors away – RBA change course and raise rates

Sean Langcake

Head of Macroeconomic Forecasting, OE Australia

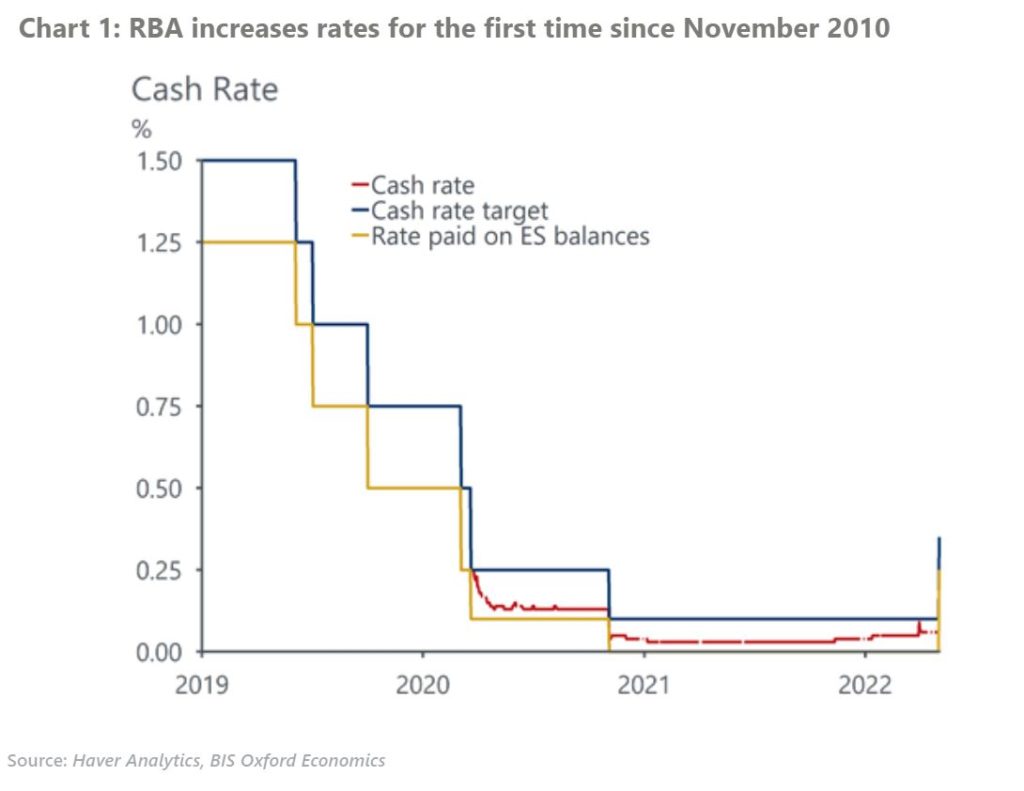

- The RBA has opted to raise the cash rate target to 0.35%. For some time, the RBA identified faster wage growth as its trigger for raising rates. Official data sources have provided no new information on this front over the past month. But the board has put their faith in information from the RBA business liaison program that wage growth is picking up.

- As noted by the RBA, inflation pressures at present are primarily being caused by global and domestic supply disruptions, which are expected to abate. Higher interest rates will do little to cool inflation caused by negative supply shocks. Today’s move is about trying to control inflation expectations and signal the RBA’s tolerance for an inflation overshoot is limited.

- Today’s cash rate move will be the first of several over the remainder of 2022; we expect the cash rate will be at least 1% by the end of the year. The forthcoming Statement on Monetary Policy will shed more light on the RBA’s current reaction function; a significant upgrade to their inflation outlook has been foreshadowed.

In concert with raising rates, the RBA has announced it will shrink its balance sheet, effectively tightening monetary conditions over the next few years. The RBA’s balance sheet expanded considerably through the pandemic due to the Term Funding Facility, QE and yield curve control programs. Although new asset purchases ceased some time ago, there was still a choice to either maintain the size of the balance sheet or allow it to shrink as assets mature; by choosing the latter, the RBA has opted for tighter policy.

Moving the cash rate target to 0.35% is a slightly curious move that defies the RBA’s conventional target structure and previous guidance. The rate paid on bank balances has been lifted from 0% to 0.25%; the cash rate has traded closer to this floor rate than its target through the pandemic due to excess liquidity in the financial system. We expect the cash rate will trade at a slight premium to the floor rate for now, but it will converge back toward target over time alongside the attenuation of the RBA’s balance sheet.

Meet the team

Sean Langcake

Head of Macroeconomic Forecasting, OE Australia

+61 2 8458 4236

Sean Langcake

Head of Macroeconomic Forecasting, OE Australia

Sydney, Australia

Sean Langcake is Head of Macroeconomic Forecasting at Oxford Economics Australia where he is responsible for macro forecasting and analytical content. Sean is a regular contributor in the national media on Australian and global economic trends and policy issues.

Prior to joining Oxford Economics, Sean worked in a wide variety of roles at the Reserve Bank of Australia, largely focussing on forecasting and macroeconomic modelling. Sean holds a Masters Degree in Economics from the University of New South Wales, as well as a first class Honours degree in Economics and a Bachelor of International Studies from the University of Adelaide.

Thomas Rudgley

Economist, Macro Consulting

+61 (0) 2 8458 4223

Thomas Rudgley

Economist, Macro Consulting

New York, United States

Thomas is part of Oxford Economics’ Macroeconomics Consulting team based in New York. He produces scenario analysis, forecasts, and data visualisations across a range of industries to help clients navigate the tumultuous economic environment.

Tags:

You may be interested in

Service

Australia Macro Service

In-depth insights and analysis of key domestic and global trends, enabling clients to make better strategic decisions, manage risks and take advantage of newly-developing opportunities in a fast-changing economic environment.

Find Out More

Post

Australian revenue upside allows purse strings and a smaller deficit

The strong performance of the Australian economy over the past six months has led to a sizeable revision of Treasury's projections for the budget deficit. Stronger-than-expected revenue growth means a deficit of 3.5% of GDP is now expected in FY22, down from 4.5% of GDP in the last MYEFO from October 2021. The ongoing strength in the labour market and higher commodity prices are the main sources of the revision to revenue projections.

Find Out More

Post

Australia’s cooling property market no immediate threat to new housing

Residential real estate markets globally performed strongly over 2020 and 2021 and Australia was no exception. Low borrowing costs, grant incentives, pandemic driven housing preference shifts, elevated savings and amassed household wealth underpinned the strong property price growth recorded over the last two years

Find Out More