Blog | 06 Jul 2022

Greece’s toll roads show why infrastructure investors must pay attention to local economics

Tom Rogers and David Ashmore

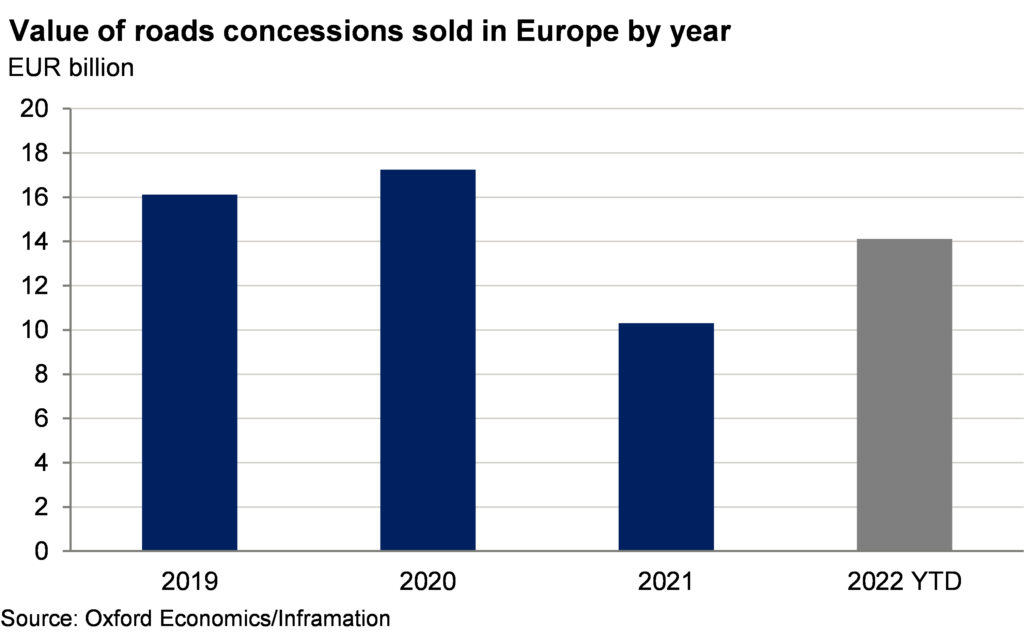

The recent surge in inflation across the world—especially in European economies—has accelerated the hunt for assets perceived to yield inflation-protected returns. Fixed assets in particular are benefitting from this development. For example, concessions to operate European toll roads worth a total of around €14bn have been sold through the first half of 2022, already well above the full-year total in 2021 and on course to comfortably motor past the €16bn transacted in 2019.

But to protect their investors from taking on excessive risk or over- or underbidding, asset managers must understand not only the macroeconomic conditions surrounding the asset but, crucially, the local economic conditions that drive revenues and cost. For asset managers looking to understand cost-side risk it is important to undertake a due-diligence assessment of local conditions. Failing to do puts significant risk onto bidders.

Some governments do help potential investors understand the local context for infrastructure risk: Australia’s Federal Infrastructure body, for example, helps infrastructure stakeholders through its Infrastructure Risk Dashboard. But this is very much the exception.

Greece offers an example. The Attica Motorway (Attiki Odos), part of the main north-south national road axis in the Greater Athens metropolitan area, is set to be relet to the market. Bids will be sought from interested parties to acquire and operate the road in return for a stream of net income (toll revenues less operational expenditure). To assess the appropriate bid level, investors will need to estimate both future demand and costs.

Two critical local economic issues will come to the fore.

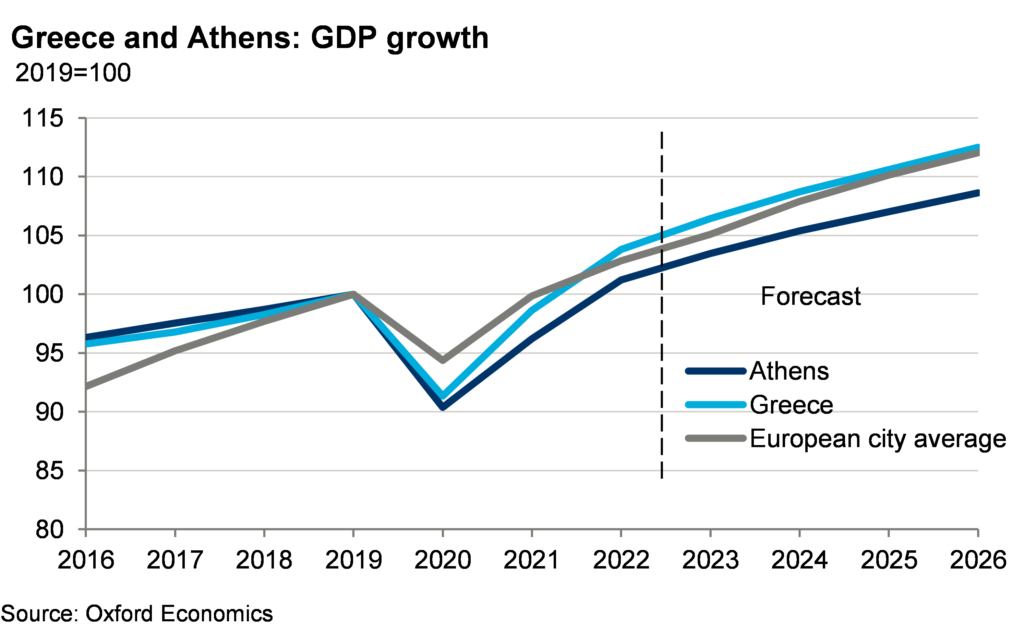

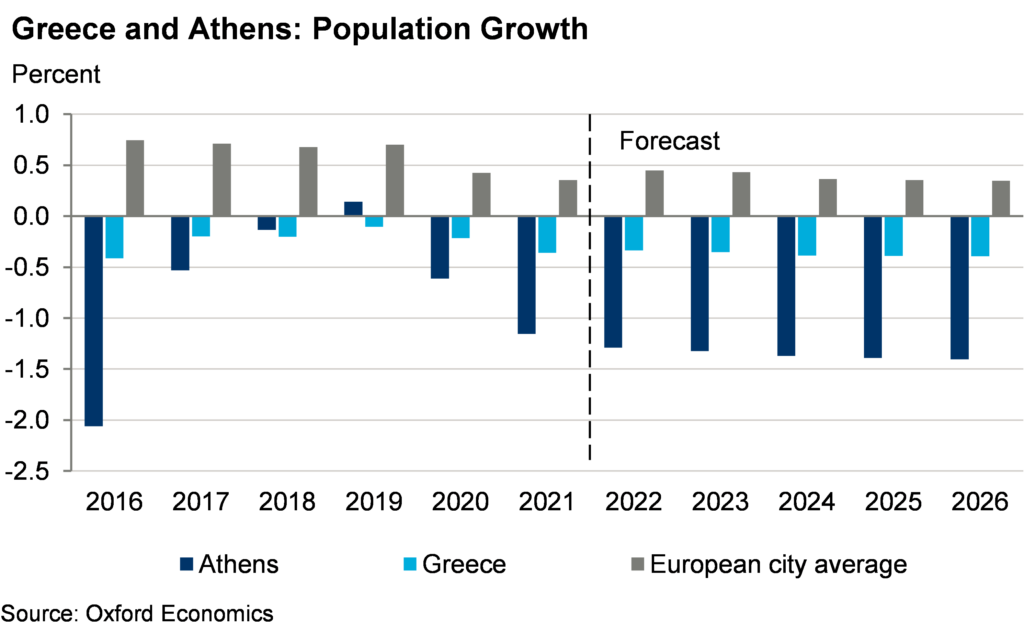

The first is the economic outlook for the asset’s catchment area. Our research finds capital cities usually have stronger economic outlooks than their national economies—the concentration of high-value services such as finance, legal and tech, and positive demographic factors such as young workers heading to the capital in search of opportunity, underpin capital city advantage. But in the case of Athens, our forecasts indicate the opposite is likely: As Greece’s capital and centre of government, Athens is especially exposed to Greece’s extended period of fiscal austerity, which we expect will last until at least 2026. An especially poor outlook for the public services sector (in contrast to better prospects for travel and tourism, which power growth in many other regions) means Athens’ economic and demographic outlook is likely to be weaker over the coming years than the national economy.

Secondly, asset owners are responsible for operating costs, which in the case of a toll road largely consists of maintenance to a level where lifecycle costs are minimised. For some maintenance costs (such as energy and metals), national and global benchmarks provide relevant guides. But other key inputs—such as cement and stone, and skilled construction workers—are delivered by highly localised markets. These local supply chains can display much greater variation than nationally or globally traded inputs.

The increased focus of asset managers on infrastructure assets will continue, as nominal interest rates (though rising) will remain low by historical standards into the long-term. The competition for decent, inflation-proofed returns will mean infrastructure remains in demand amongst fixed asset managers. But smart asset managers will look beyond national indicators to ensure they are recommending the right investments to their clients.

Authors

Tom Rogers

Associate Director, Capital Projects and Assets Consulting

+44 (0) 203 910 8047

Private: Tom Rogers

Associate Director, Capital Projects and Assets Consulting

London, United Kingdom

Tags:

You may be interested in

Post

The Economic Impact of the British Army

This study, commissioned by the British Army, assesses both the long-term contribution the organisation makes to the UK's productive capacity and its UK economic footprint in 2023/24.

Find Out More

Post

Strategy Key Themes 2025: Opportunities amid heightened uncertainty

We think the environment of strong US demand coupled with still ample global liquidity, should be positive for US risk assets.

Find Out More

Post

New Canadian immigration plan will shrink population, slow economy

The government's plan to cut immigration and reduce the number of temporary residents will cause Canada's population to decrease slightly in 2025 and 2026, after soaring by more than 2 million people over the past two years. This unprecedented immigration policy U-turn will significantly dampen economic growth over the next few years.

Find Out More