Blog | 12 Nov 2021

Vaccination not the only remedy for African tourism recovery

Jacques Nel

Head of Africa Macro, OE Africa

If widespread domestic vaccination was the only way to revive international tourism, most African countries would be in big trouble. The continent is by far the least vaccinated region globally. While vaccination progress is expected to gather pace as advanced economies place more weight on the risk of mutations and as vaccines become more accessible, reaching anything close to population immunity could take years for many African countries at the current rate of progress.

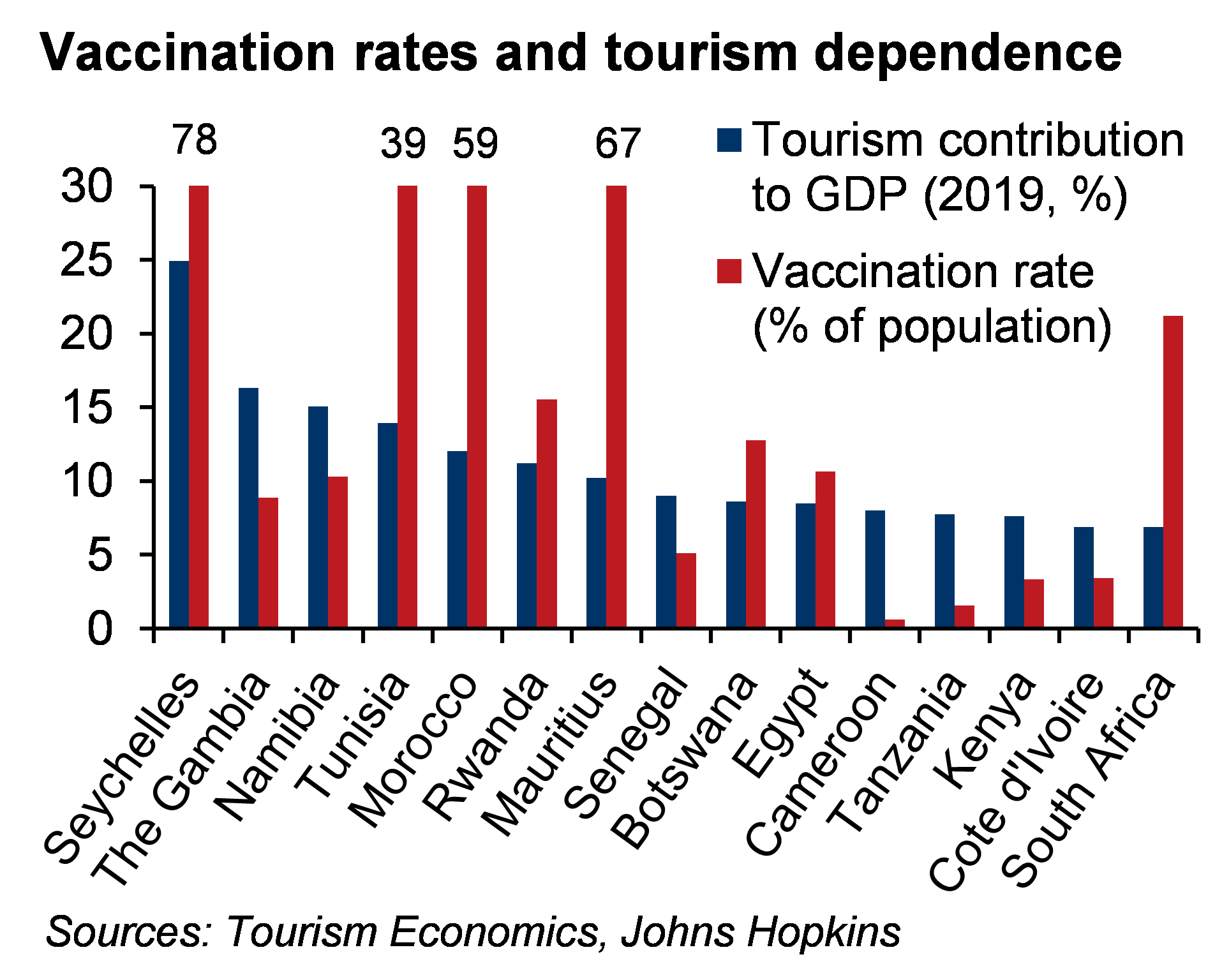

Africa’s island nations are some of the most tourism-dependent economies on the planet. In pre-pandemic times countries including Gambia, Namibia, Tunisia, Morocco and Rwanda relied on tourism to generate between 10% and 15% of total economic output. Tourism also accounts for a disproportionately large share of employment in most countries. The island nations of Seychelles and Mauritius as well as Morocco and Tunisia lead the continent in terms of vaccination progress, but other tourism-dependent economies such as Namibia (with around 10% of the population having received at least one jab) and Rwanda (16%) are undoubtedly far from population immunity. Around half of African countries have vaccination rates of under 5%.

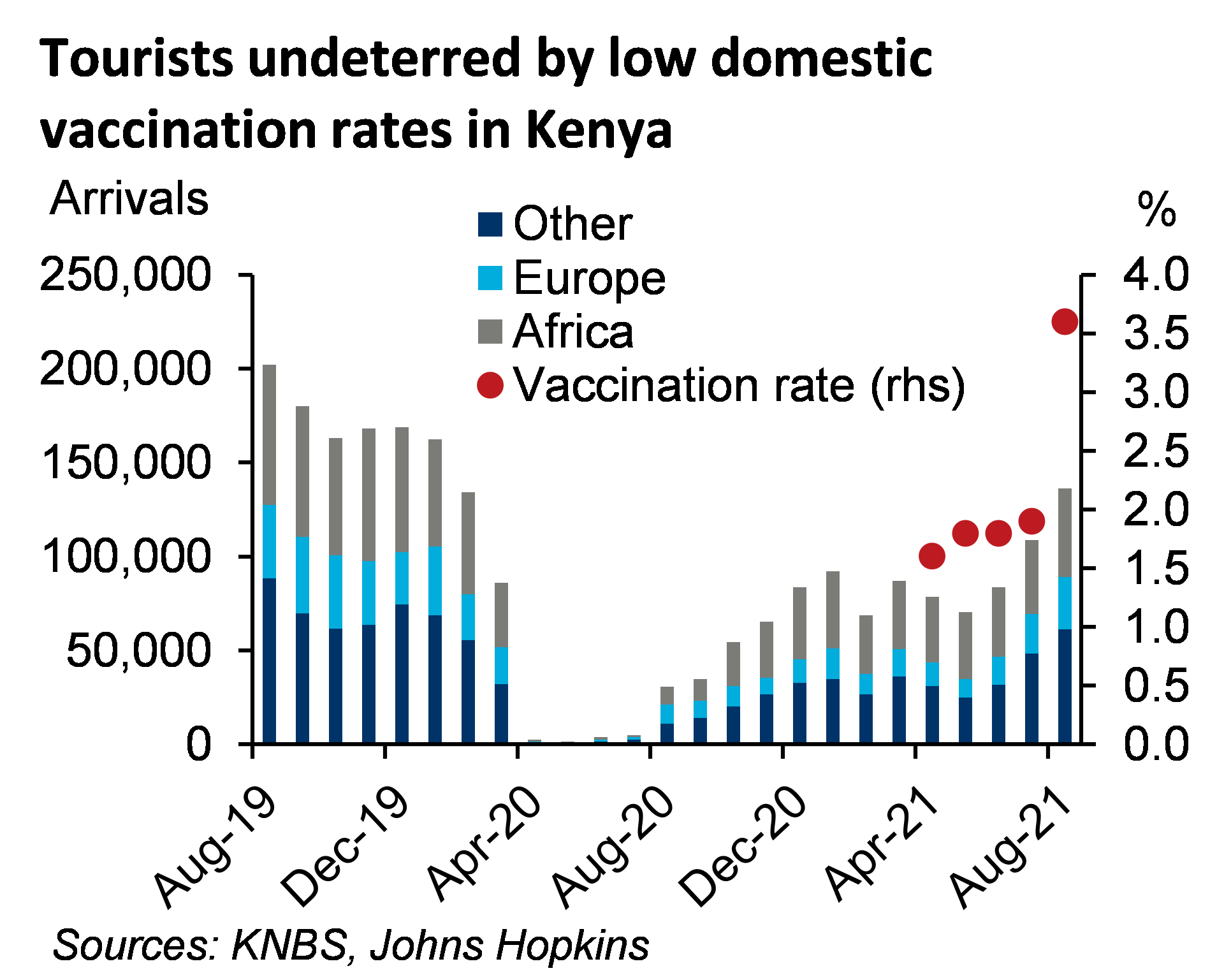

But it is becoming increasingly apparent that vaccination rates in tourism destinations are by no means the only factor affecting the recovery in tourism. Kenya, for example, continues to struggle with low vaccination rates (trending around 4% of the population) but tourist numbers have seen a good recovery; although still down 33% relative to 2019 levels, the August international arrival figures show a strong recovery. The makeup of arriving visitors, from a source-market perspective, is similar to that seen in pre-pandemic times.

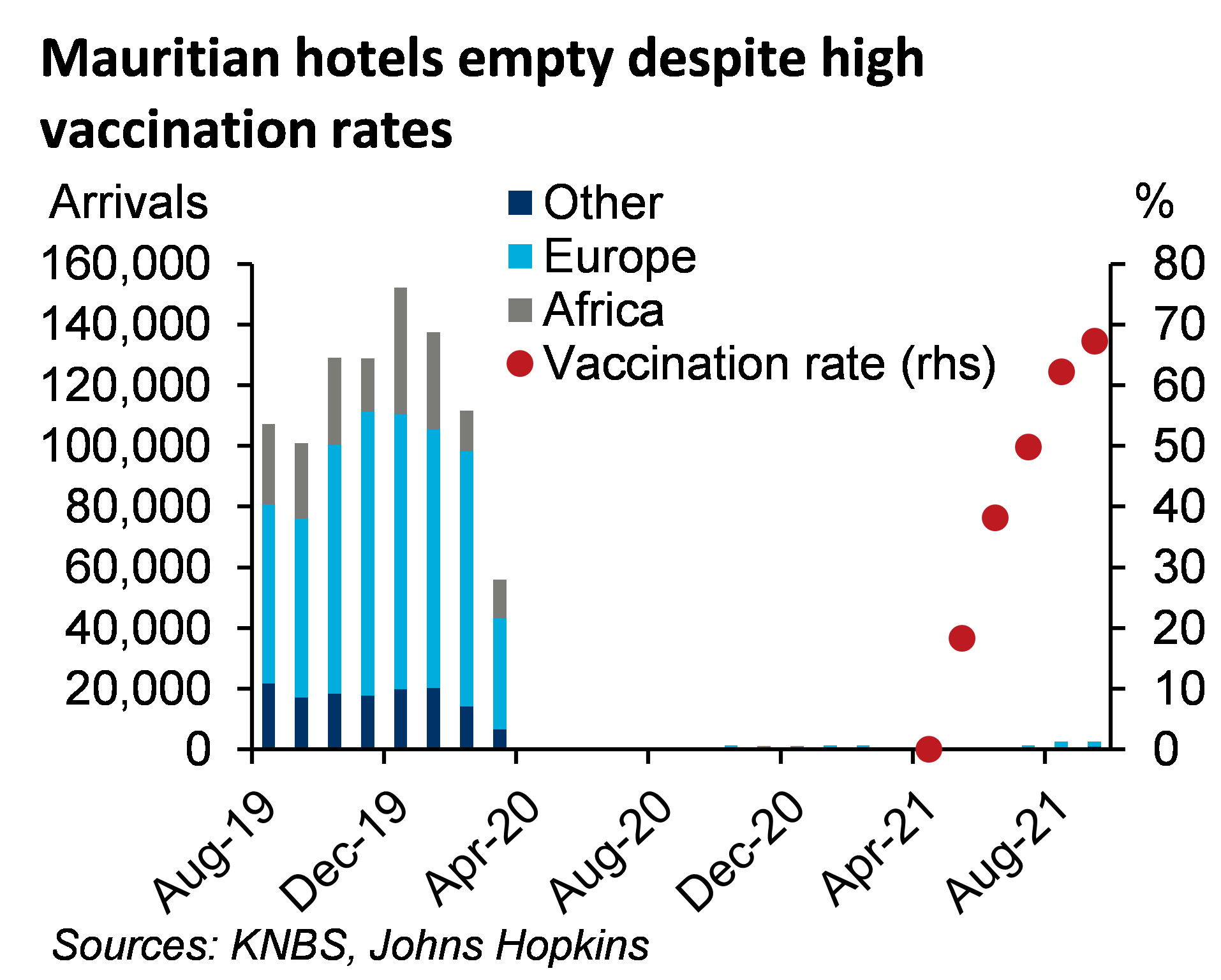

In contrast, Mauritius, with a population vaccination rate trending just under 70%, saw around 2,500 international tourist arrivals in September—a reduction of around 98% compared with 2019 figures.

These two observations highlight the fact that idiosyncratic factors, including lockdown tendencies, vaccination rates in source markets, and even logistics will play a significant role in the tourism recovery. For instance, intermittent surges in infections and Covid-19-related deaths in Mauritius have compelled the government to more often make use of much stricter containment measures than those seen in Kenya. The risk of lockdown—or at least perceptions thereof—persists, and when considering a vacation destination holidaymakers could decide on destinations where chances of tightening restrictions are minimal. Given the reduction in vulnerability to severe infection following full inoculation, it makes sense that tourists from highly vaccinated source markets will be much more concerned about the quality of the holiday than the risk of infection when planning that once-a-year trip.

What feeds into a government’s decision to intensify containment measures at the expense of tourism recovery? Here again, various idiosyncrasies will inform these decisions, including the death toll of previous surges, the broader economic impact of tighter restrictions, and the political costs (or benefits) of curtailing individual freedoms. Public sentiment on these issues varies between countries in interesting ways, and policymakers are responsive to it.

Vaccination is the biggest step toward regaining normality and the importance thereof extends well beyond economic considerations. The ability to source vaccines was in large part beset by factors out of African governments’ control, but the recovery in tourism will very much be a product of government decisions.

Tags:

You may be interested in

Post

Oxford Economics enhances its real estate solutions with the addition of MSCI data

Oxford Economics is delighted to announce a significant product enhancement to its Real Estate Economics Service and Global Economic Model, with the addition of MSCI historic real estate index data.

Find Out More

Post

From Floppy Disks to AI: A Fireside Chat with Adrian Cooper, CEO of Oxford Economics

Discover the journey of Adrian Cooper, CEO of Oxford Economics, in shaping the firm into a global leader, along with his insights and vision for the future in an exclusive interview.

Find Out More

Post

Oxford Economics introduces new Global Tech Spend Forecasts

Oxford Economics is excited to announce the launch of the Global Tech Spend Forecasts service, offering the most reliable forecasts on enterprise IT spending across 35 industries and 25 countries, with forecasts out to 2050.

Find Out More