Blog | 20 Mar 2023

China travel recovery: Timings are clear, but magnitude remains uncertain for 2023

Jessie Smith

Economist, Tourism Economics

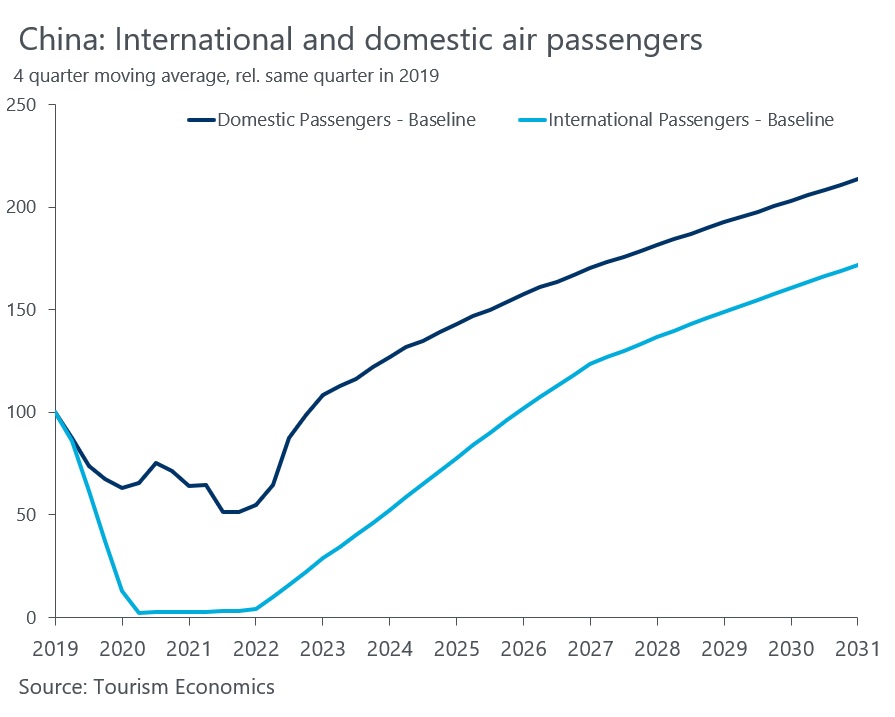

The late December announcement of China’s intention to re-open its borders for travel took the international community by surprise, with little time to prepare. Border re-opening fell just before Lunar New Year, which proved to be significantly stronger than the last with domestic travel reportedly at 89% of 2019 levels and an initial surge in both inbound and outbound visits, albeit to levels well below those in 2019. With the Lunar New Year marking the kick-off of China’s re-opening, questions follow about the shape and scale of China’s return to travel across 2023. Some observers expect the rebound to be rapid, but there are reasons to take a more measured view.

We remain cautious in our Global Travel Service (GTS) outlook for China’s outbound travel recovery. For the first half of the year, focus will be on short-haul travel, particularly to Hong Kong, Macau, Thailand, and Japan. Hong Kong International Airport reported a 2,900% YoY increase in passengers in January 2023, following the easing of both its and China’s travel restrictions. Despite this growth, January visits only reached a third of pre-pandemic levels. Moving into the second half of the year we expect a wider-spread, longer-haul recovery.

There are several significant challenges to recovery, and it is possible that travel growth could be even weaker this year than in our conservative baseline outlook. Pre-existing capacity constraints will be worsened by the lack of clear communication around re-opening. The logistics involved with reinstating China to the global travel network takes time, and the lack of warning ensures both a delayed return to travel and some excess demand. In early February Chinese travel agencies resumed overseas package tour sales—a notable portion of pre-pandemic outbound travel—but initial bookings data indicate that demand remains subdued.

Significantly inflated prices, both due to limited flights and higher fuel prices, are perturbing some buyers. We expect supply constraints to loosen across the year, but in the short term some excess demand may arise from a lack of financially viable options for travellers. Higher air travel costs are likely to remain into the medium term as jet fuel costs remain elevated, placing pressure on air fares while many airlines service high debt levels accumulated during the pandemic. Long-haul travel from China to Europe in particular will also face higher costs for some carriers as longer routes may be required to avoid the air space restrictions imposed by Russia. The limited lead time also applies to passport and visa processing, which will constrain the bounce back in demand due to limited application processing capacity, which had been halted for the last three years.

Though household savings have accumulated throughout the pandemic, these are comparatively modest due in part to subdued income growth over the pandemic, capping the rate of consumer-led recovery. This reduced willingness to spend is also coupled with clouded consumer confidence. Although January 2023 held a small increase in Chinese consumer confidence from 2022’s record lows, it still sits well below levels seen in the past 20 years. Alongside a lack of consumer confidence, many individuals in China remain hesitant about travelling internationally, thus some domestic for international travel substitution will continue in the short term.

Chinese outbound travel had seen rapid growth pre-pandemic, attributed to a burgeoning middle-class coupled with falling prices. While the era of lower transport costs appears to be over, the growing wealth across China remains a key feature of its outbound travel growth potential. The key question is how strong the bounce back in Chinese outbound will travel be in 2023. Our upside scenario estimates Chinese outbound travel could reach 48% of 2019 levels in 2023, compared with 64% in our current baseline, amounting to 17.4 million additional Chinese travellers this year. However, as economic forecasts show hampered consumer spending due to low consumer confidence and depressed income growth, outbound travel recovery this year may not be as buoyant as people may hope.

While destinations eagerly await the return of Chinese travellers, outbound travel recovery relies heavily on sentiment change, and cautious behaviour is unlikely to disappear overnight. As one industry expert put it, “People have waited for three years—there is no need to rush.”

Author

Jessie Smith

Economist, Tourism Economics

+44 1865 268 900

Jessie Smith

Economist, Tourism Economics

Oxford, United Kingdom

Jessie is an Economist within the Tourism team, publishing research and analysis on tourism and travel trends, with a particular focus on the Americas region. Jessie has also been involved in consultancy projects for a range of clients including Airbnb, Booking.com, and the World Travel and Tourism Council.

Jessie joined Oxford Economics after graduating with a first-class honours degree in Economics from the University of Exeter along with industry experience. After completing her placement year at the Department for Work and Pensions, specialising in Universal Credit strategy around children, Jessie also rebranded the Government economics schools outreach programme, improving the diversity of students studying economics in further education.

Tags:

You may be interested in

Post

Trade war scenario threatens US travel sector

Research Briefing China travel recovery: Timings are clear, but magnitude remains uncertain for 2023 International travel to the US is expected to decline.

Find Out More

Post

Short-Term Rentals Generate €149B Economic Impact, 2.1M Jobs Across EU in 2023

Evidence-based short-term rental rules protect the right to live, host, and travel affordably in Europe.

Find Out More

Post

Tourism Key Themes 2025: Growth continues amid greater uncertainty

Travel demand will continue to grow in 2025, despite heightened uncertainty in key demand drivers and markets.

Find Out More