Blog | 05 May 2023

Converging trends in global trade create a data imperative for government and business leaders

Thang Nguyen-Quoc

Lead Economist, Macro Consulting

As China finally becomes the last major economy to dismantle its Zero Covid restrictions and fully opens its borders, governments and business leaders are scrambling to understand what a post-pandemic global trade system will look like.

The coronavirus pandemic has accelerated three trends that were already disrupting world trade. First, the increasing use of digital technologies is revolutionising the way business is conducted, streamlining supply chains, and increasing efficiency. Second, geopolitical competition and concerns about supply chain resilience have driven the trend toward regionalisation of trade. Third, consumers and businesses are increasingly looking for environmentally and socially responsible products and services, leading to a rise in sustainable trade practices.

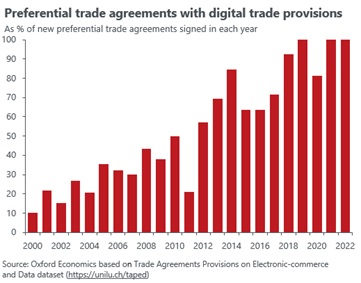

These trends were already in motion prior to the pandemic, but what is new is that these trends are increasingly converging. All the recent preferential trade agreements (PTAs) now include provisions to facilitate e-commerce and digital trade. In 2010, only half of the new PTAs included such provisions.

This rising overlap highlights the increasing importance of issues such as cross-border flows of data for international production and trade. At the same time, it reflects the shifting nature of economic fragmentation from tariff barriers toward technological decoupling, exemplified by recent sanctions on Russia and further policies such as the US CHIPS Act.

Similarly, sustainability policies such as the European Union’s plan for a Carbon Border Adjustment Mechanism would accelerate regionalisation of trade between the EU and other high-income countries, where production processes tend to be less carbon intensive.

To harness these trends, organisations have invested in their ability to anticipate major changes. This investment starts first with the monitoring of global risks and mapping out potential futures. Traditionally, decision-makers then use foresight analysis and scenario planning to qualitatively evaluate the impacts of these risks on future economic and business conditions. The recent data revolution in strategic management means this process needs to evolve to a more rigorous approach to incorporating future scenarios in the decision-making process. This requires quantifying the trajectories of key economic drivers such as domestic and global demands, and input costs (e.g. labour, finance and energy).

Furthermore, the intensity of risk may also matter as much as its direction. For example, Oxford Economics’ research shows that global economy will suffer in a scenario where the US and EU shut down Russia and China’s access to all new technology, and both countries retaliate with the same measures against the West. However, the economic costs would fall disproportionately on China and Russia—reducing their real GDP in 2030 by almost 1.9% in China and 1.3% in Russia. In contrast, it would reduce real GDP in 2030 by only 0.3% in the US and by 0.2% and in the eurozone and UK.

The COVID-19 pandemic highlights the need to anticipate emerging trends and build organisational resilience. For that, governments and companies need to better leverage data to make smarter decisions and prepare for the future. Policy-makers and business leaders that fail to adopt a more robust and quantitative approach to anticipatory planning risk finding themselves locked out of the new megatrend global trading environment.

Author

Thang Nguyen-Quoc

Lead Economist, Macro Consulting

+65 68500121

Thang Nguyen-Quoc

Lead Economist, Macro Consulting

Ho Chi Minh City, Vietnam

Thang Nguyen-Quoc, Ph.D. leads Oxford Economics Asia’s Macro consulting team in Singapore. In this capacity, he supports clients with carrying out bespoke forecast and scenario modelling, as well as thought-leadership reports on trade and green transition. His core expertise is in policy analysis related to international trade and investment. His doctoral thesis evaluated the impacts of digitalization, protectionism and regionalism on the trade patterns of developing countries, using a range of econometric techniques.

Prior to joining OE in 2022, Thang spent a decade delivering flagship economic reports on Asian and African economies at the Organisation for Economic Cooperation and Development (OECD) in Paris. He also worked in various roles at the World Bank, National Academy of Social Sciences (US), and Vietnam Commercial Bank. He got a Ph.D. in International Economics from University Paris-Dauphine, M.Sc. from Barcelona School of Economics and B.A. from Ohio Wesleyan University.

Tags:

You may be interested in

Post

The Estimation Game: What do business transformations really cost?

Oxford Economics, SAP Signavio, and LeanIX partnered to conduct fresh research on business transformation and everything that these journeys entail. The report, based on a survey of 800 executives, reveals key insights into establishing clear goals, securing workforce buy-in, and managing risks, with a spotlight on how organizations can transform successfully despite common hurdles like cost overruns and data management challenges.

Find Out More

Post

Buckle up: Trump era brings economic uncertainty to cybersecurity

Senior Editor Teri Robinson spoke with Chief US Economist Ryan Sweet about the what the second Trump administration will mean for cybersecurity, including the shifting responsibilities of defenders the safety of critical infrastructure, and the rise of AI.

Find Out More

Post

Buckle up: Trump era brings economic uncertainty

Elections have consequences, and inaugurating a new president means policy change will soon follow.

Find Out More