Recent Release | 31 Jul 2023

The economic case for investing in social & affordable housing

Oxford Economics Australia

Oxford Economics Australia was engaged by the Construction, Forestry, Maritime, Mining And Energy Union (CFMEU) to explore the economic case for investing in Australia’s social and affordable housing, potentially funded by revenue from a super profit tax.

The first part of our analysis quantified the current gap in social and affordable dwellings by estimating unmet demand. Our analysis estimates that there is currently a gap of 750,700 social and affordable dwellings in Australia (the housing gap). This gap is expected to rise to 946,900 if no action is taken to substantially increase the supply of social and affordable dwellings.

Our analysis also quantified the investment required to close the housing gap. This considered only the capital investment required to build the required social and affordable dwellings. The investment required to close the gap is significant and requires long-term revenue streams to ensure ongoing investment into the sector. We estimate an investment of $511 billion is needed to close the housing gap by 2041, or an average $28 billion per annum.

Finally, we considered if a super profits tax could fund the required investment to close the housing gap. Our analysis indicates that an economy-wide super profits tax could raise the $28 billion per annum investment required to close the housing gap in social and affordable housing by 2041.

Theoretically, the benefit of a permanent, well-designed general excess profit tax is that it is efficient, does not discourage investment and automatically taxes economic rent without the need to identify profitable sectors during specific episodes. However, correctly calibrating the design features of the tax is crucial to limit impacts on investment and market distortions which would reduce economic activity, wages, jobs and therefore the social welfare it was designed to promote.

The experts behind the research

Emily, Alex and Geof bring years of experience in economic policy analysis and property market forecasting. Working with clients across both the public and private sector, the team provide insights into the macroeconomic environment including property market conditions and the policy landscape.

Emily Dabbs

Head of Macroeconomic Consulting

Alex Hooper

Lead Economist

Geoffrey Snell

Lead Property Economist

Tags:

Recent related reports

US wealth effects are packing a larger punch than ever

Wealth effects proved to be a quite reliable tailwind to consumer spending this cycle.

Find Out More

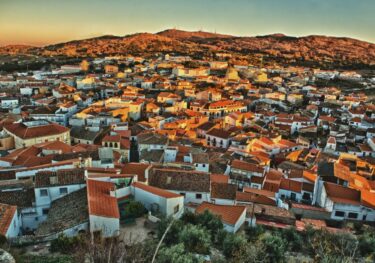

Housing affordability lowest in Greek, Danish, and German cities

House prices across Europe have soared over the past decade, especially in cities. During this time, incomes in Europe have not kept pace with house price hikes on average, squeezing the purchasing power of homebuyers in many European cities.

Find Out More

Steady, Yet Slow: How Oxford Economics Sees Global Economic Growth in 2025

Oxford Economics set the stage for the year ahead, at our second Global Economic Outlook Conference, in London on Wednesday, 5 February.

Find Out More

The European housing market has turned a corner, but challenges remain

The housing market across most of Europe has now improved, but has it reached the tipping point?

Find Out More