EM Asia leads the pack with highest convergence potential

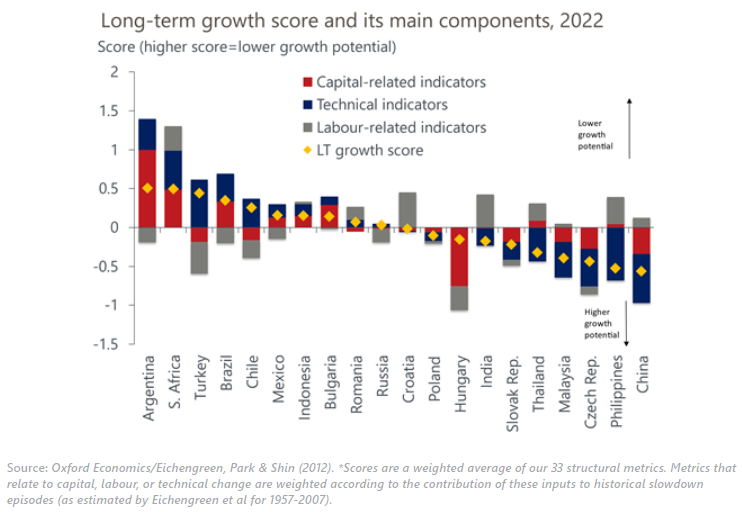

We have updated work we first published in February 2020, which looks at the selected EM economies’ ability to escape the “middle-income trap” and eventually achieve high-income status. Based on the middle-income trap literature, we developed a long-term growth indicator that used 33 metrics to assess risks to EM economies’ long-term growth potential.

What you will learn:

- China, the Philippines, the Czech Republic, and Malaysia are well positioned to grow, according to our 33-factor long-term growth indicator for 20 emerging market (EM) economies. By contrast, Argentina, South Africa, Turkey, and Brazil have the weakest long-term outlook.

- EM Asia is the region with the most favourable long-term growth score, replacing EM Europe which was in the lead the last time we conducted this exercise just prior to the pandemic. With all Latin America countries in our sample now in the “potential laggards” camp, the region continues to face relatively weak prospects for long-term growth.

- Our methodology captures underlying structural strengths and deficiencies that do well in explaining past growth differences. Nine out of ten countries for whom our long-term indicator suggests further convergence potential caught up with the US in 2013-2022.

Tags:

Related Posts

Post

Economies with pre-existing conditions suffer bigger Covid scars

We project the distribution of long-term economic pain inflicted by Covid will be similar to humans in the sense that those with pre-existing conditions will end up suffering the most.

Find Out More

Post

Emerging Markets Monitor: Reassuring signs of slowing inflation

We have raised our aggregate GDP growth forecast for EMs in 2023 by 0.2ppts because most performed better than we had expected in Q1 and have remained resilient in Q2. That said, we have scaled back our expectations for growth in 2024 by 0.1ppt.

Find Out More

Post

Key themes 2023 – Emerging markets look relatively resilient

In a tough global environment, we are below consensus on advanced economy growth and anticipate most will fall into recession in 2023.

Find Out More