Why we lowered our China medium-term growth forecasts

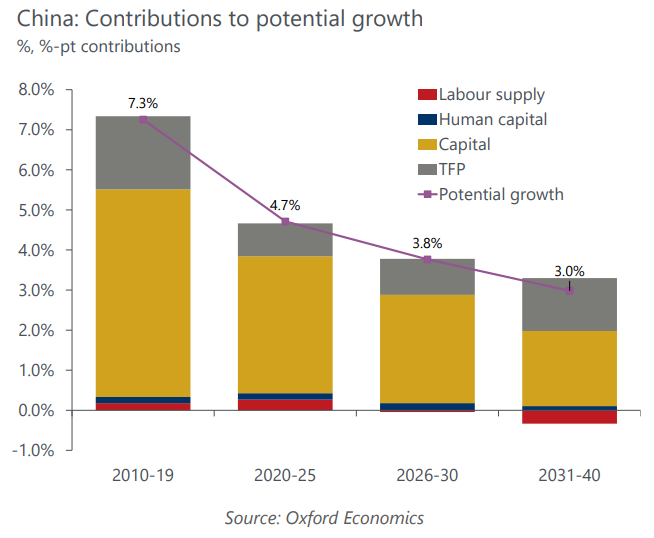

The combined large shocks from years of regulatory uncertainty, the prolonged zero-Covid policy, and a housing correction have undermined China’s supply-side potential more than we previously anticipated. We have therefore cut our estimates of China’s future potential GDP growth rates.

What you will learn:

- Despite slowing, we still expect China’s economy to eventually converge with the US in GDP size by the mid-2030s. However, the bigger challenge for policymakers in the coming years is growth sustainability.

- As the economy rebalances slowly towards a consumption-driven growth model – so a moderation in the contribution from capital – and amid a decline in the working age population, the outlook for China’s trend growth depends to a large extent on raising total factor productivity (TFP). Our base case assumes that continued reforms and the uptrend in R&D spending drive a recovery in TFP in the coming decades.

- The risks to our already-cautious forecasts are still moderately skewed to the downside, particularly if the pace of capital accumulation slows more than we anticipate. Geopolitical tensions leading to more restricted access to technology will also pose a risk to productivity growth.

Tags:

Related Posts

Post

Tariffs 101: What are they and how do they work?

Tariffs are taxes imposed by a government on goods and services imported from other countries. Think of tariff like an extra cost added to foreign products when they enter the country. They’re usually a percentage of the price of the goods, making imported items more expensive compared to domestically produced good

Find Out More

Post

Global Scenarios Service – Heightened Tensions

This quarter’s scenarios quantify key risks to the global economy. These relate primarily to trade protectionism and other geopolitical tensions, structural weakness in the Chinese economy, the stance of monetary and fiscal policy, and financial market conditions.

Find Out More

Post

U.S. dollar strength to remain; Fed to hold interest rates until December

Innes McFee, Managing Director of Macroeconomic and Investor Services at Oxford Economics, discusses the outlook for the U.S. dollar and adds that tariffs will be a “negative” for the U.S. economy.

Find Out More