The miracle growth story of Vietnam has further to unfold

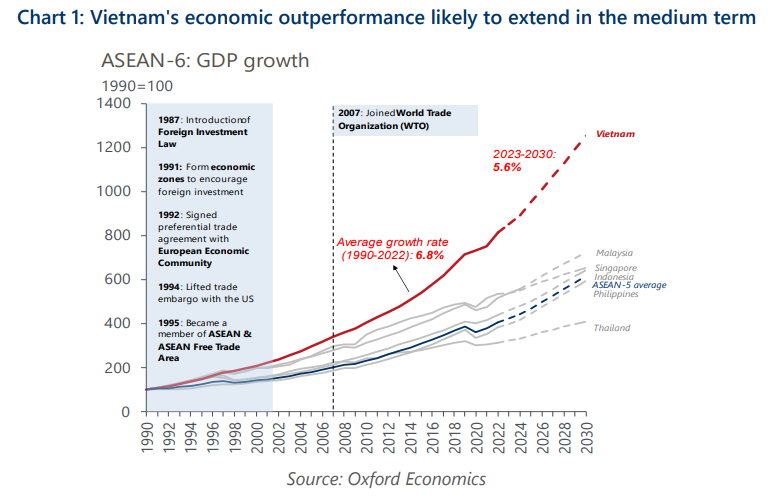

Vietnam has long been hailed as a development success story. Thanks to its successful economic reform, Vietnam’s GDP grew by an average rate of 7% annually in the past three decades, surpassing all its ASEAN regional peers. Although 2023 and 2024 are set to see Vietnam’s weakest growth outside of Covid years due to domestic and external headwinds, we think the pain is short-term.

What you will learn:

- We believe Vietnam’s global share of goods exports will increase further, spurred by multinationals’ China Plus One strategies, driving GDP outperformance relative to the country’s ASEAN peers until at least 2030.

- Vietnam has emerged as a key winner amid the global supply chain reshuffling of recent years. Not only has it quickly increased its share of US electronics imports since 2018 – surpassing most of US’ key import partners – but data this year also suggest that Chinese firms are investing more in production bases in Vietnam.

- To the extent that US-China trade tension persists, there are reasons to believe that this rivalry will continue strengthening the trade uptrend and FDI inflows. Vietnam has one of the most attractive business environments among similar-income economies regionally, with competitive labour costs and relatively flexible labour regulations that should ensure its attractiveness.

Tags:

Related Posts

Post

Vietnam: Growth will be ahead of regional peers in 2025

Vietnam's economy has been the region's outperformer in 2024, with full-year growth likely at 6.7% y/y. In 2025, we think Vietnam will continue to outperform its peers, growing by 6.5%.

Find Out More

Post

Adjusting our assumptions toward stronger US tariffs

In the second release of the November baseline, we updated our tariff assumptions, but the impact on GDP, inflation, and interest rates was small.

Find Out More

Post

Growth forecasts trimmed on review of Trump 2.0 impact

We have revised down our global economic forecasts slightly from our snap post-election assessment. The broad picture is little changed, though: a Trump presidency should have a mild impact on topline macro variables, while the effects on individual sectors and financial markets will likely be larger.

Find Out More