Nordics: Key themes 2024 – Light at the end of the tunnel

The rapid surge in interest rates will continue to weigh on the Nordic economies next year with little external support, but it’s not all gloom with inflation easing and some pockets of strength. We think four themes will be key in charting the outlook for Nordic economies in 2024:

This research report expands on these key themes:

- Central banks will start easing policy as inflation drops. Inflation dynamics will continue to be crucial. We expect headline and core inflation to continue dropping, allowing the region’s central banks to embark on an easing cycle. This should support asset prices and, with a delay, the real economy. We think Sweden’s Riksbank will cut rates sooner than Norway’s Norges Bank.

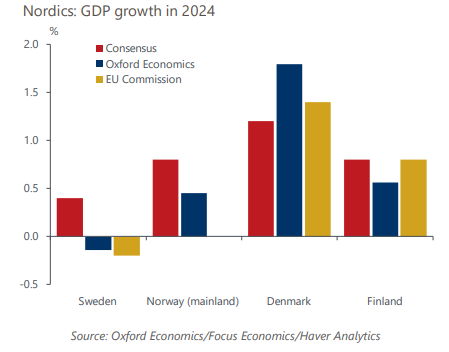

- Growth will pick up – though at different rates across economies – and will remain below potential. This is because mortgage payments will largely offset the boost to real incomes from lower inflation, while investment will take time to pick up due to subdued domestic demand. Eurozone growth will also be weak, weighing on exports.

- Labour markets will weaken. The region’s labour markets have started to show cracks, as demand for labour drops and layoffs step up. We expect unemployment to peak in 2024, but the increases will be relatively small due to labour hoarding. Consequently, the deterioration in labour markets will only be a small drag on household incomes and the economy. And finally, the industrial cycle will turn to an upswing. We expect industrial production to expand next year after a weak 2023 alongside an upturn in the global industry cycle. Demand should bottom out and a re-stocking process start soon. The Nordic economies boast highly competitive industries, particularly Sweden’s defence, Denmark’s pharmaceutical, and Norway’s oil and gas.

Tags:

Related Posts

Post

CRE key themes 2024 – A year of transition

After a difficult 2023, we think five key themes will shape the outlook for commercial real estate next year.

Find Out More

Post

Japan Key themes 2024 – Will wage-led inflation gain momentum?

Inflation will likely decelerate in 2024 as the impact of imported inflation wanes. We expect the Bank of Japan will end its negative interest rate policy in April after confirming a high wage settlement. But our medium-term projection is that a zero-interest rate policy will take its place and last for years.

Find Out More

Post

Asset Allocation Key Themes 2024 – Risky assets are not out of the woods

We think risk assets will underperform in 2024. We map out the implications of our key 2024 global macro themes for asset allocation.

Find Out More