Emerging Markets forecast issues – Policy easing faces stronger headwinds

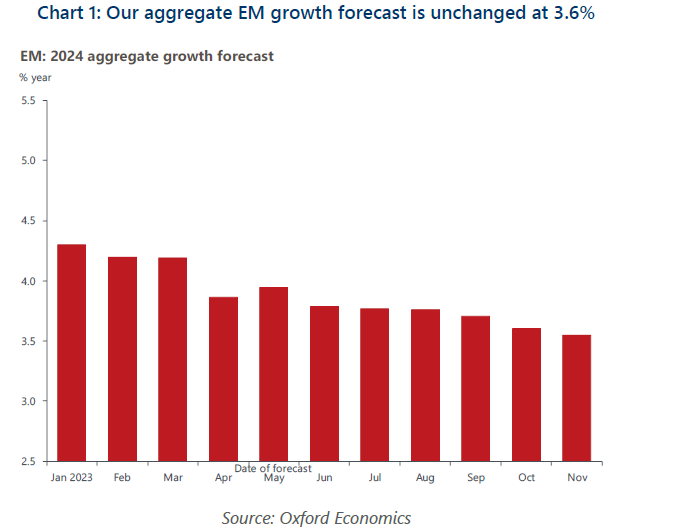

In our latest monthly forecast, we raised our aggregate 2023 GDP growth forecast for emerging markets (EMs) by 0.1ppt to 4.1%. We raised our 2023 GDP growth forecast for China by 0.1ppt to 5.2% after a slight outperformance in Q3, consistent with the official growth target of “around 5%”. We maintain our 2024 aggregate EM growth forecast at 3.6%.

What you will learn:

- Our aggregate EM average inflation forecasts are unchanged at 8.5% in 2023 and 7.6% in 2024, but we think country-specific inflation paths will diverge. Renewed food and energy price pressures may slow inflation’s decline in parts of EM Asia and Latin America. By contrast, we see disinflation progressing quicker in Central Europe amid falling demand.

- High US rates, a strong US dollar, and high oil prices led to surprise rate hikes in Indonesia and the Philippines, defying our predictions. In the Association of Southeast Asian Nations (ASEAN), the pivot to rate cuts is unlikely until Q2 2024, at the earliest. We raised our year-end policy rate forecasts across Latin America, with Mexico’s central bank first cut delayed until 2024.

- The extension of the pause in the Fed’s hiking cycle provides a reprieve to EM currencies and local bonds, somewhat improving the balance of risks assessed by EM central banks. We think the next move by central banks in 13 out of 20 major EMs will be a rate cut. But the surprise decision by Poland’s central bank to put its easing cycle on hold shows that even in Central Europe cuts may be delayed into 1H 2024.

Tags:

Related Content

Economies with pre-existing conditions suffer bigger Covid scars

We project the distribution of long-term economic pain inflicted by Covid will be similar to humans in the sense that those with pre-existing conditions will end up suffering the most.

Find Out More

EM Asia leads the pack with highest convergence potential

Based on the middle-income trap literature, we developed a long-term growth indicator that used 33 metrics to assess risks to EM economies' long-term growth potential.

Find Out More

Middle East escalation would pose mild recession risk

Our latest scenario analysis suggests that the global economy would falter in the event of an escalation of the Israel-Hamas war that severely disrupted the global supply of oil. But assuming the disruption was not protracted, we think any global recession would be mild and fleeting even if oil prices reached $150pb.

Find Out More

After the post-pandemic slump, a steady climb back for Latin America

We expect Latin America's six largest countries' combined GDP to expand 0.8% next year, down from our 1.8% forecast for 2023 and the consensus' 1.4%. The dissipation of idiosyncratic shocks and less restrictive domestic policies should support a broad regional recovery in 2024 from the recessions LatAm's major economies are in or about to enter.

Find Out More