MENA: Key themes 2024 – The GCC will defy the global slowdown

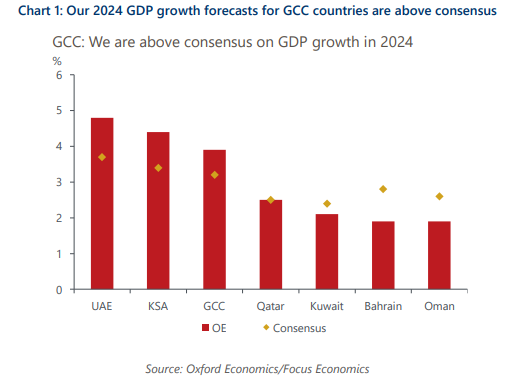

The Gulf Cooperation Council (GCC) region will expand less than we initially thought this year, but growth will improve in 2024 and outpace most advanced and emerging economies. There are four themes that shape our above-consensus 2024 GDP growth forecast for the GCC of 3.9%.

This research report expands on these key themes:

- Energy sector will see a slow turnaround. We expect regional producers to stick to oil supply curbs in the near-term, before unwinding them later in 2024. This will translate into a positive contribution to overall growth from the energy sector after a retreat this year.

- The non-energy economy will remain decoupled from global trends. Our key call for 2024 is that non-energy sectors drive overall growth with expansion of 4%. Government policies will underpin this resilience; we see a broadly stable fiscal outlook, and growth in off-budget spending in Saudi Arabia and the UAE. Meanwhile, GCC inflation will hover at a comparatively low level in a global context.

- Tourism and renewables will remain key diversification engines. We see steadfast investment in non-energy sectors, including tourism and renewables, as it is the essence of regional development visions.

- A widening of the Israel-Hamas war would upend 2024 outlook. Our optimistic view is vulnerable to a regional war escalation scenario through the prospect of disrupted oil supply, negative impact on investment and travel demand, and a deterioration in the global macro backdrop.

Tags:

Related Posts

Post

MENA | Can Turkey Keep the Lira Steady?

In response to the lira sell-off last week, initial estimates suggest that the central bank of Turkey spent $12bn to defend the currency, after slipping almost 4% following the arrest of Istanbul’s mayor

Find Out More

Post

MENA | Saudi Arabia’s Credit Upgrade: What’s Driving the Growth?

Turkish annual inflation continued its downtrend in February, easing to 39.1%, the lowest since mid-2023. The monthly increase in prices of 2.3% was driven by higher costs across services, especially rents and transport, as well as processed food.

Find Out More

Post

MENA | Can Egypt’s Inflation Drop Spark a Rate Cut?

Turkish annual inflation continued its downtrend in February, easing to 39.1%, the lowest since mid-2023. The monthly increase in prices of 2.3% was driven by higher costs across services, especially rents and transport, as well as processed food.

Find Out More

Post

MENA | Is Turkey’s inflation finally under control?

Turkish annual inflation continued its downtrend in February, easing to 39.1%, the lowest since mid-2023. The monthly increase in prices of 2.3% was driven by higher costs across services, especially rents and transport, as well as processed food.

Find Out More