Blog | 19 Dec 2023

Greater downside risks are explored in our Q4 IFRS9 and CECL scenarios

Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

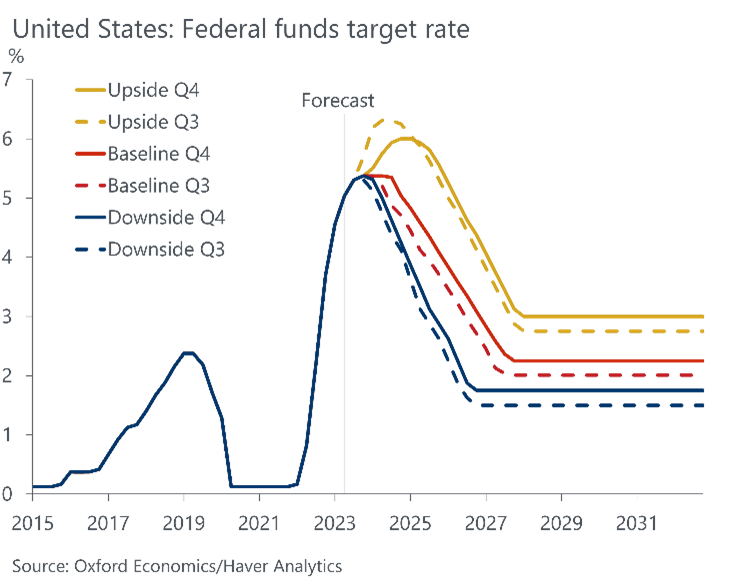

The Q4 update of our IFRS9 and CECL scenarios services paints a more pessimistic view of the balance of risks to the global economy, albeit with a lower peak in policy rates and higher terminal rates than we saw in Q3.

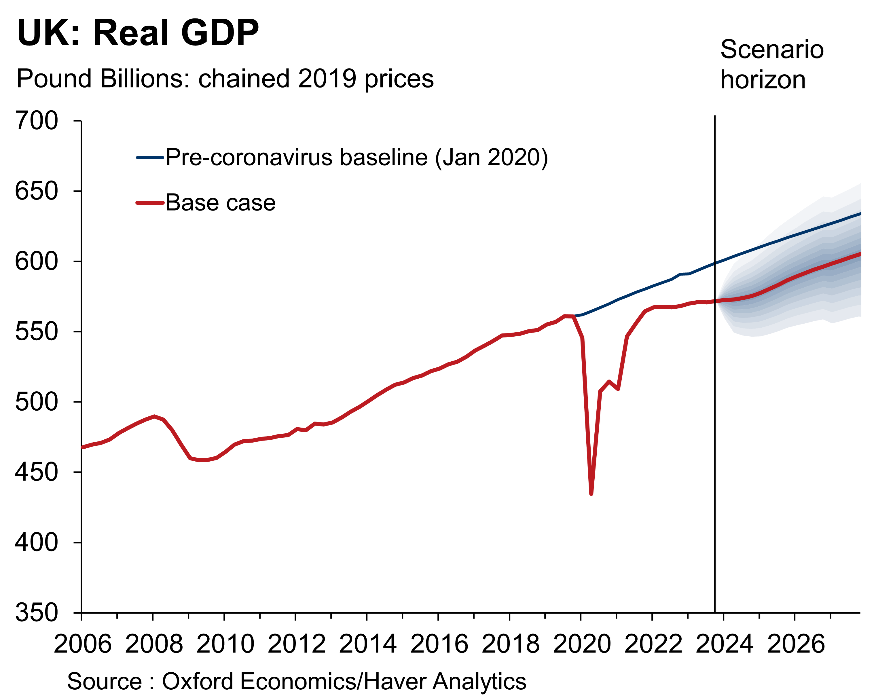

The latest batch of national accounts data for many large economies confirmed that recent economic resilience was maintained in Q3. Nonetheless, the ongoing downtrend in the global composite PMI suggests that this strength could be a last hurrah. Clients responding to our Global Risk Survey have also become more downcast in their expectations around our baseline forecast for global GDP growth compared to the last update. Overall, the net balance of risks to the outlook is more skewed to the downside than in the previous update, with fewer respondents seeing risks as balanced.

Since September, interest rate expectations for the main central banks have fallen back significantly, as markets adjust to the idea of a longer but lower peak to the current cycle in policy rates. We therefore now see a lower peak in rates in our alternative scenarios than we did in Q3. However, bond yields have risen dramatically since the middle of this year. Decomposing the changes in the forward yield curves into shifts caused by changes in the expected path of policy rates and shifts in the term premia shows that the shift in the forward curve since the start of September has been driven mainly by increases in the term premia. Given the increased inflation risk premium and higher debt burdens for some economies, we think there are stronger grounds to believe that the term premia should now be higher than in the 2010s for all the advanced economies. We have therefore raised our forecasts for bond yields in the long term by 50bps in the US and UK, by 25bps in Germany and about 20bps in Japan.

While interest-sensitive spending looks strong relative to cycles in the 1960s-1990s, it does not relative to the 2004-2007 cycle in which asset price effects were slow to materialise. So, the peak impact on spending may be yet to come, and some leading indicators in the US and Europe point in this direction. As a result, greater upside risk to terminal rates translates into a more pessimistic assessment of the overall risks to the outlook.

Our quarterly IFRS9 and CECL products combine over two decades of forecast errors with our quantitative assessment of the current risks facing the global and domestic economy to produce robust forward-looking distributions for the economy. Using specific percentile points in the distributions of several key metrics such as GDP, unemployment, interest rates, house prices and equity prices we construct five alternative scenarios at a globally consistent level to help clients assess local and global risk and cover the expected lifetime of assets.

Click here if you want to learn more about our IFRS9 service and here for our CECL service.

Author

Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

+44 (0) 203 910 8138

Private: Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

Oxford, United Kingdom

Tags:

You may be interested in

What Trump 2.0 means for the global economy

In response to the results of the US election we've adopted our 'limited Trump' scenario as our baseline view for now. The direct impact on global growth is likely to be limited in the near term, but masks major implications for trade and the composition of growth, and for financial markets.

Find Out More

Upside risks have increased in toss-up US election

We still see the presidential election as a coin flip, but our updated scenarios suggest that upside risks to our baseline forecast of growth and inflation during the next presidential term are larger than we estimated in our last update.

Find Out More

Infographic: Measuring risk exposure to China-Taiwan tensions

We have developed a globally consistent framework showing cross-country GDP vulnerabilities to an escalation in China-Taiwan tensions, factoring in three key channels of risks: trade exposure to Taiwan and mainland China, wider economic and industry reliance on semiconductors for producing output and price ramifications of shortages and disrupted shipping.

Find Out More

Why Bernanke’s review of the state of forecasting matters – to the Bank of England, Oxford Economics and you

At Oxford Economics we firmly agree with Bernanke’s forecast process recommendations to the BoE. The review also sparked us to consider our forecasting approach and how we would fare in a similar exercise.

Find Out More