Europe: Residential opportunities have a northern bias

The outlook for European residential real estate is improving. The prospect of lower interest rates means house price corrections are probably coming to an end, while still-stretched affordability will support rental demand.

What you will learn:

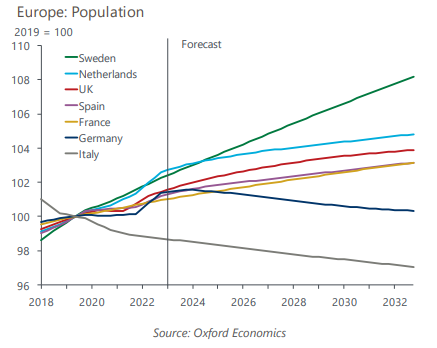

- Some markets such as Sweden, the UK, and the Netherlands offer more promising investment opportunities than others, in our view. On the demand side, we estimate these three countries will experience the biggest population increases over the next decade. Conversely, we forecast declines in Germany and Italy’s populations, despite a positive impulse from inward migration.

- Residential property prices look to have bottomed out in most European markets and prospective rate cuts should support a recovery in values. Modest price falls over the last year have done little to offset a deterioration in housing affordability and the impetus this gives to rental demand.

- Supply constraints should also support residential values, though in some markets more than others. This looks most true of the UK, which has both the smallest number of dwellings relative to population among the big European markets and, uniquely, saw no increase in the population-adjusted dwelling stock during the 2010s.

- Prior to the recent bout of high inflation, growth in European housing rental values tended to keep pace with, or exceed, inflation. The Netherlands and Sweden delivered the strongest real terms rises among the major markets. Population trends in those countries suggest that outperformance may resume now inflation is falling back to more normal levels.

Tags:

Related Posts

Post

Property risk premiums rising but will remain below average in Australia

Australian bond yields have risen over the past 18 months, highly influenced by movements in the US, reflecting more hawkish expectations for policy rates and a higher term premium.

Find Out More

Post

Geographic allocation alpha makes a comeback in CRE investment

While we expect that sector selection will still be an important component to generating alpha in commercial real estate investment, we think the thematic drivers that are likely to support outperformance over the next decade will require more emphasis on selecting for geography.

Find Out More

Post

Assessing the work-from-home impact on US office demand

The work-from-home movement has proven it has staying power. As a main driver of the structural shift in the office sector, the disruption from increased work from home is having a lasting impact on office performance. Office net operating income yields will expand significantly this year and we project office capital values will fall by 16.4% in 2023 and by 2.1% in 2024.

Find Out More