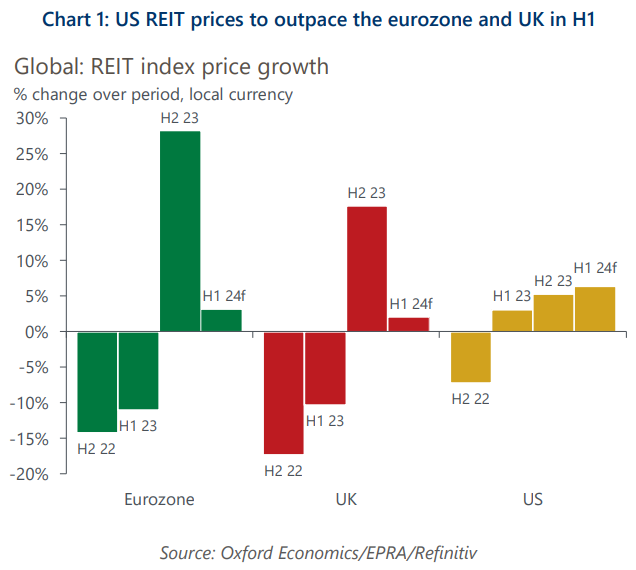

US REITs set to outperform the eurozone and UK in H1

We think that global real estate investment trust (REIT) prices will continue to grow in H1 on the expectation that a soft landing will sustain income growth and underlying asset values will find a floor.

What you will learn:

- We expect US REITs to outperform the eurozone and the UK in H1. This is a change from our June 2023 view, when we called for eurozone REITs to outperform in H2 2023. The eurozone did outpace the UK and US but was much stronger than we anticipated.

- Our US macro team significantly upgraded its forecast at the start of the year, now seeing the US economy grow by 2.3% in 2024, much higher than our forecast for the eurozone and UK.

- Given the scale of market movement in the final two months of 2023 for the eurozone and UK, we now believe that the US is best placed for near-term outperformance given that asset values are likely to stabilise this year (except offices).

- The US has a deeper REIT market with a lower weighting to office and retail than the eurozone and UK. We expect non-traditional sectors, such as healthcare, data centres, and infrastructure to be the main growth sources over this year.

- We remain cognisant of downside risks, particularly from the lagged transmission of past rate increases which will raise refinancing costs for commercial real estate and the corporate sector. There are also geopolitical risks with Middle East tensions posing a concern for global inflation.

Tags:

Related Posts

Post

Real Estate Key Themes 2025: A tentative revival for CRE growth

After a year of transition in the commercial real estate cycle in 2024, we believe CRE is poised for a tentative revival in values.

Find Out More

Post

The impact of Trump’s presidency on US commercial real estate

The policy implications from a second Trump presidency are expected to affect US commercial real estate (CRE) through curbed immigration, tax cuts, and increased tariffs. However, CRE's relative pricing to bond yields will probably most influence values in the short term.

Find Out More