Research Briefing

| Feb 14, 2024

Cross Asset: Sticking with our risk on tilt as the growth outlook improves

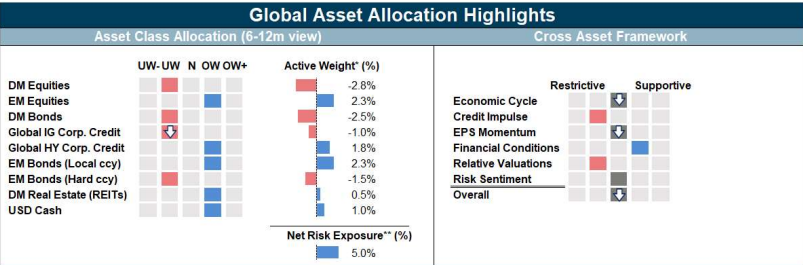

We remain modestly risk-on as our above-consensus view on US growth this year still favours risk assets over bonds.

What you will learn:

- We think the soft landing we forecast is unlikely to translate into a strong EPS recovery and we therefore prefer high-yield credit over DM equities. Credit has a lower sensitivity to swings in earnings growth and resilient balance sheets mean we are constructive on the corporate default cycle.

- We are overweight cash and underweight long duration assets including DM bonds, IG corporate and EM sovereign credit. Our soft-landing view for the global economy and elevated coupon issuance over the coming quarters favours the shorter duration segment of the curve.

Tags:

Related Services

Service

Emerging Markets Asset Manager Service

Emerging markets insight and opportunity at your fingertips.

Find Out More

Service

Global Macro Strategy Service

Global insight and opportunity at your fingertips.

Find Out More

Service

Global Asset Manager Service

A complete solution for asset managers who require convenient access to high quality, market-relevant analysis on key global markets.

Find Out More