Eurozone: Nowcasts show a cold start to 2024, but warming later

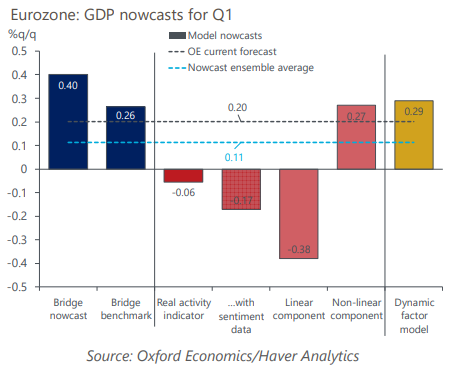

Our suite of nowcasting models corroborates our tepid near-term expectations for the hibernating eurozone economy, indicating Q1 growth will come in at 0.1% q/q. This is a touch below our 0.2% q/q baseline forecast, though the spread of results across our models plus mixed signals from latest data highlight the uncertainty around the immediate growth outlook.

What you will learn:

- Our models also indicate differences in country performance, with Spain again leading the pack. France, helped by resilient services, and Italy, boosted by solid carryover from construction, also look set for solid outturns in Q1. The German malaise is set to continue, however.

- Industry remains subdued, though we see early signs of bottoming out. Consumer spending and confidence also look weak in Q1, corroborated by our high-frequency proxy. Conversely, the labour market continues to hold up, lending flows are showing signs of a turn in the cycle as the ECB pivot nears, and financial market sentiment is on the up.

- A slow start to 2024 isn’t a disaster – growth should consolidate and broaden out gradually over the year. We think several tailwinds will strengthen: real earnings growth will pick up, confidence should improve, and the ECB will start cutting rates. This won’t do much for 2024 growth, which we expect at only 0.7% given the weak carryover. But the momentum should generate strong growth in 2025 of 1.8%.

- We think risks to our baseline are balanced. On the downside, the Red Sea turmoil could bring back supply disruption, suppressing disinflation and curbing purchasing power. Cracks in the labour market could also threaten consumer recovery. But healthy balance sheets, improving financial market sentiment, and a possible faster pass-through of rate cuts are upside risks

Tags:

Related Services

Post

Eurozone: Stubborn services inflation should not delay rate cuts

A slower fall in services inflation will partially offset the relatively stronger disinflationary forces in goods prices. We do not think it will derail European Central Bank rate cuts this year, but the pass-through of strong wage growth from the tight labour market poses upside risks

Find Out More

Post

Eurozone: Monetary loosening will boost growth – but not until 2025

After the sharp falls in eurozone inflation recently, a series of rate cuts this year by the European Central Bank is now the consensus view. However, monetary policy transmission takes time and we don't think growth will receive much of a boost from monetary loosening until 2025, though there's potential for some upside surprises.

Find Out More

Post

Eurozone: Core goods disinflation should prompt rate cuts next spring

Weak demand, profit margin compression, easing pipeline pressures, and abating supply bottlenecks mean we see core goods inflation strongly coming down in 2024, supporting our below-consensus inflation forecast.

Find Out More