Blog | 07 Mar 2024

China’s robust industrial performance raises trade tensions

Sean Metcalfe

Associate Director

Industrial production in China is forecast to post growth of 5% in 2024, for the second year in a row. Its performance will outstrip the United States and an anaemic expansion in Europe, and raises the prospect of a renewed tensions between East and West.

Solid manufacturing growth in China will play a key role in uplifting global industrial activity in 2024, which will grow by 2.7% this year after just 1.8% in 2023. Chinese growth is set to dwarf the 1.1% in the EU and the UK and 1.4% in the US, according to the latest forecasts released by Oxford Economics’ industry service team.

The robust growth in China will be based on a cocktail of state-driven investment, supply-side stimulus, and a boost in “green” manufacturing. In particular, China’s solid manufacturing outlook is rooted in continued government stimulus concentrated in green equipment and high-tech manufacturing as part of the economy’s shift away from low-value mass manufacturing. Last year saw the acceleration in Chinese output by the “new three” industries of electric vehicles, batteries, and renewables compared with modest growth in the “old three” industries of furniture, garments, and home appliances.

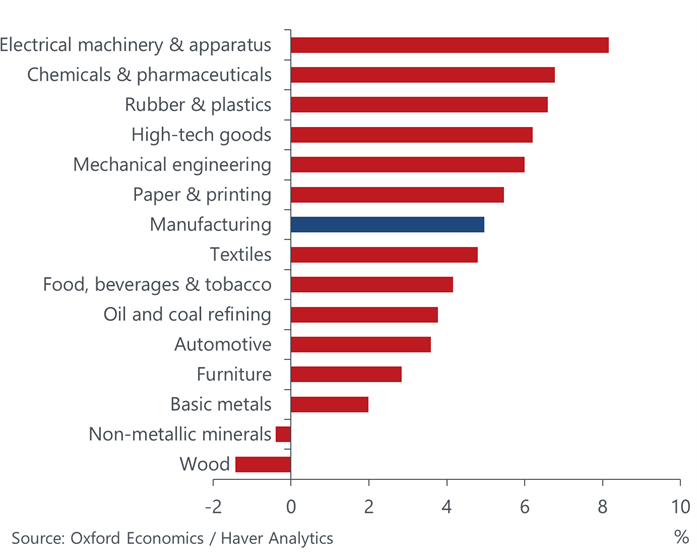

And as Fig 1 shows, growth in these sectors is expected to remain strong in 2024. Conversely, the ongoing property sector slump is set to constrain heavy industries, like construction and metals production, contributing to a high amount of variability across the spectrum of Chinese industrial activity in 2024.

However, strong production growth in the strategic industries, combined with deflationary pressures and weak domestic demand, has meant Chinese exports in certain goods categories have surged, prompting accusations of dumping among EU policymakers. The EU—Germany in particular—was the sick patient of global industry in 2023, and the near-term picture remains gloomy, compounding fears over price competitive Chinese imports.

During the second half of 2023 European companies made a series of allegations into Chinese producers dumping excess output into Europe, culminating in numerous anti-dumping investigations into Chinese companies. Excess stock intended for its domestic economy has in fact ended up in its export markets as domestic demand failed to keep up with production.

From the middle of 2024, outcomes of EU trade investigations will be released that could lead to further anti-dumping and anti-subsidy sanctions on certain Chinese goods as well as broader tariffs on Chinese imports. Europe will have to weigh up benefits versus the costs of protecting European companies from China against higher import costs and a potential trade war with China.

Meanwhile, the US could also increase pressure on the EU to side with it in its protectionist stance towards China especially with the US election in November and possibility of a new administration. Washington has maintained tariffs on certain Chinese goods, while likely Republican presidential candidate Donald Trump has confirmed that he would impose tariffs of 60% or higher on Chinese goods.

The worry is that should strong growth in price competitive exports in these sectors persist, trade tensions between China and the West could result in tariff escalation, which represents a downside risk for trade and global industrial activity.

Author

Sean Metcalfe

Associate Director

+44 (0) 203 910 8111

Sean Metcalfe

Associate Director

London, United Kingdom

Sean is an Associate Director on the Industry team, where he forecasts the utility sector, helps shape the team’s views on the Global Industrial outlook and oversees the climate-related enhancements being made to the Global Industry Model.

Prior to joining Oxford Economics, Sean spent two years working for RBB Economics as a competition economist. At RBB he was involved in the economic assessment of competition cases across a range of industries, including antitrust investigations in the telecommunications sector.

Sean holds an MSc in Economics from the London School of Economics and a BSc in Economics from the University of York.

Tags:

You may be interested in

Post

Trump tariff turbulence threatens global industrial landscape

Trump has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign. This will have a major impact on global industrial prospects.

Find Out More

Post

Europe’s defence splurge will help industry – but by how much?

Our baseline forecast now assumes that European defence spending will rise to 3% of GDP by the end of the decade. This could give a growth boost to Europe's ailing industrial sector.

Find Out More

Post

Blanket tariffs from Trump drag down industrial prospects | Industry Forecast Highlights

The impact of global tariffs, a high degree of policy uncertainty, and higher for longer interest rates are expected to hit industry—we have pushed down our 2025 global industrial production growth forecast by 0.5ppts since our Q4 2024 update.

Find Out More