Industry Forecast Highlights: Industry to rebuild momentum in 2024

As 2024 progresses global industrial activity should pick up and begin to rebuild some momentum. Pass-through from lower wholesale energy prices, a move past the peak of impacts from past rate hikes and a trough in the de-stocking cycle should benefit manufacturing activity in the advanced economies. In annual terms, we expect growth of 2.7% in industry this year.

What you will learn:

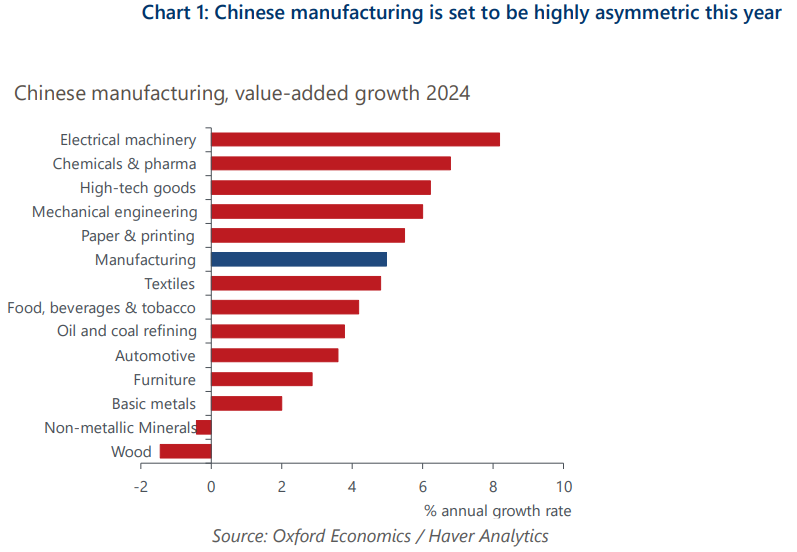

- In China, growth is likely to be highly asymmetric in 2024, and heavily concentrated in the energy transition-adjacent ‘New Three’ industries, as well as high-tech goods like semiconductors. On the flip side, the ongoing property sector slump is set to severely curtail construction.

- Strong production growth in strategic industries, combined with deflationary pressures and weak domestic demand, has meant Chinese exports in certain goods categories have surged, prompting accusations of dumping among EU policymakers.

- The EU—Germany in particular—was the major weak point of global industry in 2023. Though the near-term will remain gloomy, there are signs of weakness bottoming out and we should see a gradual, albeit unspectacular, recovery through 2024.

- The disruption to shipping activity from the Houthi attacks on Red Sea shipping routes is expected to persist until at least mid-2024. Though uncertainty is high, we think broader inflationary impacts should be muted.

Tags:

Related Posts

Post

ASEAN growth opportunities following US-China Tariffs

Using sectoral production data from Oxford’s Global Industry Service, we have been able to quantify which countries and sectors have the greatest potential for production migration. Applying this framework across Asia reveals meaningful industrial depth in Vietnam, Thailand, and Malaysia in trade-intensive segments, and a distinctive, more resource-heavy footing in Indonesia and India.

Find Out More

Post

Peak tariff impact on industry still to come

In 2026, we anticipate global industrial value-added output to grow just 1.9%, the slowest pace of growth since the global financial crisis.

Find Out More

Post

European defence spending surge: which sectors will benefit?

Our modelling suggests the main beneficiaries of the spending will be a highly concentrated subset of capital-intensive subsectors, mainly in transport and electronics.

Find Out More