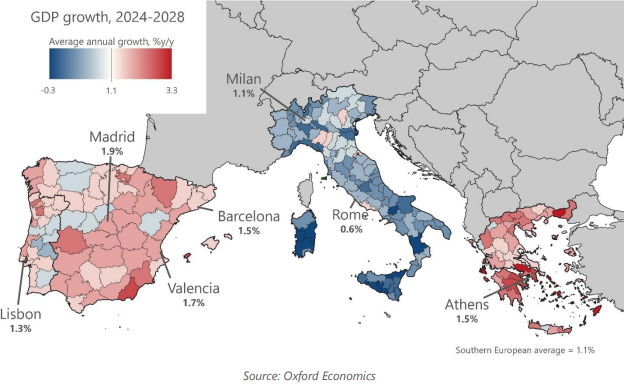

Europe: Among major southern cities, Madrid looks strongest

We are cautiously optimistic about the medium-term outlook for Europe’s cities as a whole, but less sanguine about southern European cities than most others. They have tended to underperform in the past and will probably do so in the future. Madrid, the largest, has the strongest growth prospects of the larger cities.

What you will learn:

- Madrid is the only European city that begins to rival London and Paris in GDP terms. It is home to some significant multinational companies, has a cosmopolitan and highly educated population, and like London and Paris has large professional services and information and communications sectors. But it is less successful at attracting internationally footloose companies and workers, and continues to struggle with a high unemployment rate. More positively, it did have a good year in 2023, and the Madrid Nuevo Norte regeneration project is a major attempt to reinvigorate the city, with improved links to southern France: a European tech hot spot.

- Barcelona is held back by separatist politics, but more so by its large manufacturing sector, which has a bias towards slower-growing and lower value-added legacy subsectors. In contrast, Valencia has been singled out as Ford’s main investment location for electrical vehicles, although that is a sector on which we are deliberately cautious. Valencia also still shows the scars of the global financial crisis, as does Athens.

- Among Italian cities, Milan is of course the commercial centre, but is held back by low educational attainment, and by demographic challenges—which is a problem also shared by Rome, Athens, and other cities. We see this as a bigger medium-term issue than the future of tourism across all southern European cities, despite the challenges facing that sector. Indeed, we forecast strong continuing tourism growth.

Tags:

Related Posts

Post

Europe: City employment growth eases, but office sectors still lead

Labour markets in European cities have shown remarkable resilience over the last few years, and employment in office-based sectors especially so. But from this year onwards, we expect the pace of office employment growth to slow.

Find Out More

Post

Europe: Accounting for climate transition risk in CRE required returns

We are adding a depreciation risk premium that incorporates climate transition risk to our required returns framework.

Find Out More

Post

Europe: Residential opportunities have a northern bias

The outlook for European residential real estate is improving. The prospect of lower interest rates means house price corrections are probably coming to an end, while still-stretched affordability will support rental demand.

Find Out More