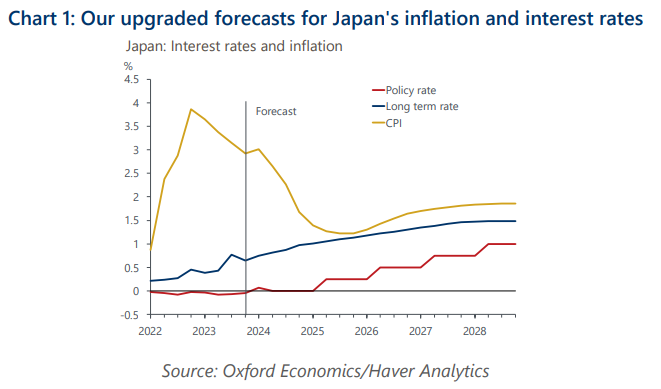

BoJ to raise its policy rate cautiously to 1% by 2028

We now project that the Bank of Japan will start to raise its policy rate next spring assuming another robust wage settlement at the Spring Negotiation. If inflation remains on a path towards 2%, the BoJ will likely raise rates cautiously to a terminal rate of around 1% in 2028.

What you will learn:

- In our view the BoJ’s policy reaction function has changed. If the BoJ continues to give absolute priority to meet the 2% inflation target, it will take a shallower path. However, the bank’s recent moves and messages reveal a strong appetite to return to positive interest rates earlier as long as inflation is broadly heading towards target.

- It’s possible that the next rate hike will happen in H2 2024, depending on the pass-through of wage rises to service prices. Still, the room for the amount of hikes is limited due to the huge downside risks in the price outlook, especially the sustainability of wage rises and pricing power. And even if a labour shortage continues to push up wages and inflation, the BoJ may hesitate to raise the policy rate if household income and consumption remain stagnant.

- Higher short-term policy rates and rising term premium caused by more uncertainty and volatility around inflation and monetary policy means we have raised our estimate for the long-term equilibrium rate for 10-year JGB yields to 1.5% from 0.7%.

- We think the BoJ will devise an exit strategy from QE policy later this year after the policy review that is underway. The BoJ will allow long-term yields to rise gradually driven by fundamentals, but those steps likely will be cautious to avoid a disorderly rise.

Tags:

Related Posts

Post

Japan’s older households to support spending under higher rates

The resilience of consumption is essential to support sustained wage-driven inflation and the Bank of Japan's rate hikes. We see little risk of spending faltering due to the projected gradual rate hikes to 1% because the ageing of society has made households' balance sheets less vulnerable to rate increases.

Find Out More

Post

Japan’s small firms’ profitability will help determine further rate hikes

Rising wage costs have been increasingly squeezing the already low profitability of small firms in Japan, thereby raising concerns about the sustainability of the wage-driven inflation dynamics. The evolution of these dynamics will be key in determining how far the Bank of Japan can raise its policy rate in the coming years

Find Out More

Post

Autos and machineries in Japan are most vulnerable to US tariffs

Our analysis of industry and trade structure between the US and Japan reveals the auto and non-electrical machinery sectors are most vulnerable to tariffs by the US. For both sectors, the US accounts for a sizeable share of total exports as well as gross output, and particularly so for auto.

Find Out More