China decoupling – how far, how fast?

Economic decoupling from China is ongoing, but the latest evidence suggests that, especially outside the US, the process is gradual and piecemeal. Trade decoupling may be slowly spreading from the US to other advanced economies, however surveys suggest foreign investors’ attitudes to China improved slightly in 2023, though they are still more negative than a few years ago.

What you will learn:

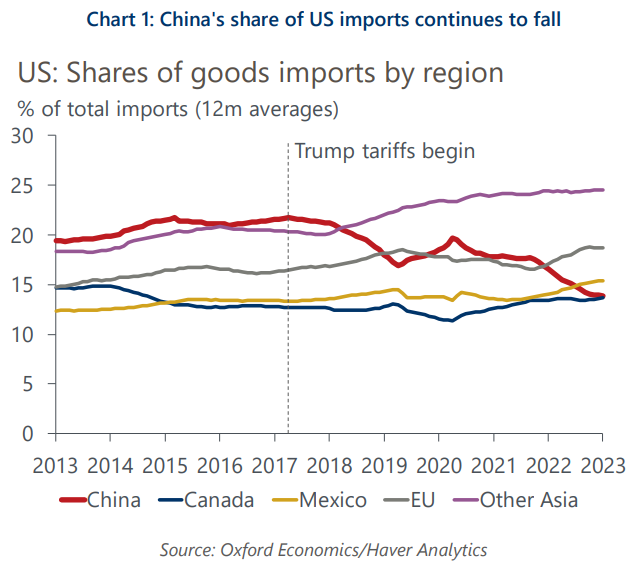

- China’s share in US imports dropped from 22% in 2018 to less than 14% in 2023, and it has been equalled or surpassed by other Asian states, the EU, Mexico, and Canada. However, the US’s indirect trade exposure to China may be rising as Chinese goods form a larger share of the imports of US trading partners like Vietnam, South Korea, and Mexico.

- Outside the US, we saw tentative evidence in 2023 that trade decoupling from China was starting to spread, especially on the export side. This is particularly notable in the semiconductors and integrated circuits sector, where EU and Taiwan exports to China dropped sharply.

- Foreign direct investment into China collapsed in 2023 to less than one-tenth of the level of FDI into the US. Surveys of foreign firms in China over the last few years show a marked drop in the share planning to raise investment there, although sentiment did improve slightly in 2023.

- Asia remains the preferred location for activity relocated from China, but there is some interest in reshoring to the US and Europe. Relocation of investment from China looks likely to be a slow process though, as only a small share of firms plan to leave the market entirely. Moreover, with foreign firms accounting for only 30% of China’s foreign trade compared to 60% two decades ago, their influence on trade decoupling will be smaller than in the past.

Tags:

Related Posts

Post

Four themes are shaping US real estate markets

This year is set to be a turning point for commercial property markets in the US. A gradual easing of inflationary pressures alongside a steady, if unspectacular, year for GDP and employment growth should help to ease the market through the final leg of the post-Covid adjustment. But there are four important themes market participants will need to understand to navigate the short and medium term successfully.

Find Out More

Post

Infographic: Key macroeconomic risks impacting global real estate performance

Continued economic growth will help stabilise commercial real estate yields and values before pricing slowly begins to recover next year. We expect global all-property total returns to average 5.3% per year over 2024-2025 in our baseline scenario. However, there are still upside and downside risks that real estate professionals should watch out for. In this infographic, we outline these risks and their impacts on property value.

Find Out More