BoJ likely to end zero interest rates in autumn

As expected, the BoJ maintained its policy rate at 0%-0.1% at Friday’s meeting. With more confidence on the ongoing wage-driven inflation dynamics and a strong appetite for policy normalisation, the BoJ looks more likely to end its zero-interest rate policy in the autumn.

What you will learn:

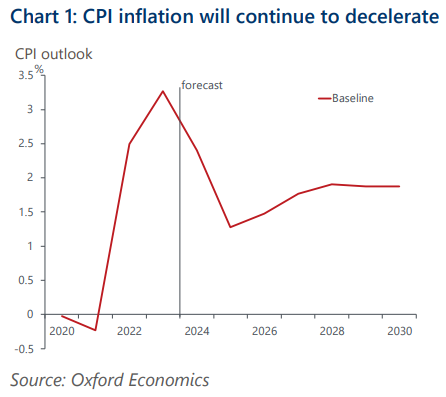

- The median CPI (excluding fresh food and energy) forecast in the Quarterly Outlook Report was unchanged at 1.9% for FY2024 and 2025. The figure for FY2026 was 2.1%, showcasing the BoJ’s confidence that it will achieve the 2% inflation target in coming years.

- The BoJ has increasingly stressed that monetary policy is data dependent. The wage settlement for SMEs at the Spring Negotiation continues to provide upside surprises.

- Assuming the recovery in real incomes and consumption is confirmed in the summer, the BoJ will likely raise its policy rate, arguing that the probability of meeting the 2% target has risen.

- We still project that the BoJ will cautiously raise its policy rate to 1% by 2028. The risk that 1% won’t be reached is also still significant due to the huge downside risks in the medium-term price outlook, especially the sustainability of wage rises and SMEs’ pricing power.

Tags:

Related Posts

Post

Japan’s on course for July rate hike, but risk of June increases

The Bank of Japan (BoJ) kept its policy rate at 0.50% at Wednesday's meeting, as expected. Despite a marginally higher increase in pay than last year at the first round of the spring wage negotiations, our baseline view is for the BoJ to hike its policy rate only gradually due to concerns about the capacity of small firms to raise wages and the lacklustre rate of consumption.

Find Out More

Post

Japan’s supply-driven food inflation to persist longer than expected

We have revised our CPI forecast upwards for this year and next, due to more persistent supply side-driven food inflation, led by soaring prices of rice. Despite the significant revision to the short-term inflation path, we don't expect the Bank of Japan (BoJ) to react with a rate hike.

Find Out More

Post

Japan’s older households to support spending under higher rates

The resilience of consumption is essential to support sustained wage-driven inflation and the Bank of Japan's rate hikes. We see little risk of spending faltering due to the projected gradual rate hikes to 1% because the ageing of society has made households' balance sheets less vulnerable to rate increases.

Find Out More