United States: Look for a low-confidence vote from the Fed

The Federal Reserve will likely signal next week that its confidence that inflation is on a sustained path to 2% has been diminished and that it is prepared to leave interest rates at current levels until it sees clear signs disinflation is back on track. We pushed the first rate cut in our baseline to September and reduced the number of rate cuts in our forecast for 2024 from three to two.

What you will learn:

- We think the Fed will announce next week that it will start slowing the pace at which it is reducing its balance sheet later this quarter. Solid April tax payments and fewer Fed redemptions of Treasury securities will allow the Treasury to keep auction sizes at current levels after three quarters of substantial increases.

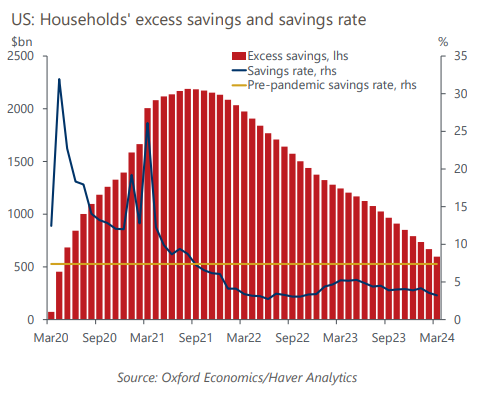

- While the headline for Q1 GDP surprised to the downside, the underlying details were solid. The GDP report and the March personal income and spending data showed consumers continuing to spend at a solid clip. Consumers have been depleting remaining excess savings at an accelerated pace, but solid household balance sheets make the low savings rate less of a concern.

Tags:

Related Posts

Post

Policymakers singular focus adds to rate cut uncertainty

Our baseline forecast for policy rates is consistent with central bankers continuing to focus almost exclusively on inflation. Their laser-like inflation focus and higher-for-longer bias are understandable after such a large and sustained inflation overshoot. But once inflation is firmly back at target and this bias reverses, it will eventually be a key source of downside risk to our policy rate forecasts.

Find Out More

Post

United States: Student loan payments are less concerning going forward

Despite last summer's US Supreme Court decision, the Biden administration has forgiven $153bn in student loan debt through piecemeal actions. This, combined with a new, more generous income-driven repayment plan and a yearlong grace period following the end of the pandemic-era pause on student loan payments, has reduced the amounts borrowers in the aggregate are paying back to the Department of Education.

Find Out More

Post

UK : The everyday economy matters to local economic performance

The everyday economy generates half of all UK employment and 33% of GVA but is often dismissed because it generates less growth than high value services and has low productivity. But indirectly it has the capacity to improve the competitiveness and performance of local economies and has been identified by Labour Party leaders as a sector to focus on, if they win the election.

Find Out More