Research Briefing

| May 17, 2024

China’s overcapacity ‘problem’ in five charts

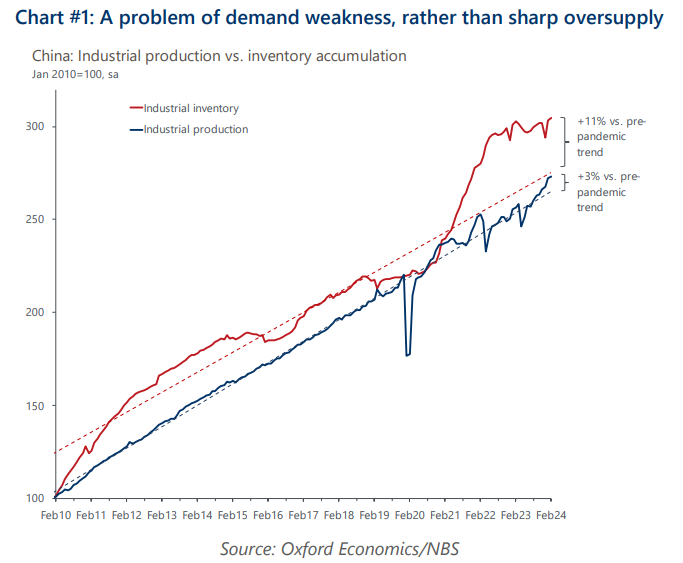

We find emerging, but not overwhelming, macro proof to support the recent geopolitical narrative of excess Chinese goods production that unfairly undercuts global manufacturing competitors on price.

What you will learn:

- Without compelling evidence in the data, there is likely no impetus for authorities to adopt meaningful course-corrective measures to rein in any perceived excess capacity problems zeroed in by Western trading partners anytime soon.

- Obviously, given the soft patch in onshore demand, and a production-driven stimulus approach, China’s industries are likely to exhibit relative cyclical oversupply in the near term.

- Sector-related data suggests that excess capacity risks remain confined within several industries with known idiosyncratic trends at play.

- The contentious ‘new three’ industries underscore China’s export dependency, and global import reliance. Optimists might point to the longer-term global demand fundamentals that support an industrial ramp-up in these areas, although it is unclear if that outweighs the risk of deflation and the associated job losses from persistent unprofitability in pockets of these industries.

Tags:

Related Posts

Post

Trump’s tariffs will likely exacerbate the slowbalisation globally

We expect Trump's tariffs will reduce global trade values by more than 7% by 2030 compared to our pre-election forecasts.

Find Out More

Post

China Key Themes 2025: A policy-driven, half-full glass economy

Deflationary risks are the biggest concern for Chinese economy in 2025.

Find Out More

Post

January poses a triple threat to US imports

January poses a triple threat to US imports

Find Out More