Research Briefing

| Jun 17, 2024

Chartbook: The largest US warehousing and logistics metro markets will lead the sector’s revival over the medium term

The industrial sector has delivered higher returns than all other property types over the last few years. We forecast that this trend will continue despite the recent contraction in the warehousing sector. In our latest US Metro Logistics Chartbook, we uncover:

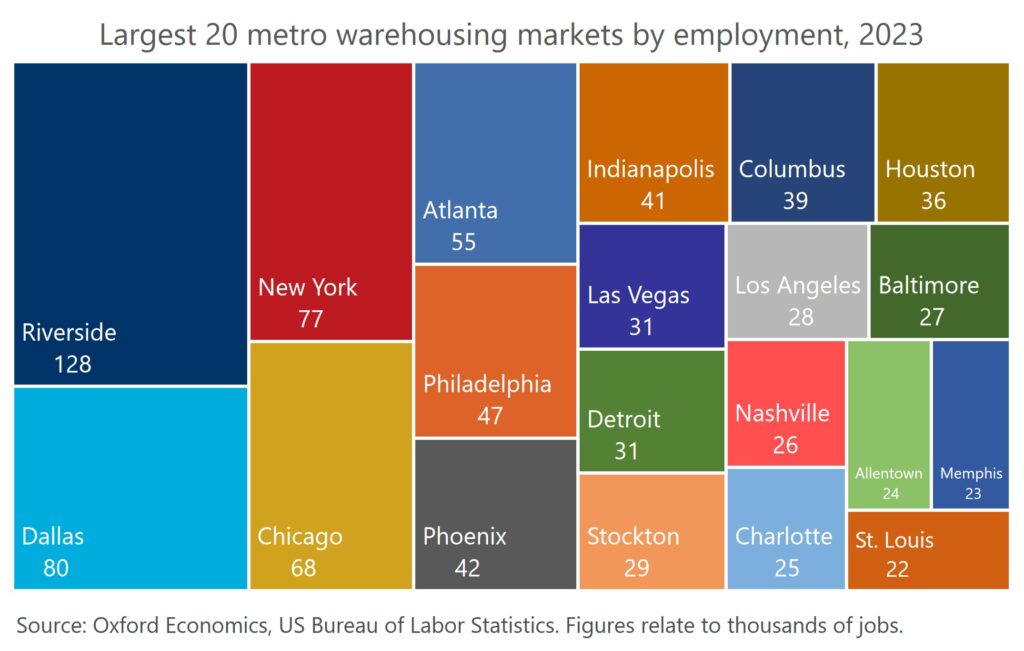

- Scope of sector: In 2023, the US warehousing and logistics sector contributed $249 billion to GDP and employed 3.7 million people. By 2028, the sector is projected to contribute $270 billion to GDP and employ 3.9 million people.

- Construction and investment trends: Warehousing construction spending soared between 2020 and 2022, but the pace slowed in 2023 and Q1 2024 as the sector corrected for the previous over-expansion.

- Growth leaders: Indianapolis, Phoenix, and Riverside will see the fastest warehousing job growth amongst the largest markets over the medium term (2024-28). Austin will be a growth leader amongst the smaller markets.

- Sectoral risks: The logistics sector faces several risks, including labor shortages, geopolitical issues, increased onshoring of logistics, and climate and environmental changes.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights