Research Briefing

| Mar 28, 2024

South Korea’s Construction Outlook, March 2024

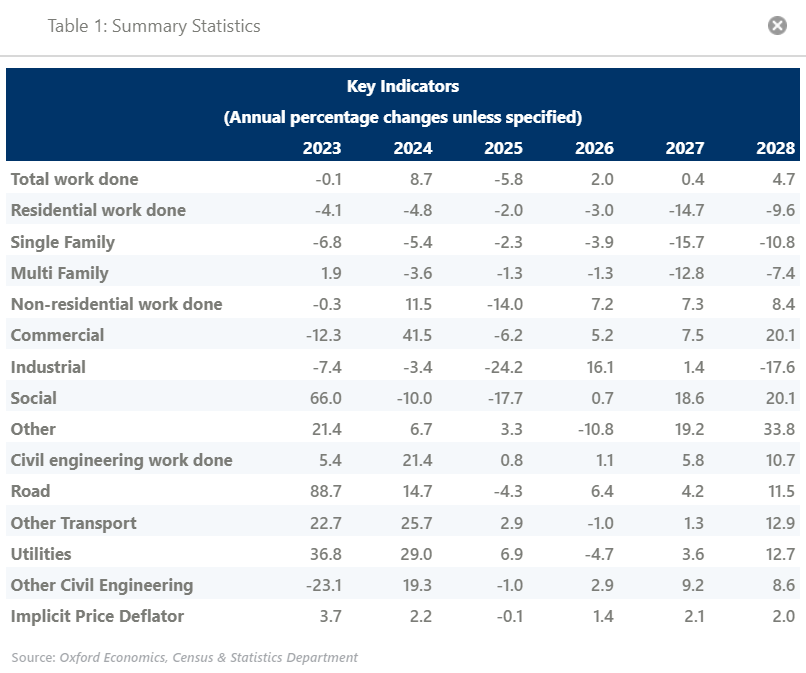

Total construction work done is forecast to expand 8.8% in 2024 after falling 0.1% last year. Demand for construction came in lower than expected in late 2023, weighed down by uncertainty around global growth, still heightened interest rates, and weakened business confidence. Construction activity this year will be boosted by falling interest rates, with the Bank of Korea expected to begin rate cuts in Q2 as inflation falls towards the target of 2%. We expect work done to climb an average 1.8% p.a. over the four years to 2028.

What you will learn:

- Residential building work done is forecast to fall a further 4.8% over 2024 after declining 4.1% in 2023. Tight credit conditions will continue to restrain demand over the short term, while poor demographics weigh on the long-term outlook. The government’s commitment to homebuilding projects will provide some support to building activity over the forecast horizon.

- Non-residential building work done is set to surge 11.5% over 2024, following a slight contraction of 0.3% in 2023. Key support will come from the commercial building and ‘other non-residential’ subsectors. The commercial sector will continue to benefit from the revival in consumer spending as international travel restrictions are eased and a rebound in semiconductor exports. Despite the strong recent performance of semiconductors, demand for industrial building will slump as developers remain cautious amid uncertainties about global growth.

- Civil engineering work done is forecast to shoot up 21.4% over 2024, building on the 5.4% growth posted last year. Work on several ongoing rail, port and power generation projects will continue to bolster growth in the near term. Activity over the medium term will be driven by the announced expansions to the railway network, major energy generation projects, several major airport developments and port redevelopment projects.

Tags:

Related Posts

No Posts Added