The bullish structural case for gold

In light of the recent consolidation period, we think there is still time to capitalise on the gold price upswing that started in Q4 last year.

What you will learn:

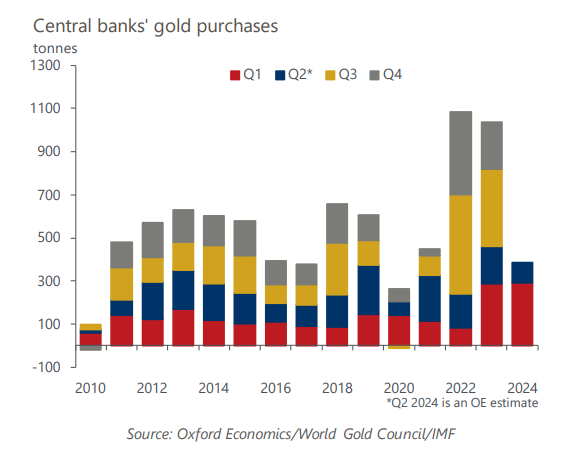

- Strong structural demand forces have created an extremely supportive environment for gold, with buying from emerging market central banks, Chinese consumers, and money managers.

- As a result, we continue to see bullish fundamentals ahead and expect gold prices to trade above US$2,500/oz by mid-2025.

- The People’s Bank of China (PBoC) has been the largest gold buyer since 2022, stockpiling more than 300 tonnes of gold before halting its purchases in May. We see upside risks to gold should the PBoC continue buying at the same pace as in 2023, with scope for the price to hit US$3,000/oz by end-2026.

Tags:

Related Services

Service

Industry and Product Market Forecasting

Oxford Economics helps you translate what the broader questions around key economic and sector trends, risk, technology disruptors, as well as policy and regulatory changes mean for your organisation. Our models and forecast datasets can be customised to fit your unique needs, helping you quantify key correlations for sales and market demand forecasting and more generally support your overall decision-making process.

Find Out More

Service

Global Commodity Service

Monthly reports on commodity price trends and forecasts, as well as weekly briefings on the latest price action.

Find Out More

Service

Pricing and Cost Service

Monthly reports on commodity price trends and forecasts, as well as weekly briefings on the latest price action.

Find Out More