Blog | 16 Jul 2024

Could the election spark renewed interest in UK-focused stocks?

The UK election has concluded with Labour securing a landslide victory. This result is likely to set the stage for a period of political stability and, combined with signs of a consumer-driven economic recovery, makes domestic-focused UK stocks increasingly attractive. For asset managers and investors looking to optimise their equity strategy, this could be the time to revisit these stocks, particularly the FTSE 250.

Labour’s win: what it means for the UK economy and market

Firstly, it’s important to note that we don’t expect the UK’s economic outlook will significantly change following Labour’s landslide election victory. Our macro team’s modelling finds that the new government’s manifesto pledges will have a negligible impact on economic growth as the new tax and spending pledges are small in scale and fiscally neutral. The size of its majority means there is scope for Labour to pursue a more expansionary approach than its manifesto implies. However, even if the government tweaks the existing fiscal rules to allow for higher spending —our alternative scenario—our modelling suggests this will only result in slightly stronger GDP growth over the course of the parliament.

That said, the prospect of a period of political stability with a generally pro-business government may help to improve sentiment towards UK assets, which have been out of favour for years. As the UK investment landscape becomes more predictable, we expect a modest revival in flows to UK-focused ETFs, especially as political uncertainty is rising elsewhere.

More importantly, the Labour government is inheriting a nascent economic recovery, which is boosting domestic-focused UK stocks. In recent months UK activity data have surprised to the upside, despite disappointing in other regions, and we think this is likely to continue. Our macro colleagues forecast that the UK economy will grow by 1.1% in 2024 and 2% in 2025, compared to the Bloomberg consensus forecasts of 0.7% in 2024 and 1.3% in 2025.

A consumer-lead recovery offers trade opportunities

Following a tough period for UK consumers, we expect consumption to recover this year, leading the UK’s economic recovery.

Lower inflation will boost real household incomes over the next two years. While the lagged impact of past interest rate rises will continue to weigh on the recovery this year, lower interest rates will likely begin to offer support to growth next year. We expect the Bank of England to cut rates by 25bps in August and November and by another 100bps in 2025.

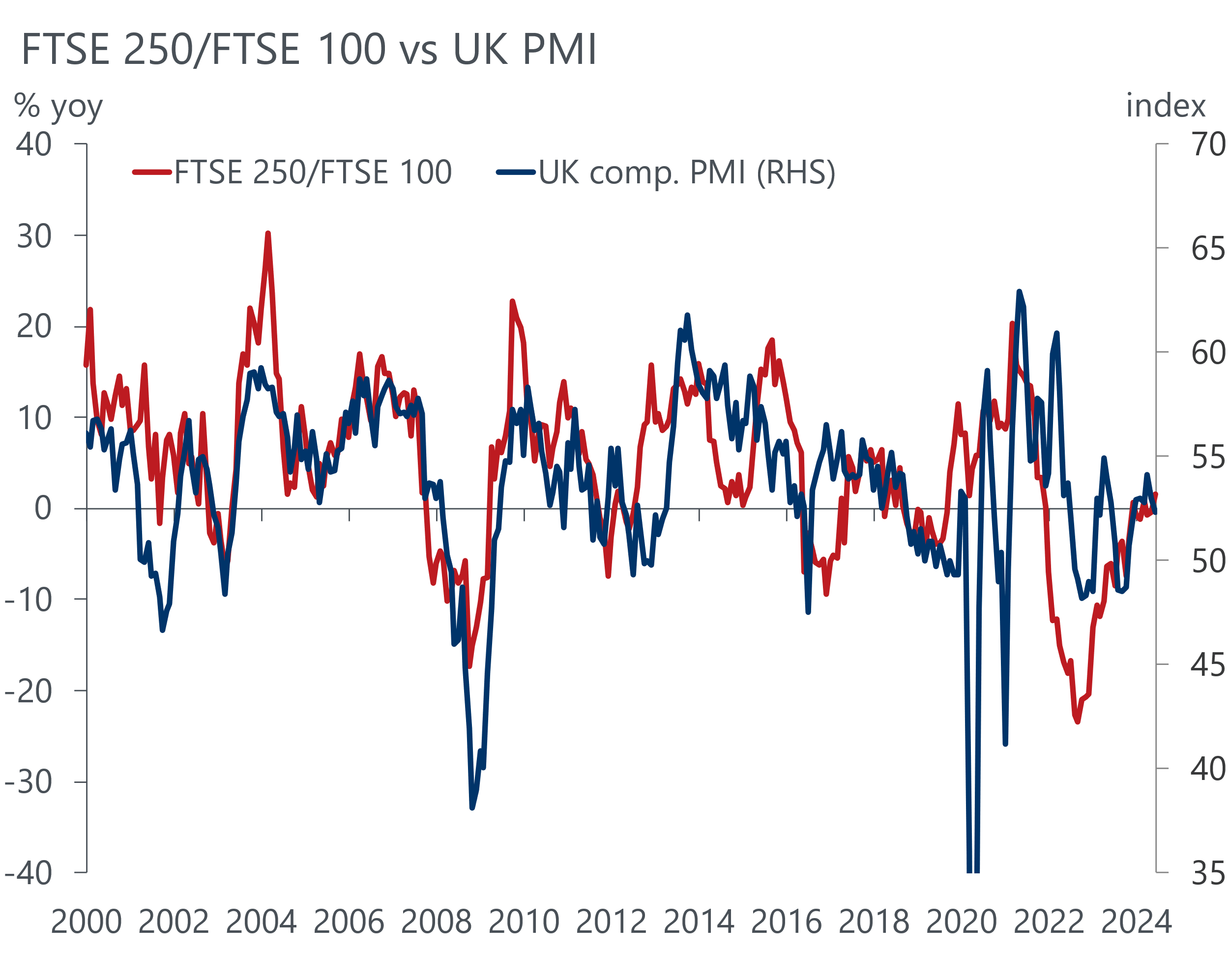

As domestic demand recovers, we should see a recovery in EPS growth for the more domestic-focused parts of the UK equity market, such as small and mid-caps. These companies have seen their profit margins squeezed over the past year as they have struggled to pass on rising costs, against a backdrop of weak demand. Our forecast suggests they are now through the worst, which is consistent with recent business surveys that show CFOs expect margins to increase over the next 12 months.

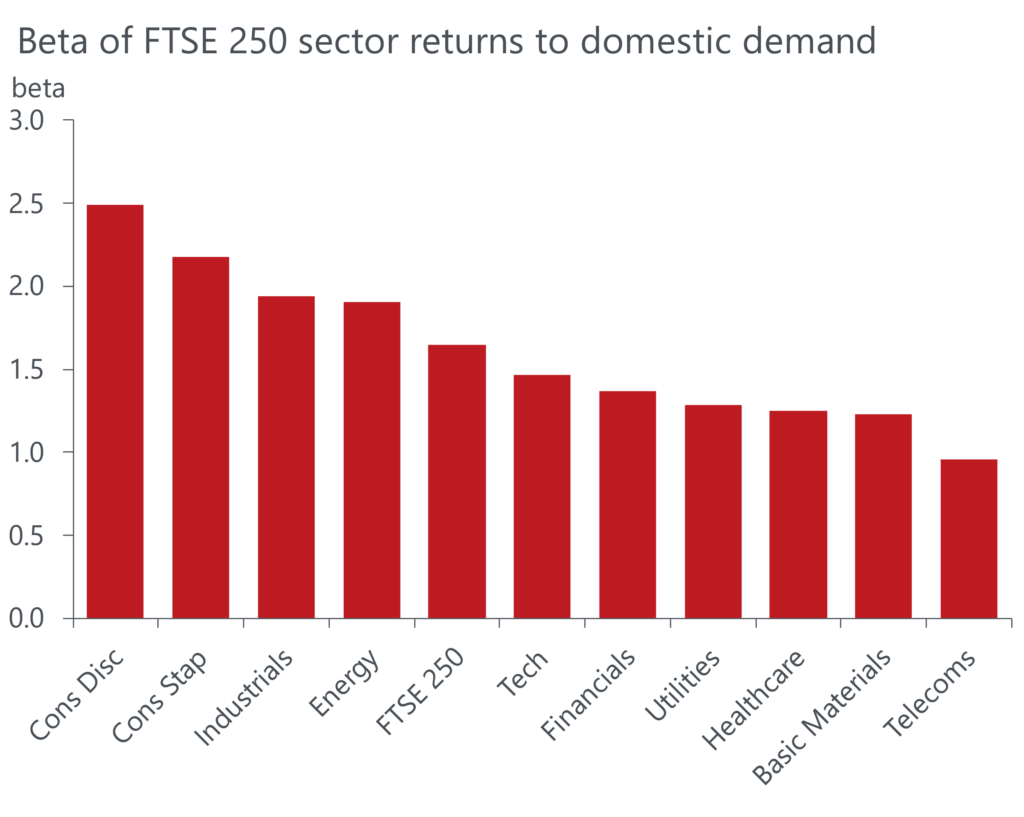

The mid-cap consumer discretionary sector is likely to be a key beneficiary of the domestic recovery. Almost two-thirds of the sector’s revenues are generated within the UK and the sector has a high beta to domestic demand growth. Recent retail sales data have been volatile, but paint the picture of a consumer sector which is gradually recovering. A steady improvement in consumer confidence is a positive sign, suggesting scope for a move away from the extremely high rates of saving seen in recent quarters. This supports our view that we are likely to see a solid consumption recovery in H2 2024 and 2025.

On a sectoral basis, homebuilders may benefit from the new government’s plans to reform the planning system and increase the supply of affordable housing. However, our Cities and Regions team argue that this will be easier said than done and do not expect plans to profoundly reform the market. In addition, housebuilder stocks have rallied sharply since Q4 last year and appear to already be pricing in a recovery with relative PE multiples well above their 10-year range. This could limit their returns in the near term unless consensus expectations are well exceeded. In contrast, other parts of the mid-cap consumer sector such as personal goods, media, and retail remain cheap compared to historic norms and may be better placed to outperform alongside a consumer recovery.

Sign up for our asset management newsletter

Get our latest insights straight to your inbox.

Disclaimer

Analysis and information provided to clients by Oxford Economics through its macro strategy services is for research purposes only and does not constitute an offer to sell or buy any security or a recommendation to do so. Research and publications provide information and analysis that Oxford Economics believes to be accurate and are published with the understanding that neither the analyst nor Oxford Economics are providing investment advice; anyone who needs investment advice should consult an investment professional.

For audiences based in Mainland China: by clicking “Submit”, you have read, understand and agree to our Privacy Policy. This includes the transfer of your personal information outside of the jurisdiction in which you are located.

Author

Daniel Grosvenor

Director of Equity Strategy, Macro Forecasting & Analysis

+44 (0) 203 910 8106

Private: Daniel Grosvenor

Director of Equity Strategy, Macro Forecasting & Analysis

London, United Kingdom

Daniel is an equity strategist, responsible for developing our equity views across countries, sectors and investment styles. He joined Oxford Economics from HSBC, where he spent a decade working within their global equity strategy team, in both London and Hong Kong.

Andrew Goodwin

Chief UK Economist

+44 (0) 20 3910 8013

Andrew Goodwin

Chief UK Economist

London, United Kingdom

Andrew Goodwin is the Chief UK Economist at Oxford Economics. He is responsible for Oxford Economics’ UK macroeconomic forecasting and analytical content. Andrew regularly comments on the UK’s economic outlook in print, online and broadcast media. Andrew has been with Oxford Economics since August 2008.

Before joining Oxford Economics, he spent three years working for Experian, where he managed the Regional Planning Service and produced UK macroeconomic forecasts from the national level down to local authorities. Before joining Experian, Andrew spent four years as a senior economist at the Confederation of British Industry (CBI).

Tags:

You may be interested in

Post

Labour’s plan to build more homes is encouraging, but do not expect it to profoundly reform the market

At the top of the Quality of Life category are cities with lower inequality and residents that live long lives. Most of these cities also provide residents with access to a wide range of recreation and cultural amenities. They tend to be smaller than the leading cities in the Economics or Human Capital categories, and every city in the top 10 is located in Western Europe, bar one in Australia.

Find Out More

Post

UK General Election: Why Labour and Tory manifestos are a missed opportunity

Join Andrew Goodwin, Chief UK Economist, as he outlines the potential economic impact on fiscal policy of the manifestos published recently by the Conservative and Labour parties.

Find Out More

Post

UK Elections | Beyond the Headlines

In this week’s Beyond the Headlines, join Andrew Goodwin, Chief UK Economist, as he outlines how we’ve changed our UK interest rate forecast after a busy week for the UK economy.

Find Out More