Asia Pacific: Summertime blues foreshadow the slowdown

Four themes have dictated Asia’s macroeconomic outlook over the summer and are likely to continue to exert an influence over the rest of the year and into 2025, in our view.

What you will learn:

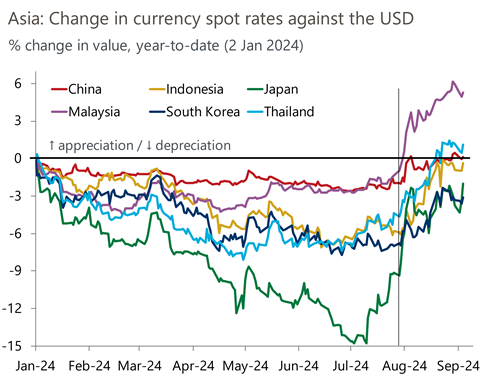

- The first is the financial market volatility we saw in early August that has resurfaced this week. Among other concerns, worries are building that growth in the US could slow by more than what financial markets had discounted, and that the Federal Reserve may have waited too long to cut rates and slipped ‘behind the curve’. We look at how that could affect Asia.

- Second, we have now received Q2 growth data from across Asia. While not apparent from year-on-year numbers, a closer look indicates that the growth slowdown may already be upon us. What’s more, it looks unlikely that aside from the current boost from AI, Asia has an engine of growth to rely on.

- Third, given a cut in the Fed Funds rate is imminent and that Asian central banks’ usual reaction is to follow the Fed, we ask will this time prove the exception? We think three central banks – India, Malaysia, and Thailand – are unlikely to be moved. We examine the reasons for the exceptionalism and the likely monetary stance in those countries.

- Fourth, in China the tussle between a structural slowdown and cyclical policy support seems to be going the way of the former. Growth in Q2 was worse than expected and a turnaround appears unlikely. Exports are doing well, but that strength is unlikely to endure.

Tags:

Related Posts

Post

China strategising for a second Trump term

US tariffs under a Trump presidency and a Republican-led Congress are a major concern for China. However, we expect additional US tariffs wouldn't be implemented until as late as 2026 and the effects could be mitigated early on by expansionary fiscal policy in the US.

Find Out More

Post

Asia maintains fiscal consolidation, but debt to fall slowly

Recently, Asian economies have looked to consolidate their fiscal balances as the need for counter-cyclical policy reduces.

Find Out More

Post

EV shift could pose a big challenge to Japanese economy

Amid the fast-progressing electric vehicle (EV) shift, maintaining high competitiveness in auto-related sectors and ensuring a smooth labour transition across industries are crucial for the growth of the Japanese economy. As auto production shifts towards EVs, which require different inputs from traditional internal combustion engine cars, parts suppliers will need to adapt to avoid losing market share to foreign players. Change in automotive supply chains would also require workers to move across different industries, a task particularly challenging for Japan.

Find Out More

Post

Japan – Next rate hike soon, but politics gets murky

The Bank of Japan's decision to maintain the policy rate at 0.25% today surprised no-one. Although the quarterly outlook report shows the economy is on track to achieve the 2% inflation target, the central bank is waiting for more data to confirm household income and consumption are recovering, and the US economy is on track for a soft landing.

Find Out More