Blog | 11 Sep 2024

Rising demand fuels surge in US data centre construction

Sebastien Tillett

Economist

The demand for data centres in the United States is rapidly increasing, driven primarily by the continued rise of cloud computing and the emergence of artificial intelligence (AI). As businesses and consumers generate more data than ever and AI requires greater computational power to train more advanced models, companies are investing heavily in building the infrastructure needed to store, process, and deliver this capability.

By understanding the growth trajectory of this subsector we can better assess the impact that emerging technologies like Generative AI will have on industries and the broader US economy. Since July 2024, the US Census Bureau has published data centre construction spending and the early results align with our analysis of the sub-sector globally. To support this, we now include a forecast for data centres as part of our US Construction Service.

Understanding data centre growth

One of the primary drivers of the surge in data centre construction is the massive increase in data consumption. Cloud computing has become an essential service for businesses of all sizes, allowing them to scale their operations quickly and efficiently. The growing reliance on remote work and digital collaboration tools has accelerated the demand for cloud services. This, in turn, requires more data centres to manage the storage and processing needs of companies across industries.

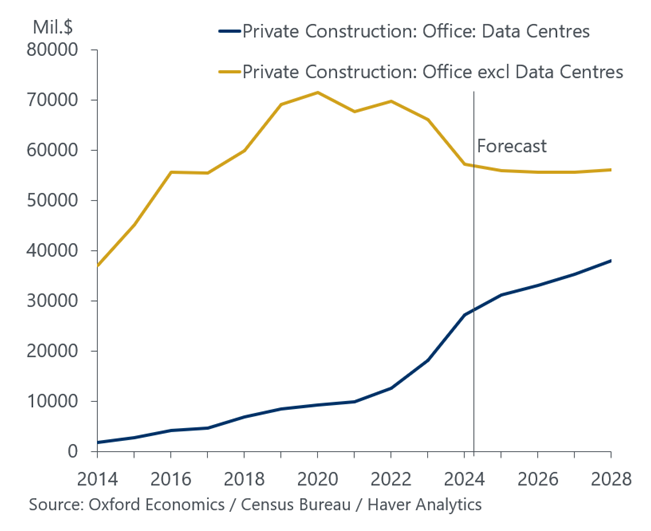

To illustrate just how large this change has been, we can look at the shifting share of overall office construction spending since 2014. Figure 1 highlights how data centre construction has risen considerably over the previous decade against a backdrop of falling office spending. This becomes even more pronounced after the Covid-19 pandemic when US office real estate has taken a large hit. In 2014, data centres only accounted for roughly 5% of spending whereas now they represent almost a third (32%). We believe data centre construction will continue to eat into the total share of office construction, approaching 40% by 2028.

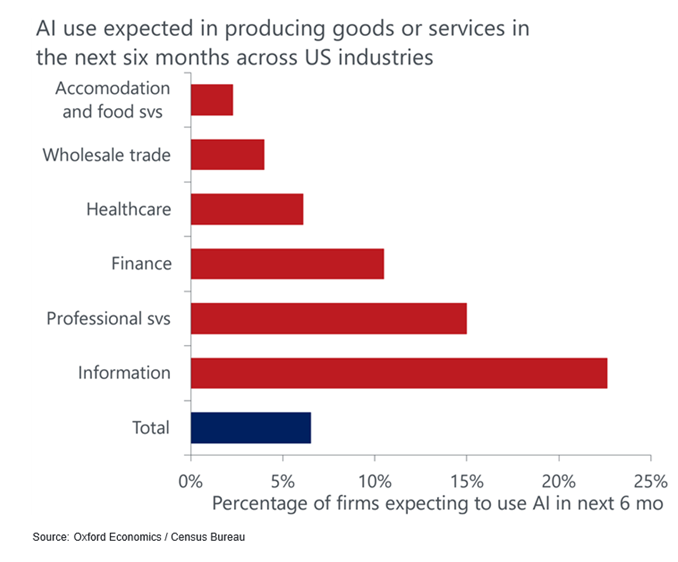

AI and machine learning is also playing a critical role. According to US census survey data, 7% of firms across all industries plan to use AI in the production of goods and services in the next six months (Figure 2). This is borne out by the construction statistics since Q1 2021, a year before ChatGPT was released, that show construction spending on data centres was more than 250% higher while office spending was down by around 15%. Data centre providers are attempting to catch up on demand and this trend is likely to continue, considering the resource heavy method of training models currently in use, as well as the need to process more and more queries.

Challenges in the Sector

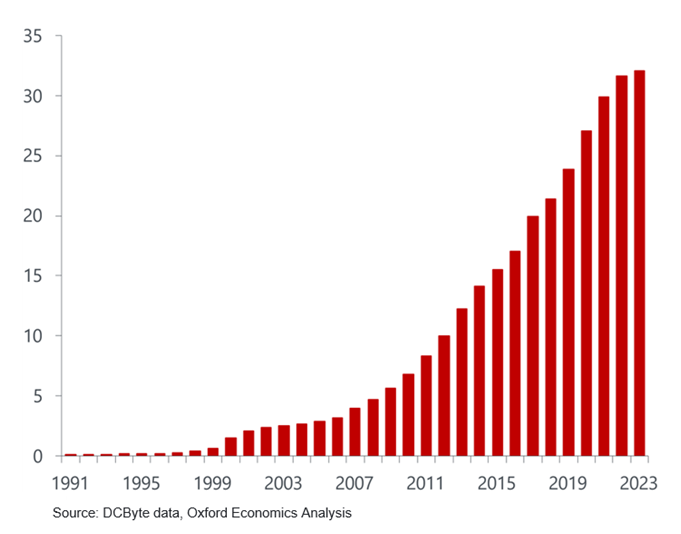

One of the biggest concerns to data centre growth is energy consumption. Data centres require massive amounts of electricity to operate, and as more facilities are built, concerns over their environmental impact are growing. Global IT power capacity of data centres is estimated to be around 32 gigawatts as of 2023, equivalent to around 1% of the global electricity supply (Figure 3). The downside risk to construction spending is that governments cut back on planning permissions for these projects to bolster their environmental credibility, thus slowing down spending.

Nevertheless, power generation and transmission need to keep in lockstep with the sector energy demands to enable continued growth. Given the strategic importance of this sector and pressure from companies with the largest stock caps in the US, it is unlikely that growth will be stunted in the short term and longer-term opportunities beckon.

As digital transformation accelerates, the demand for data centres in the US will continue to grow. These facilities will play a crucial role in powering the next generation of digital services and innovations, ensuring that the US remains at the forefront of economic growth.

Author

Sebastien Tillett

Economist

+44 748 026 7287

Sebastien Tillett

Economist

London, United Kingdom

Sebastien joined Oxford Economics in 2023 as a graduate working across freight and transport advisory consulting. His main area of experience is in providing data analysis on projects within the maritime/trade and transport industries.

Prior to working at Oxford Economics, Sebastien had technology roles at AMP and Macquarie Bank before completing a Master of Economics.

Tags:

You may be interested in

Post

AI and the US economy – Minor gains now, but future benefits

The impact of AI is highly visible in some segments of the economy but barely seen in others, leaving the net effect on productivity, employment, and GDP as negligible at best.

Find Out More

Post

Buckle up: Trump era brings economic uncertainty to cybersecurity

Senior Editor Teri Robinson spoke with Chief US Economist Ryan Sweet about the what the second Trump administration will mean for cybersecurity, including the shifting responsibilities of defenders the safety of critical infrastructure, and the rise of AI.

Find Out More

Post

GenAI productivity gains will skew towards services

Productivity gains from the use of Generative AI (GenAI) and other similar technological advancements are set to boost medium-term economic growth, but the gains will be spread unevenly across sectors.

Find Out More