Research Briefing

| Sep 18, 2024

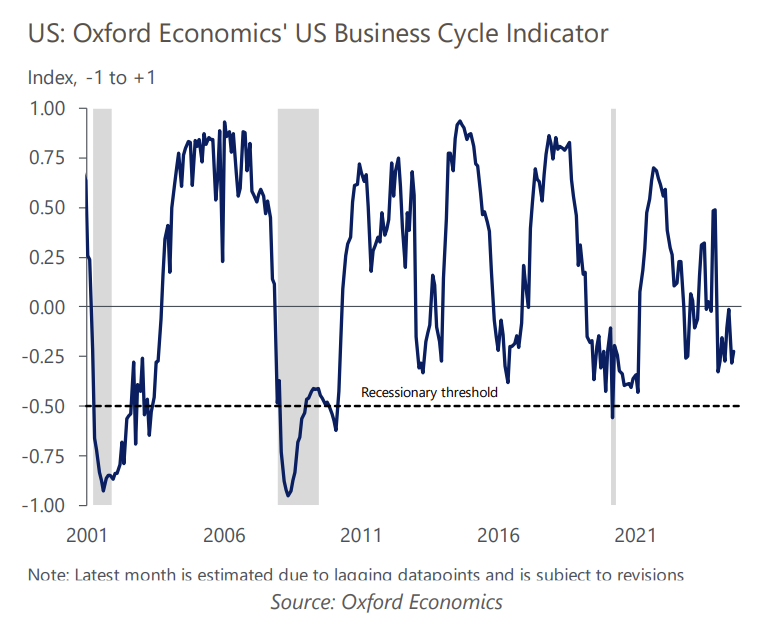

US Recession Monitor – Hear no recession, see no recession

Recession alarm bells should sound a bit muted with an encouraging employment report, solid gains in retail sales, and a rebound in industrial production easing fears of an economy on the precipice of a downturn. A soft landing is in sight but will require cutting interest rates.

What you will learn:

- The consumer remains a pillar of strength within the economy, and there are plenty of reasons to believe they will continue to spend at a decent clip. Lower mortgage rates will allow homeowners to tap into home equity while decelerating inflation will boost real disposable income.

- Absent a marked pullback in consumer spending, the risk of a cycle of layoffs, lower consumer spending, and additional layoffs is limited. We anticipate the unemployment rate rising only 0.2ppts from its current levels as solid corporate profit margins keep layoffs relatively low.

- Our probability of recession models moved mainly sideways in August. While increasing in recent months, odds are still below the historical threshold that would justify considering a recession in our baseline, and these odds are still lower than they were a year ago.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Tech Spend Forecasts

Plug into success with unparalleled IT spending market intelligence

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More