Risks to US industry from election skew to the downside

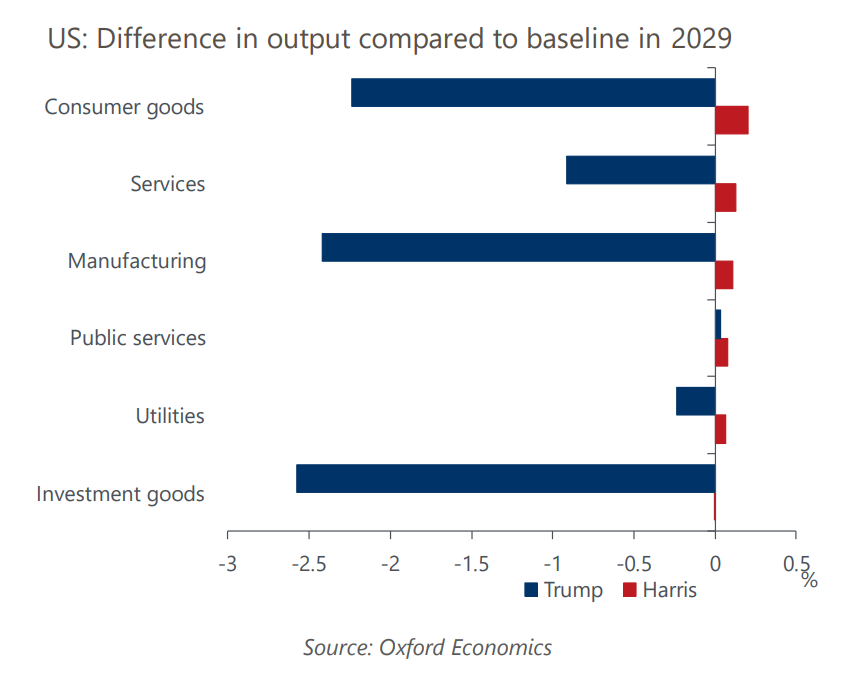

Analysis of potential US election outcomes—using tailored industry scenarios available as part of our Global Industry Service—shows that risks, particularly for manufacturing, range from firmly negative to marginally positive in the various plausible post-November policy trajectories. Our baseline forecast is for some form of divided government that will not alter the current trajectory of industrial growth. If either side achieves a governing trifecta and fully implements its agenda there are, however, differences: the growth consequences are mostly negative under former president Trump and mostly positive (albeit very marginal) under Vice President Harris.

What you will learn:

- Under our Democratic trifecta scenario, consumer facing sectors are the biggest beneficiaries as Harris’ economic plan is focused on supporting household through higher social spending. Her plan for expanding the child tax credit, lower cost for prescription drug, education, and childcare, and affordable housing initiatives will boost consumers’ purchasing power, which will have the effect of boosting overall GDP mildly and, by extension, demand for US-made goods.

- Meanwhile, our recalibrated Trump scenario shows manufacturing sectors, including electrical engineering, mechanical engineering, and metal products, will be among the hardest hit. The repeal of the clean vehicle tax credits in the Inflation Reduction Act (IRA) affects industries in EV supply chains, but a repeal of other clean energy tax credits has been removed from previous versions. The largest impact on US industry would come from weaker domestic demand shaped by policies on tariffs, immigration, spending, and the resulting monetary response.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US Tech Spend Forecasts

Plug into success with unparalleled IT spending market intelligence

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More