Research Briefing

| Oct 11, 2024

The US consumer will remain a pillar of strength

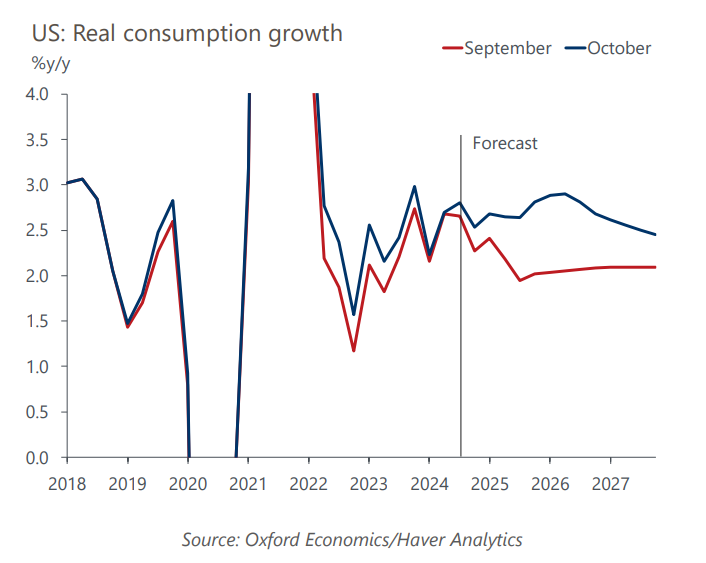

We are significantly raising our forecasts for consumer spending growth over the next few years. We expect real consumption growth to accelerate to 2.7% in 2025, up from our previous forecast of a slowdown to 2.1%.

What you will learn:

- We remain upbeat about the outlook for real disposable incomes. The labor market is likely to remain resilient, while strong productivity growth will keep inflationary pressures muted. With revisions showing the saving rate at a healthy level, the strength of income growth will flow into stronger consumer spending.

- The rise in housing equity, together with falling interest rates, is a key upside risk over the next few years. If households were to spend just one cent for every dollar rise in housing wealth since the pandemic, the boost to consumption would be $150bn or 0.8%.

- Conflict in the Middle East and the election are the main downside risks to our forecast. Significantly higher oil prices or tariffs on imported goods would hit households’ real incomes and cause consumer spending growth to slow.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More