Research Briefing

| Oct 16, 2024

Global: Revisiting the global impact from a slowing China

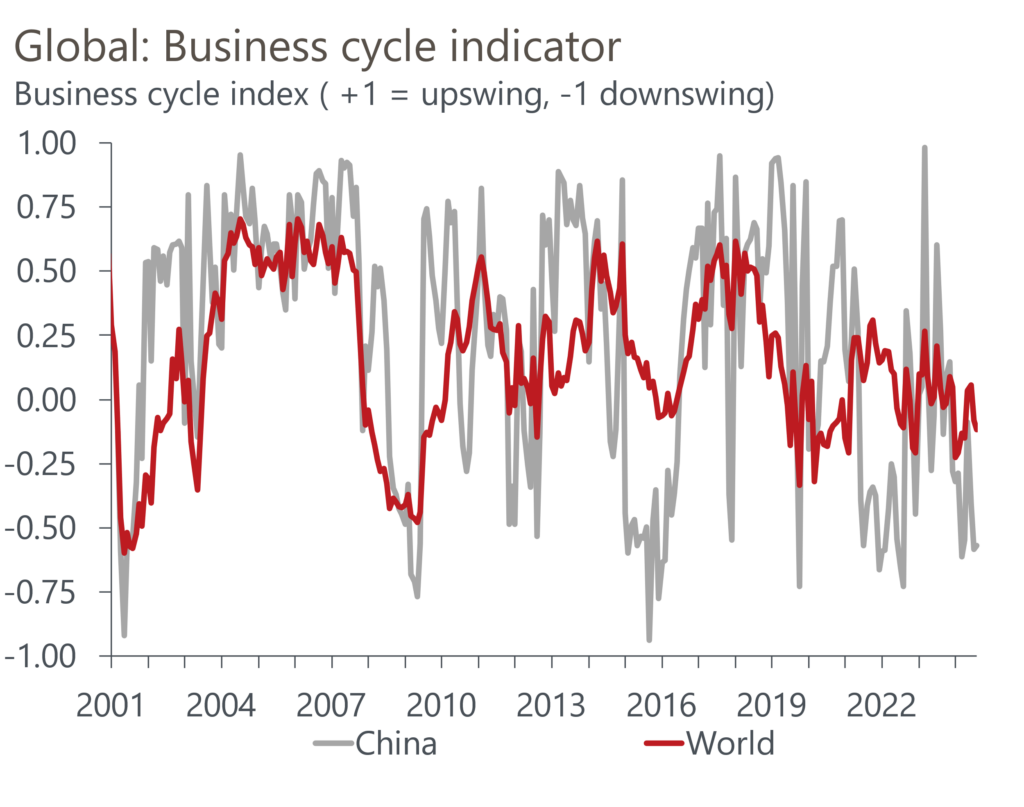

China’s economy looks to have entered a marked downturn. Cyclical trends in China are always tricky to assess given the ‘smoothing’ of official data, but one clear signal that the economy is struggling is the recent stimulus package announced by the authorities – policy moves can often be revealing about underlying trends in China.

What you will learn:

- Recent policy moves and our proprietary indicators suggest that China is suffering a marked economic downturn. If China’s growth undershoots our forecasts, our modelling suggests that the global effects could be significant, depending on the extent of financial spillovers.

- To assess the potential impact, we created three scenarios based on different degrees of financial spillovers and different policy responses by the Chinese authorities. In all cases, the biggest effects are on economies that have deep trade links to China, followed by exporters of China-sensitive commodities.

- A scenario with high financial spillovers would lead to a 1% cut to world GDP by 2026, while a lower spillovers scenario drags world GDP down 0.7%. This could be further reduced by strong fiscal policy action by China.

- In the severest scenario, the GDP of South Korea, Taiwan, and Vietnam is reduced by around 1% by 2026 compared to our baseline, while the GDP of commodity exporters like Russia, Brazil, and South Africa falls 0.5%. The smallest effects are on advanced economies, especially the US due to its low trade and financial exposures to China and its neutral commodity exposure.

Tags: