Five key commodity trends to watch for in 2025

By Stephen Hare, Kiran Ahmed, Diego Cacciapuoti and Samuel Bakst

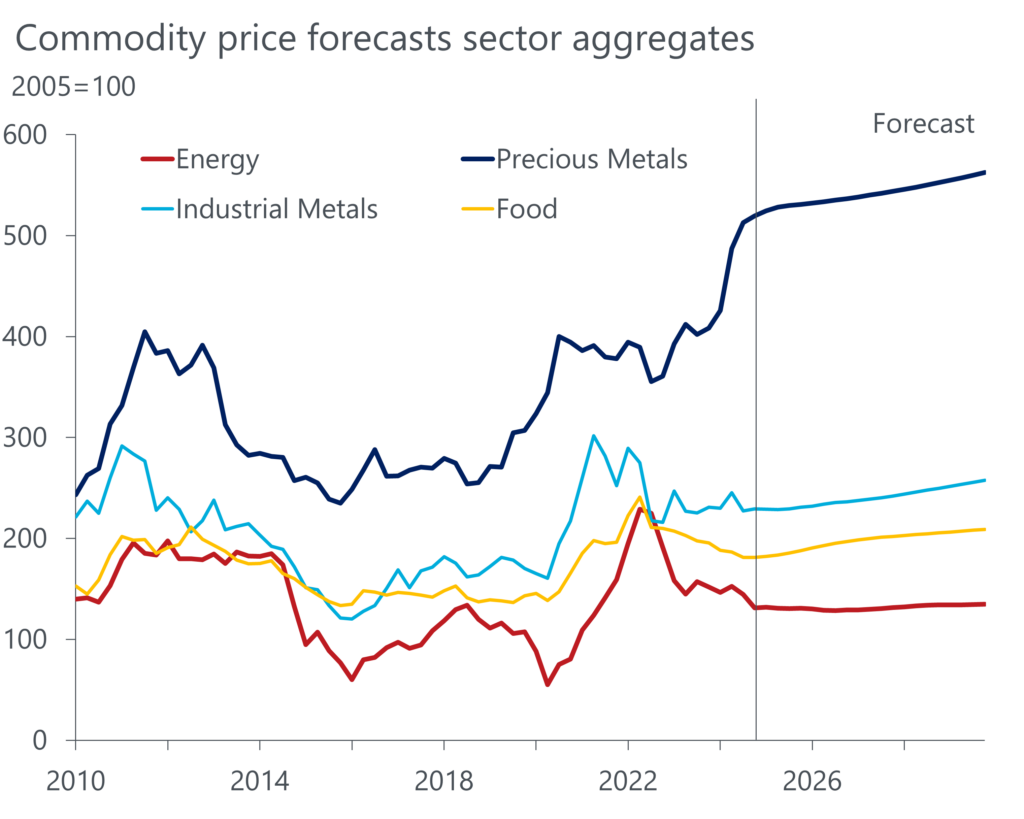

- Commodity prices have plunged this year, and investment banks are slashing their forecasts for 2025, but we see a more nuanced outlook.

- In this blog, we explore five key themes facing commodity markets in 2025 and discuss the outlook for supply, demand and prices.

Demand has been weaker than investors anticipated in 2024, especially in China, albeit broadly in line with our own more bearish expectations. Strong supply from commodities such as wheat, steel, and crude oil has also weighed heavily on prices and contributed to inventory build. The exception has been gold, with central banks driving its price higher and making it a bright spot for the whole sector.

Looking into the next 12 months, we see a more nuanced outlook for commodities market. Here are the five key commodity trends to watch for in 2025.

1. OPEC+ dilemma will see supply increase next year

Weak demand has driven oil prices, while robust non-OPEC supply growth has mostly offset OPEC’s production cuts. Consequently, OPEC+ has delayed production increases and is unlikely to lift supply in the last months of 2024. The group’s dilemma is whether to continue withholding production, lose market share, or increase output and suffer reduced prices and margins. Overall, we expect OPEC+ will start increasing production next year, so long as prices don’t deteriorate further. The group will provide a key area of supply growth next year while US supply growth slows.

Global oil demand has been disappointing, and we anticipate a similar level of global economic growth in 2025: solid but unspectacular. China has been the principal point of market weakness, while lacklustre industrial and construction activity has also squeezed oil demand. In the US, gasoline inventories, a key measure of oil demand, are above their long-run seasonal levels. Demand for vehicle fuel in developed countries will see a long-term decline as consumers transition to EVs, a headwind to demand and prices. Accordingly, we think Brent crude could fall further as weak market sentiment continues.

Unlock exclusive economic and business insights—sign up for our newsletter today

2. Natural gas will have a boom year driven by demand

This year prices in the natural gas markets remained subdued due to strong production and record high levels of gas in storage helping to temper prices. Looking ahead we see the expiration of the Russia-Ukraine five-year pipeline deal at the end of this year, extending the continent’s supply risk culminating in greater demand for liquified natural gas (LNG). US LNG will be its main source market as new LNG export capacity in the Gulf of Mexico comes online later this year. Prices in the US will be further supported by a surge in industrial demand as well as piped exports to Mexico.

3. Steel overcapacity will get worse

Steel prices have been bearish due to subdued demand and oversupply weighing on prices, which will persist next year. Domestic steel demand in China is poor as the steel-intensive property sector contracts. China’s steel supply has fallen this year, but not enough to rebalance the market and restore equilibrium as mills are reluctant to lose market share and have ramped up exports. Global steel markets, especially neighbouring emerging market economies, are flooded with cheap exports, leading to oversupply even in countries with tariffs on Chinese steel. Unfortunately, significant new capacity is coming online over the next two years, escalating the overcapacity problem.

Global manufacturing activity has also deteriorated this year, weighing on demand. Weak demand will persist into early 2025 due to the lagged impact of monetary tightening on spending. However, advanced economy central banks are reducing rates, which will encourage spending on capital-intensive sectors later in 2025. Consequently, global metal demand outside of China will slowly improve throughout 2025, which will offer some support to prices.

4. Gold will continue to shine

The Fed cut rates by 50bps in September 2024, and gold has been finding strong support from falling yields. Falling rates will decrease the opportunity cost of holding non-yielding assets like gold, stimulating investment demand in the form of exchange traded funds, which will push gold prices higher.

Strong demand from emerging market central banks has also created a supportive environment for gold. We think this is an attempt by some central banks to diversify their reserves away from the US dollar, with China the largest buyer accounting for more than 180 tonnes in the last two years.

While we believe there may be room for prices to consolidate temporarily, we keep our bullish view as gold fundamentals remain tight, with strong central banks’ purchases and demand stemming from falling Treasury yields that will push gold prices to continue to be one of the best-performing assets in 2025.

5. Grain prices will bottom out

Grain prices have fallen sharply this year, and the extent of the decline has surprised us and other analysts. However, prices are now starting to bottom out in line with our expectations.

The reason for weak price action this year is supply. Agricultural markets are well supplied, and we can see this in the stocks-to-use ratios. The soybean metric for 2024/25 will be at its highest level in 17 years on strong Brazilian harvests and weak demand. Similarly, the maize ratio remains at a high level for 2024/25. In contrast, the wheat metric continues to trend lower, pointing to a tightening market but it still remains at a comfortable level. Indian export restrictions had kept rice prices elevated despite good harvests, but the recent lifting in restrictions has seen prices plunge.

Rice prices are set to decline on an annual basis in 2025 reflecting the recent easing in Indian export restrictions. With regards other agricultural prices, we think rising fertiliser prices will put a floor under prices. Soybean prices will remain depressed in 2025, reflecting looser market dynamics. Prices for maize and wheat are expected to rise from current levels but will remain below 2021-2023 levels.

In 2025, the commodity markets are poised for significant shifts influenced by geopolitical developments, economic policies and global demand dynamics. To help professionals navigate the volatility, we have published our “Commodity Key Themes 2025” report, which delves into five events shaping the commodity market outlook.

The analysis and forecasts in this blog are backed by our Global Commodity Service, which offers insights into how shifts in market fundamentals—ranging from geopolitical tensions to monetary policy easing—could shape the commodity outlook. To make the most of our expert insights for your own analysis, request a free trial by clicking here.

Subscribe to our newsletters

Subscribe to our newsletter to get our insights straight to your inbox. Additionally, you can check ‘Talk to us’ box to have our team contact you about a free trial of our services and how we can support you.

Tags:

Related Reports

Ukraine-Russia ceasefire changes risk profile for commodities

We assess the implications and risks for our commodity price forecasts against the backdrop of a 'fragile' ceasefire in the Russia-Ukraine conflict.

Find Out More

Trump’s tariffs on Canada would raise regional commodity prices

A blanket 25% tariff on Canadian imports to the US could have a significant impact on commodity prices, squeeze profit margins of Canadian exporters and raise prices for US end-users.

Find Out More

Commodity Key Themes 2025: Expect market turbulence

The commodity markets are poised for significant shifts influenced by geopolitical developments, economic policies and global demand dynamics in 2025.

Find Out More

How China is reframing its Africa strategy

We think the impact of the stimulus announced by China on the prices of commodities exported by Africa will be limited. What matters more is China’s changing long-term strategy on the continent.

Find Out More