Nordics: Growing tailwinds to support a cyclical recovery

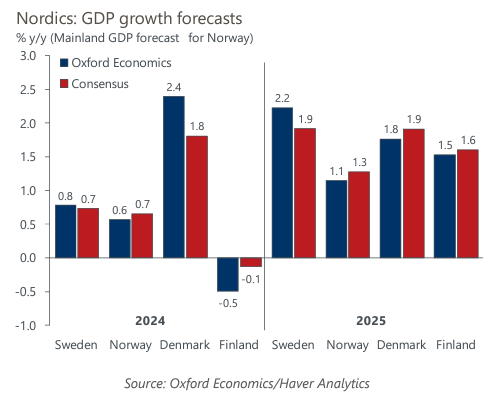

We expect growth across the Nordic economies to pick up in the near term, with quarterly growth in Sweden and Norway among the highest across advanced economies by late next year, driven by cyclical tailwinds and policy easing. Key downside risks relate to a larger weakening of the labour market than we expect and households saving rather than spending their income gains.

What you will learn:

- The key growth drivers are real income gains supporting consumption, improved confidence across sectors, and lower interest rates leading to higher investment. Monetary policy is becoming less restrictive, while fiscal policy will be expansionary in Sweden and Norway. The policy support together with cyclical tailwinds will support stronger growth next year.

- High inflation in the Nordics is over with the headline rate well below 2% for several months in all but Norway. Policy easing is well underway in Sweden and will be the fastest among all advanced economies. But Norges Bank remains focused on the last inflation mile, with a first rate cut in Q1 2025.

- We think the outlook for Nordic currencies will be determined by external events. Over recent years, these currencies flagged more on negative global news and appreciated less on good news. We expect them to rise over the medium term, although geopolitics and new supply side shocks present key downside risks.

Tags:

Related Services

Post

Norway and Sweden: Currency outlooks are gradually improving

We think that the Norwegian krone and the Swedish krona will hold on to their recent gains and appreciate further next year. Following significant volatility recently, a combination of fading domestic risks and favourable external developments will provide support for both currencies. Data surprises present the key risk.

Find Out More

Post

Nordics: Growth to pick up this year, but it will diverge

The Nordic economies will have a better 2024 than last year, but growth rates will diverge across the region. The main growth drivers will be improving domestic demand, higher confidence, and easing financial conditions amid lower inflation and policy easing. A pharma boom will make Denmark outperform, while a weak finish to 2023 will weigh on growth in Finland and Sweden.

Find Out More

Post

Nordics: Climate policies will have an uneven impact across regions

The growing impact of climate change means that mitigation policy is becoming more prominent across the Nordic region. The transition policies that governments enact will have significant economic consequences, and their impact will be felt unevenly across regions. To help organisations understand the implications of different policies, we have developed a range of scenarios which plot potential pathways towards net zero.

Find Out More

Post

Nordics: Key themes 2023: A year of two halves

Following a hard winter, we expect the Nordic economies to rebound from mid-2023 as falling inflation turns real incomes positive, alleviating uncertainty, boosting confidence, and allowing central banks to end policy tightening.

Find Out More