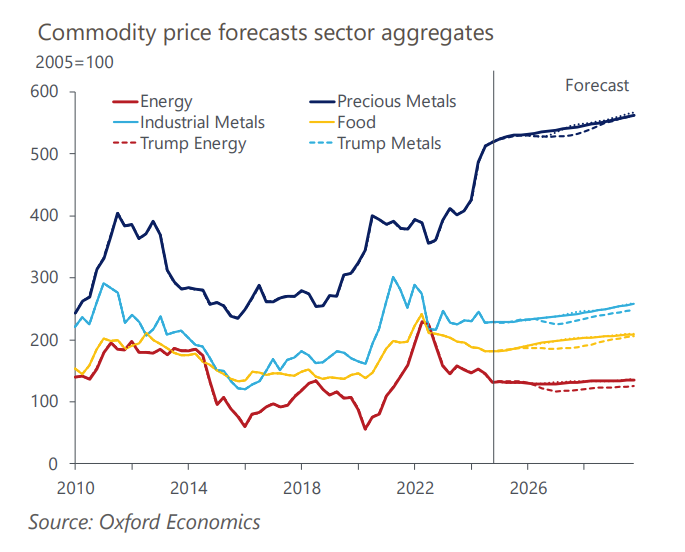

Trump presidency could alter the trajectory for commodity prices

Our analysis suggests that while a Harris presidency, assuming Democratic control of Congress, would have a minor positive impact on commodity prices, a Trump presidency with Republicans controlling Congress has the potential to lead to lower commodity prices.

What you will learn:

- The broadest channel, affecting almost all commodities is weaker economic growth as trade tensions contribute to softer global growth. China is particularly hard hit resulting in lower commodities demand and prices.

- Trump has campaigned to unleash a new era for fossil fuels if he were to win in November leading to a period of low oil and gas prices for consumers. An acceleration to the current expansion in US production in oil and gas would lower prices which would outweigh greater demand for diesel and gas through the repel of tax credits in the Inflation Reduction Act (IRA). The latter would, though dampen demand for transition metals.

- Steel imports from China are already tariffed and will be less affected as they now account for only 2% of the US’s total steel imports. Retaliatory action by China is likely to hit soybean prices though, particularly given China still accounts for over 50% of US soybean exports.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

Global Commodity Service

Monthly reports on commodity price trends and forecasts, as well as weekly briefings on the latest price action.

Find Out More

Service

Global Industry Service

Gain insights into the impact of economic developments on industrial sectors.

Find Out More

Service

Global Industry Model

An integrated model covering 100 sectors across 77 countries and the Eurozone.

Find Out More