Research Briefing

| Oct 23, 2024

A window of opportunity edges open for real estate

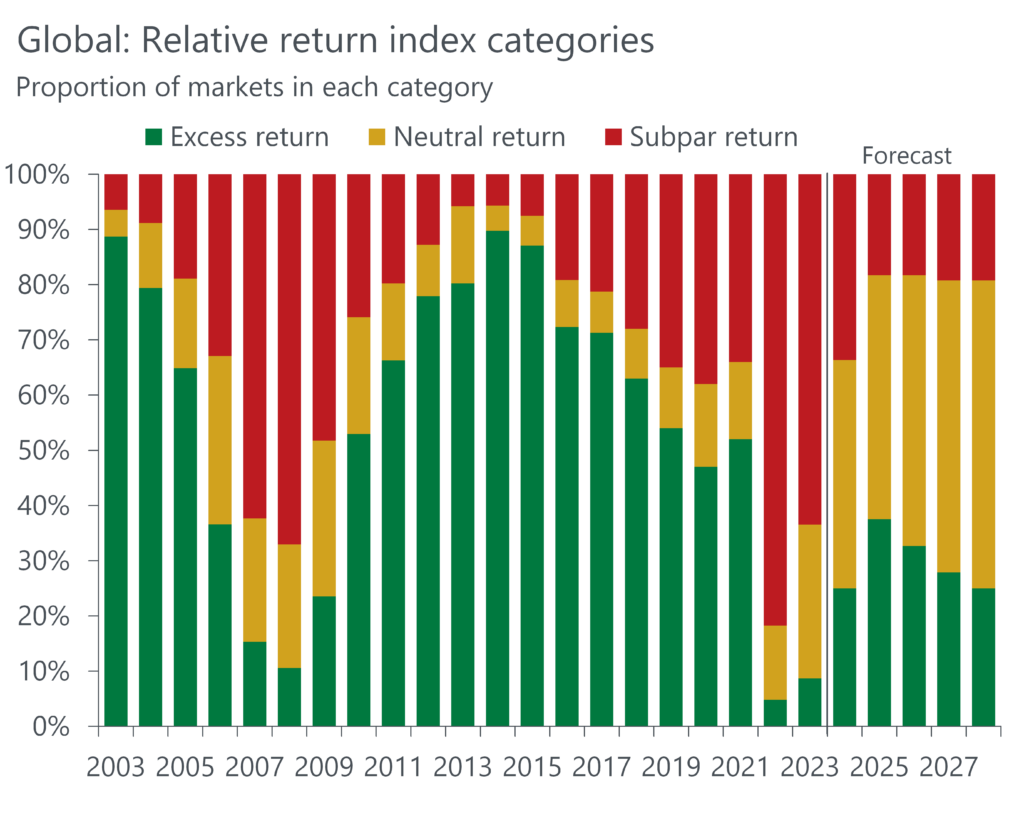

Our Global Relative Return Index (RRI) is unchanged from six months ago at 52.7 for 2025, signalling that we are still on course for a sustained pick-up in investment opportunities after the initial phase of the recovery this year. Although 10-year bond yield forecasts are higher than six months ago, expected returns have also increased, offsetting each other at the top-line index level.

What you will learn:

- By 2026, we think that the number of compelling excess return opportunities will fall, but neutral return markets will broaden. This reflects the challenge of this cycle – limited capital growth driven by yield compression due to higher terminal rates relative to pre-pandemic.

- The most appealing sector continues to be industrial. We think the best opportunities next year will be found in Switzerland, the Netherlands, Sweden, Germany, and Portugal. These markets have the widest spread between their required return and expected return.

- Our call is not without risk. Our Global Business Sentiment Index suggests businesses have become less positive regarding near-term prospects for the global economy, though they view a global recession next year as unlikely.

- Our baseline is predicated on sustained interest rate cuts. But there are forces that have the potential to knock disinflation off course, including geopolitics – trade tariffs, Russia-NATO relations, and Middle East escalation top the list of concerns.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Housing affordability lowest in Greek, Danish, and German cities

House prices across Europe have soared over the past decade, especially in cities. During this time, incomes in Europe have not kept pace with house price hikes on average, squeezing the purchasing power of homebuyers in many European cities.

Read more: Housing affordability lowest in Greek, Danish, and German cities

Office employment in cities is resilient, but risks remain

Oxford Economics set the stage for the year ahead, at our second Global Economic Outlook Conference, in London on Wednesday, 5 February.

Read more: Office employment in cities is resilient, but risks remain

Steady, Yet Slow: How Oxford Economics Sees Global Economic Growth in 2025

Oxford Economics set the stage for the year ahead, at our second Global Economic Outlook Conference, in London on Wednesday, 5 February.

Read more: Steady, Yet Slow: How Oxford Economics Sees Global Economic Growth in 2025

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights