Research Briefing

| Oct 23, 2024

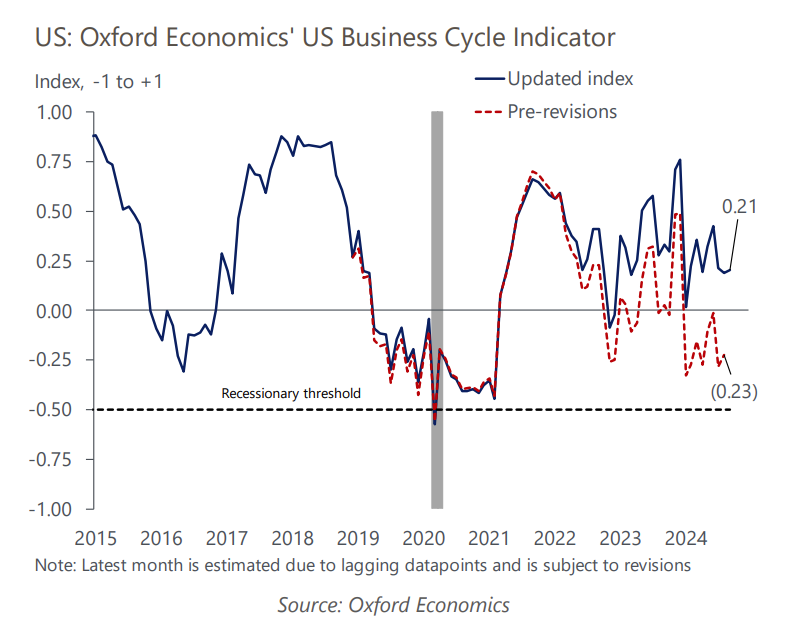

US Recession Monitor – Revisions reduce recession risks

Our probability of recession models showed marked improvement in September, reversing much of the recent rise. Against this backdrop, our conviction in our above-consensus GDP growth forecast for 2025 increased.

What you will learn:

- The annual revisions to GDP substantially lifted our business-cycle indicator and underscore the resilience of the economy. Stronger productivity growth implies a robust short-run potential growth rate, while stout personal income growth indicates household balance sheets remain in great shape, in aggregate.

- Recent data supports our view that the labor market went through a lull, but nothing worse. The health of the labor market will be muddled over the next few months because of the hurricanes. However, separating the signal from the noise, we don’t anticipate a material shift.

- An emerging risk is the potential for long-term rates to be higher than anticipated, emphasized by the recent rebound in the 10-year Treasury yield. We used our Global Economic Model to simulate the implications of higher long-term rates, and while the drag on the economy isn’t enormous, it lends some downside risk to those sectors facing a wave of refinancings next year.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More