What Trump 2.0 means for the global economy

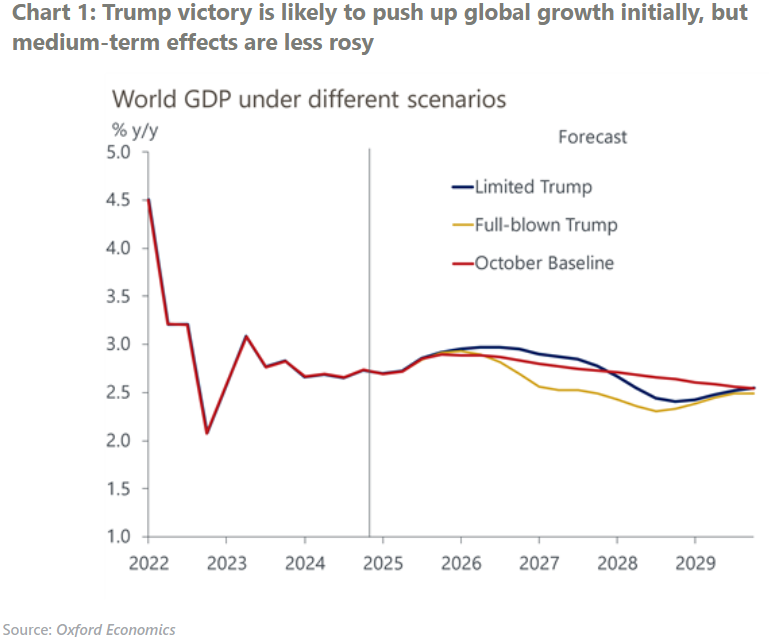

In response to the results of the US election we’ve adopted our ‘limited Trump’ scenario as our baseline view for now. Overall, a Trump Presidency with potentially full Republican control of Congress has prompted us to nudge up our nearer term global GDP growth forecasts slightly. The direct impact on global growth is likely to be limited in the near term, but masks major implications for trade and the composition of growth, and for financial markets.

What you will learn:

- These effects may grow over time as the full scope of President-elect Donald Trump’s intentions becomes clear. In a scenario in which the more radical aspects of his policy agenda, particularly on tariffs, are adopted, the impact on the rest of the world is very sizeable.

- Targeted tariffs on China, the EU, Mexico, and Canada will eventually depress exports of the affected sectors to the US. But the impact on overall export volumes may be tempered by trade diversification and higher US demand thanks to much looser US fiscal policy. That said, the impact on different sectors could be large depending on the form of the new tariff regime.

- A key unknown is whether a clean sweep raises the risk that a Trump administration will push through more extreme policy measures, such as larger, less-targeted tariffs. Uncertainty over Trump’s stance on the conflicts in Ukraine and the Middle East also adds to the risk of greater instability in both regions, which could take a toll on regional, and even global, growth.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Reports

Post

US Recession Monitor – Despite rising odds, no slump in sight

President Trump ordered a 25% tariff on autos and auto parts, starting on April 3.

Find Out More

Post

US wealth effects are packing a larger punch than ever

Wealth effects proved to be a quite reliable tailwind to consumer spending this cycle.

Find Out More

Post

Tracking the impact of US tariffs on spending and prices

Our bottom-up framework of how imports feed into consumer spending identifies where we expect the largest tariff impacts.

Find Out More

Post

US Recession Monitor – Despite rising odds, no slump in sight

Our internal recession models support our opinion that a looming downturn is unlikely, despite rising recession risks.

Find Out More