How another Trump presidency will affect Canada

Another Trump presidency will increase US fiscal stimulus, curb immigration, and lead to new tariffs on China, Canada, Mexico, and the European Union. These measures will have a marginal impact on GDP in Canada, but modestly raise inflation and likely cause higher interest rates.

What you will learn:

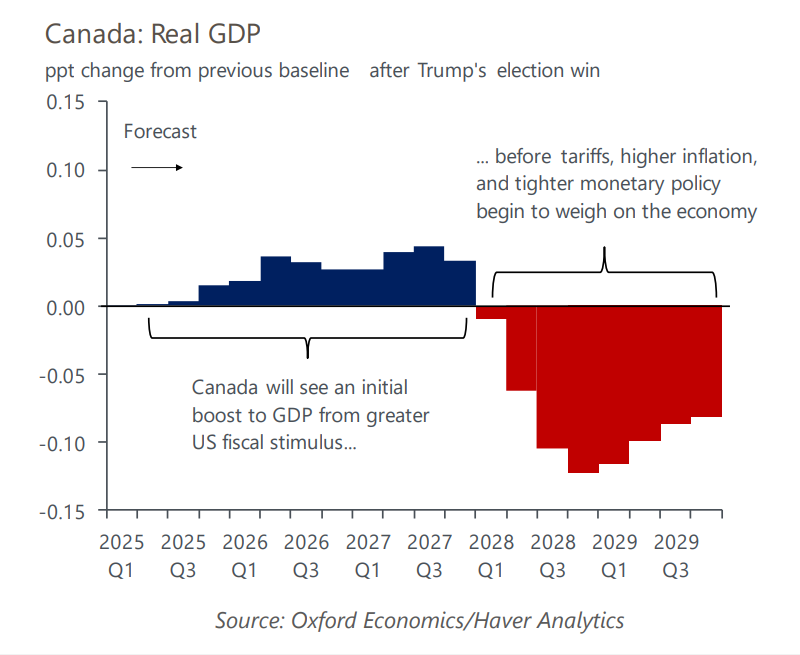

- However, the economic outlook for 2025 doesn’t change much since it will take time for changes in US policy to be implemented. The impact on Canada’s economy will be mixed, as the initial boost to exports from greater US fiscal stimulus fades and the drag from tariffs, higher inflation, and tighter monetary policy builds.

- As was the case during Trump’s first term, global trade policy uncertainty will increase. Our new baseline assumes Trump phases in 10% tariffs on about one-tenth of US imports from Canada between 2026-2027 and Canada follows suit with proportional retaliatory tariffs of its own.

- Canada’s energy, auto sector, and other heavy manufacturers are most vulnerable to blanket US tariffs. But we think it’s likely that Trump uses targeted tariffs on steel and aluminium, lumber, or Canada’s supply-managed dairy industry as leverage ahead of the USMCA review in 2026.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

Canada Macro Service

Comprehensive coverage of the Canadian economy, providing clients with all of the information they need to assess the impact of developments in the economy on their business.

Find Out More

Service

Canadian Province and Metro Service

Data and forecasts for Canadian provinces and metropolitan areas.

Find Out More

Service

Canada Provincial Territorial Model

A rigorous and comprehensive framework to develop forecasts, scenarios and impact analysis at the national, provincial and territorial levels.

Find Out More