China strategising for a second Trump term

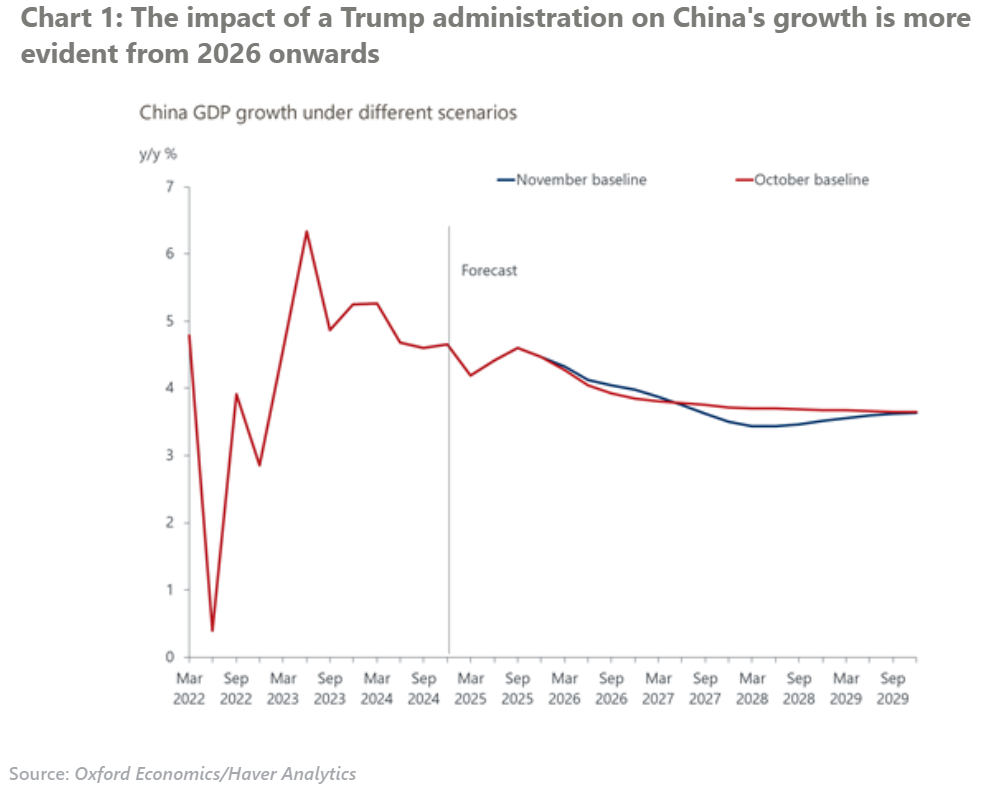

US tariffs under a Trump presidency and a Republican-led Congress are a major concern for China. However, we expect additional US tariffs wouldn’t be implemented until as late as 2026 and the effects could be mitigated early on by expansionary fiscal policy in the US.

What you will learn:

- Our modelling suggests that US tariffs could reduce China’s GDP by a cumulative 0.4ppts over 2027-2029, which would be manageable. However, the magnitude and the timing of tariff increases will affect the ultimate outcome and we believe the risks are skewed to the upside.

- China has developed a versatile set of tools beyond simple tit-for-tat trade retaliation to respond since 2016-2020, when the previous Trump administration imposed the first set of tariff hikes. China could weaken its currency and increase export tax rebates as defensive moves. Restricting exports of essential materials such as rare earth metals, and imposing tariffs on strategic US import sectors are also plausible measures.

- Though not an imminent threat, external uncertainties could require a more forceful domestic response, especially considering the severe downward pressure on China’s economy. In the longer term, China’s industrial policy may become more domestically focused, with a stronger emphasis on industrial competitiveness.

Tags:

Related Services

Post

3 Key Takeaways from Trump Tax Cuts on US Consumer Spending

At Oxford Economics, we have been closely monitoring the potential impact of President Trump's tax cuts on the US economy. Our latest forecasts shed light on how these changes could affect consumer spending, particularly among high-income households.

Find Out More

Post

Nowcast shows strongest rise in PCE prices in six months in the US

Our nowcast suggests October's headline and core PCE inflation will be at their fastest monthly pace in six months and above the Fed's most recent forecasts.

Find Out More

Post

What does Trump 2.0 mean for construction globally?

The election of Donald Trump will affect global construction activity through fiscal stimulus, curbed immigration, increased tariffs, and policy decisions.

Find Out More

Post

US forecasters’ mailbag – Post-election edition

We received many questions, including during our recent webinar, about the changes to the forecast following the election along with key assumptions.

Find Out More