What does Trump 2.0 mean for construction globally?

What you will learn:

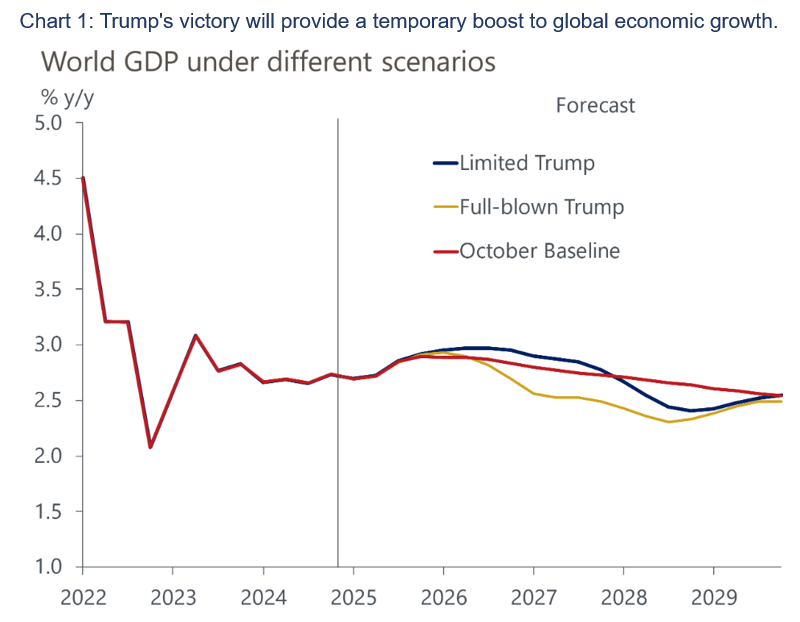

- The election of Donald Trump will affect global construction activity through fiscal stimulus, curbed immigration, increased tariffs, and policy decisions. Our macroeconomic baseline view has shifted to our ‘limited Trump’ scenario, although our ‘full-blown Trump’ scenario remains a possibility if specific guideposts are met.

- US fiscal expansion is likely to support privately funded construction activity in the near-term, but will result in slower monetary loosening in 2026. Immigration cuts, however, will reduce long-term demand for housing, and risk exasperating construction labour shortages in the US.

- The impact of tariffs is unclear. We expect them to boost manufacturing and warehousing investment in ASEAN countries, while the impact in the US depends on the extent of retaliatory tariffs from other countries. China may continue to reroute US bound exports to other countries – but there could be a reduction in Belt and Road projects.

Tags:

Related Services

Post

How another Trump presidency will affect Canada

Another Trump presidency will increase US fiscal stimulus, curb immigration, and lead to new tariffs on China, Canada, Mexico, and the European Union.

Find Out More

Post

Adopting the Limited Trump Scenario as the new baseline

Following the outcome of the US elections, we have adopted our 'limited Trump' scenario as our new baseline forecast. Our new baseline assumes a Republican-led Congress extends the personal tax cuts under the 2017 tax law and enacts higher spending levels.

Find Out More

Post

Global Implications of the US Election on the Middle East

As campaigning in the US election comes to a close, we look at the potential implications of victory by each candidate on the Middle East, focusing on foreign affairs, economics and security risk.

Find Out More

Post

Markets have soured on the UK Budget, but calm should return

Following Wednesday's UK Budget, gilt yields have risen sharply as financial markets appear concerned over the scale of the extra borrowing, that some of it will fund current spending rather than investment, and the narrow headroom it leaves.

Find Out More