Growth forecasts trimmed on review of Trump 2.0 impact

We have revised down our global economic forecasts slightly from our snap post-election assessment. The broad picture is little changed, though: a Trump presidency should have a mild impact on topline macro variables, while the effects on individual sectors and financial markets will likely be larger.

What you will learn:

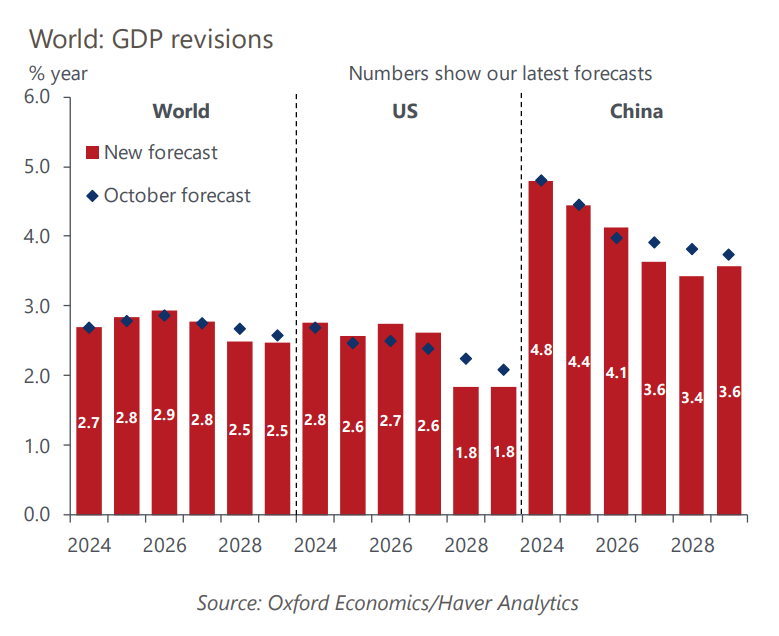

- We now expect world GDP to be slightly lower than we forecast immediately after the US election result. Our 2025 growth forecast is unchanged at 2.8%, but we have trimmed growth in 2026 to 2.9% from 3.0% in our first November release.

- A key shift is that we now assume that Japan, South Korea, and Vietnam will also face US tariff hikes – and the net wider could be cast wider still. We also assume larger US tariffs on China and greater retaliation. We have also reduced our forecasts for world trade growth to reflect a less-conducive global trade environment.

- The other shift is that we have increased the impact on investment. We think Trump’s victory could boost US investment by almost 1.5% compared to our October baseline by end 2027, but it will leave firms outside the US navigating a thick fog for a few years. Along with a higher borrowing costs, this means we now expect investment outside the US to be 0.7% below our pre-election baseline by the end of Trump’s second term

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More