Spain: Regional growth driving the house price boom

House prices are booming in Spain. A combination of strong demand and supply-side constraints has placed significant upward pressure on prices in recent years, and this will likely remain the case in the near term. But such growth has come at a hefty cost. Housing affordability has declined sharply for local residents, sparking large-scale protests in major cities and policy responses from both national and local governments.

What you will learn:

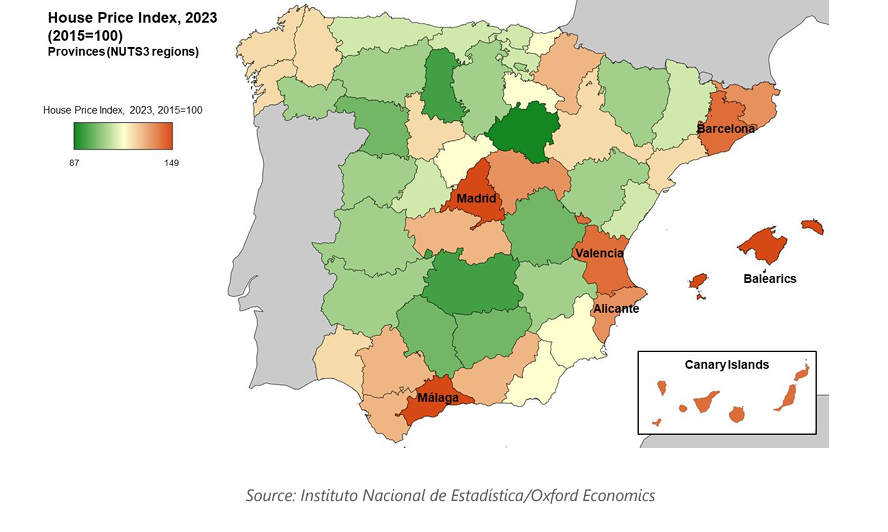

- The national increase in house prices has been driven entirely by growth in a few select cities and key tourism hubs. Since 2015, the Balearics and Malaga have seen the fastest overall rises, which partly reflects their especially pronounced growth post-Covid-19. Madrid closely follows, with the capital notably outstripping Spain’s other urban giant, Barcelona, since 2021, after achieving broadly comparable gains in the preceding years.

- Collectively, just seven Spanish regions accounted for 80% of national population growth over the last decade. And we find a close relationship between the spatial distribution of this population increase and house prices. Underpinning the demographic change has been immigration into the major cities and tourism centres, with significant inflows of both workers and retirees lifting property demand.

- But population dynamics tell only one part of the story. Growth in tourism demand has brought some welcome revenue, but in conjunction with the rise in the short-stay accommodation sector, has placed some additional pressure on housing stock in some locations. And price pressures have been further exacerbated by a severe shortfall in the number of house completions relative to the increases in household numbers.

Tags:

Related Services

Post

The impact of Trump’s presidency on US commercial real estate

The policy implications from a second Trump presidency are expected to affect US commercial real estate (CRE) through curbed immigration, tax cuts, and increased tariffs. However, CRE's relative pricing to bond yields will probably most influence values in the short term.

Find Out More

Post

A window of opportunity edges open for real estate

Our Global Relative Return Index (RRI) is unchanged from six months ago at 52.7 for 2025, signalling that we are still on course for a sustained pick-up in investment opportunities after the initial phase of the recovery this year.

Find Out More

Post

The four megatrends that will shape the future of commercial real estate

Fundamental forces including demographics, Ai, geopolitics and climate change play a key role in building resilience into long-term CRE investment strategies. Our research shows that advanced economies are generally better positioned for the critical megatrends. Australia, Singapore and the UK are the top three most resilient CRE markets, each with unique strengths.

Find Out More

Post

Institutional Real Estate: Australia, Singapore, and the U.K. rank as top markets in Oxford Economics’ Megatrend Resilience Index for Real Estate

This innovative research provides a forward-looking perspective on the long-term influence of megatrends on commercial real estate, offering valuable insights to investors navigating a complex and rapidly evolving market worldwide.

Find Out More