China sectoral implications of Trump 2.0

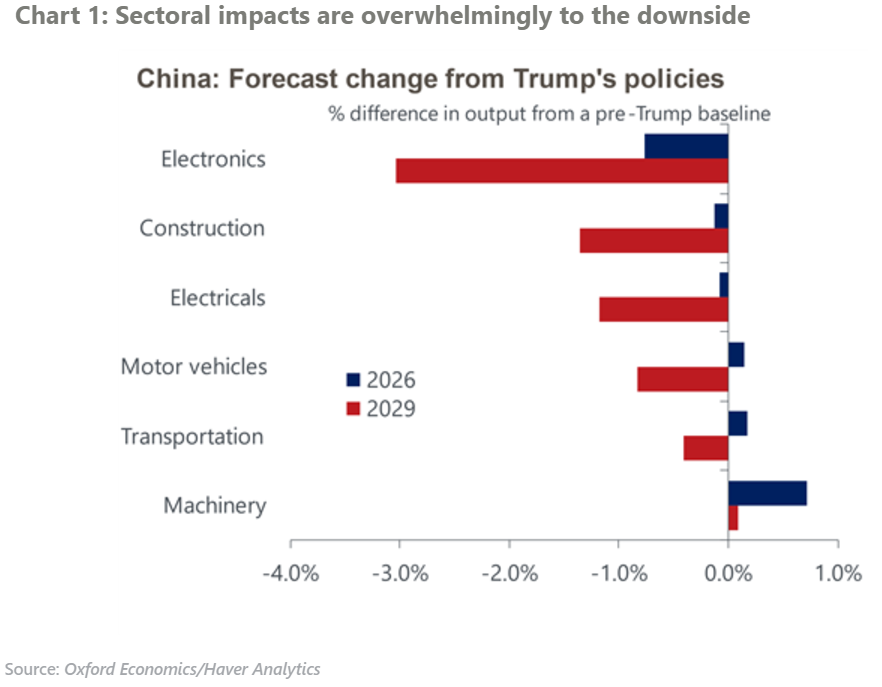

The incoming Trump administration’s trade policies will have significant impacts on China’s sectoral outlook. There will be a small near-term boost to Chinese output prior to the introduction of tariffs owing to a frontloading of orders. However, the long-term impact will be overwhelmingly negative on Chinese industrial activity.

What you will learn:

- Chinese authorities will use fiscal and monetary policy to support the economy, particularly focusing on the property and construction sectors. However, declines in private investment and lower exports to the US will ultimately outweigh the expected fiscal and monetary offsets.

- Supply chains will be disrupted as firms seek to reposition their operations away from China to avoid tariffs. This is particularly true within the automotive and machinery sectors where parts are often traded cross-border multiple times before final assembly. This disruption will be felt most significantly in China, but the impact will be global owing to China’s centrality in global manufacturing.

- The high-tech electronics sector will be amongst the hardest hit. Advanced production will likely migrate to regional peers such as Japan, South Korea, and Taiwan, while lower value-add activities will move towards ASEAN nations. In addition, export restrictions will likely stem the flow of knowledge, hitting productivity and eroding Chinese high-tech competitiveness.

Tags:

Related Posts

Post

Which regions are most exposed to the 25% automotive tariffs?

While the automotive tariffs will likely lead to some production being reshored to US plants, they will also raise costs for US manufacturers and households.

Find Out More

Post

Trump tariff turbulence threatens global industrial landscape

Trump has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign. This will have a major impact on global industrial prospects.

Find Out More

Post

Tracking the impact of US tariffs on spending and prices

Our bottom-up framework of how imports feed into consumer spending identifies where we expect the largest tariff impacts.

Find Out More